Property Tax Deduction Strategies For 2021 & 2022

Content

You can find this number in Box 4 of your 1098 form. You can deduct up to $10,000 (or $5,000 if married filing separately) of state and local taxes, including property taxes. Keep records that support an item of income, a deduction, or a credit appearing on a return until the period of limitations for the return runs out. (A period of limitations is the period of time after which https://turbo-tax.org/ no legal action can be brought.) For assessment of tax you owe, this is generally 3 years from the date you filed the return. For filing a claim for credit or refund, this is generally 3 years from the date you filed the original return, or 2 years from the date you paid the tax, whichever is later. Returns filed before the due date are treated as filed on the due date.

Ellen McElroy and Michael Resnick of @ESgloballaw give an overview of the CARES Act and outline some recommendations on how to claim the deduction for qualified improvement property. https://t.co/75zo2NzSYJ

— Bloomberg Tax (@tax) May 20, 2020

To be deductible, the interest you pay must be on a loan secured by your main home or a second home, regardless of how the loan is labeled. The loan can be a first or second mortgage, a home improvement loan, a home equity loan, or a refinanced mortgage.

Property Tax Deduction: Can You Write Off Real Estate Tax?

This method spreads costs over 27.5 years—what the IRS considers the “useful life” of a rental property. Security deposits are not taxable when you receive them if the intent is to return the money to the tenant at the end of the lease. But what if your tenant does not live up to the lease terms?

The amount applied to reduce the principal of the mortgage. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. No matter when the indebtedness was incurred, you can no longer deduct the interest from a loan secured by your home to the extent the loan proceeds How To Claim The Property Tax Deduction weren’t used to buy, build, or substantially improve your home. As an employee, you can deduct mandatory contributions to state benefit funds that provide protection against loss of wages. Refer to Publication 17, Your Federal Income Tax for Individuals for the states that have such funds.

Personal property taxes

The Tax Cuts and Jobs Act nearly doubled the amount of the standard deduction, which greatly decreased the number of tax filers whose actual deductions exceeded the standard amount. In fact, the portion of tax filers who itemized dropped from about one in three in 2017 to about one in ten in 2018, which is the first year in which the higher standard deduction was in effect. According to the IRS, the average real property tax deduction claimed for tax year 2018 was just over $6,800. Qualifying adoption expenses exceeding 3% of total Iowa net income, less any Adoption Tax Credit claimed, are eligible for deduction.

Start by finding your tax records – your local taxing authority should be able to give you a copy of the tax bill for your home. Meanwhile, scrutinize the registration paperwork on your car, RV, boat or other movable assets, as might be paying property taxes on those as well. North Carolina itemized deductions are not identical to federal itemized deductions. Itemized deductions, complete Lines 1 through 9 ofForm D-400 Schedule A, N.C. Itemized Deductions.

Homeowner’s Homestead Credit Refund

Repairs include painting, fixing a broken toilet, and replacing a faulty light switch. On the other hand, improvements add value to your property and are not deductible when you pay for them. Instead, you recover the cost of improving a property by depreciating the expense over your property’s useful life.

- If you haven’t itemized your deductions before, it’s wise to talk to a qualified financial professional, so they can walk you through the process.

- Combine the amounts from both calculations for line 3, enter the total on line 3 of the form, and write “See attached” on the dotted line next to line 2.

- The total amount you can deduct is dependent on the changes to the Tax Cuts and Jobs Act, which was passed at the end of 2017.

- For joint obligations paid from joint accounts, the proration is based on the income reported by each spouse for that taxable year.

- The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

The basis of a cooperative apartment is the amount you paid for your shares in the corporation that owns or controls the property. This amount includes any purchase commissions or other costs of acquiring the shares.

How to report your property tax credit

Income Tax Return for Seniors, and itemize your deductions on Schedule A . If you itemize, you can’t take the standard deduction. Send tax questions, tax returns, or payments to the above address.

For a listing of income sources to include in total household resources, view Income and Deductible Items. Your homestead is the place where you have your permanent home. It is the place to which you plan to return whenever you go away. You must be the owner and occupant or be contracted to pay rent and occupy the dwelling. Cottages, second homes, property you own and rent/lease to others, and college dormitories do not qualify as a homestead.

Credits & Deductions

The mortgage interest credit is intended to help lower-income individuals afford home ownership. If you qualify, you can claim the credit on Form 8396 each year for part of the home mortgage interest you pay. Additional debt incurred to substantially improve your principal residence is also qualified principal residence indebtedness.

How do I apply for property tax exemption in California?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

For North Carolina tax purposes, a taxpayer is allowed a deduction for the repayment to the extent the repayment is not deducted in arriving at the taxpayer’s adjusted gross income in the current taxable year. If the repayment is more than $3,000, the deduction is the amount of the repayment. If the repayment is $3,000 or less, the deduction is the amount of repayment less 2% of adjusted gross income. For information on how to compute the claim of right deduction, see “Repayment of Claim of Right Income” and “Repayment of Claim of Right Worksheet” located in the North Carolina Individual Income Tax Instructions.

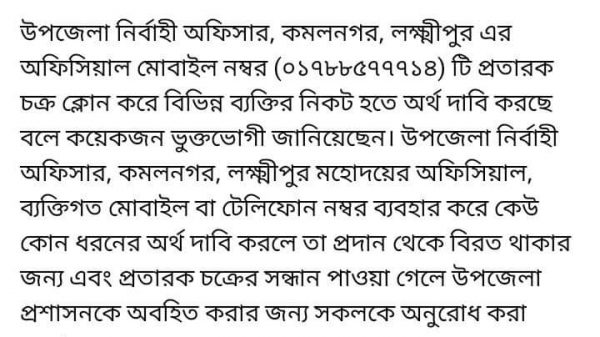

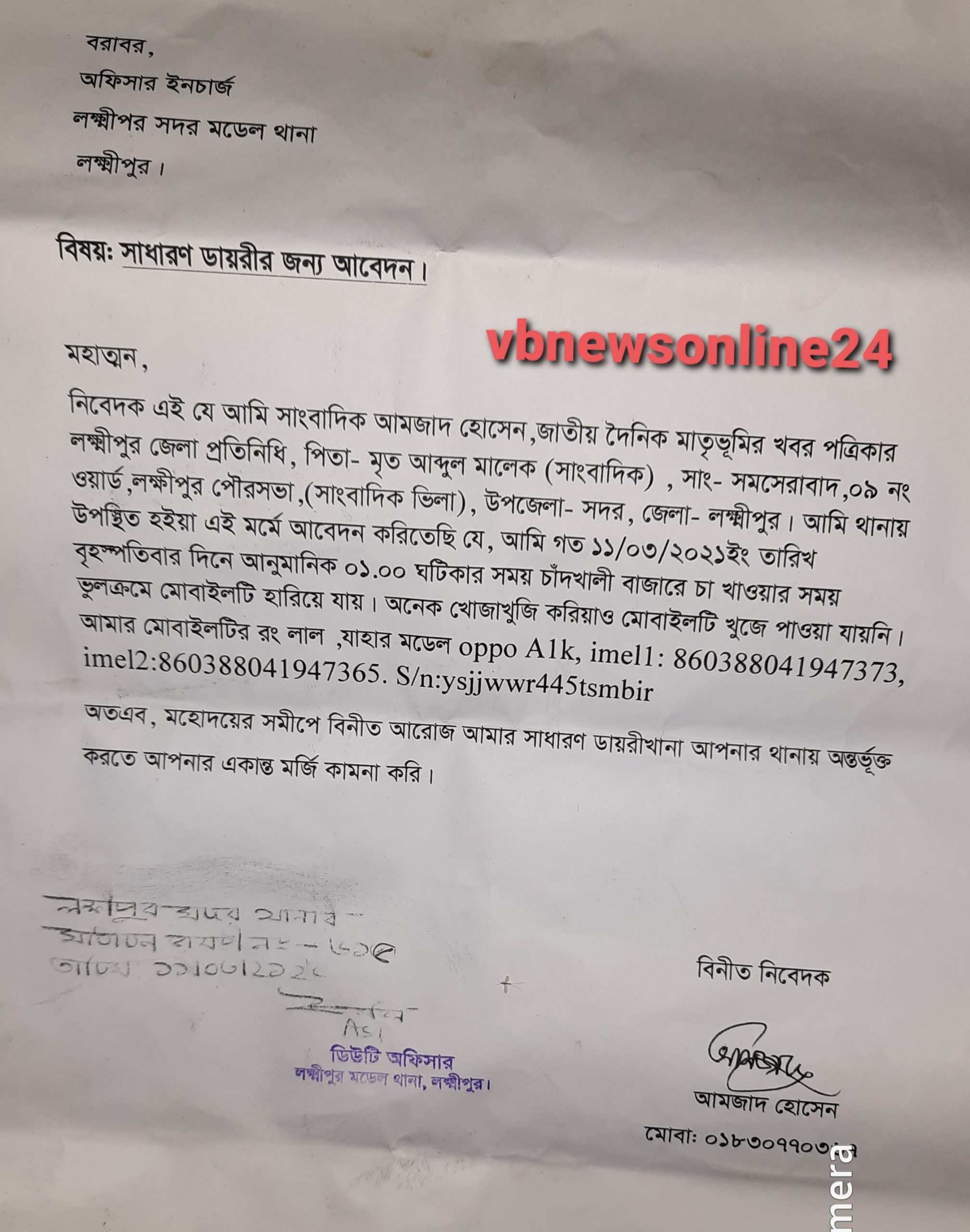

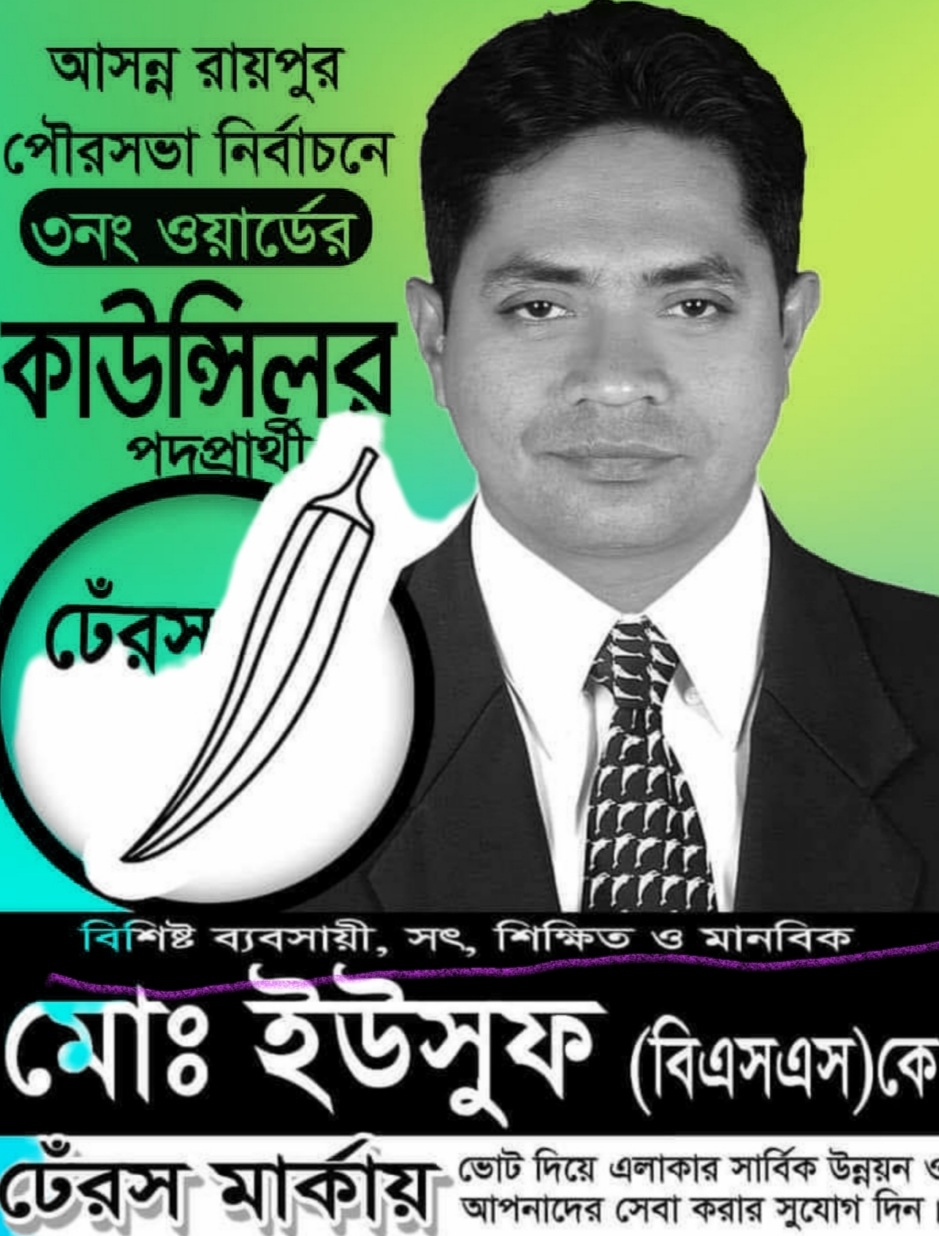

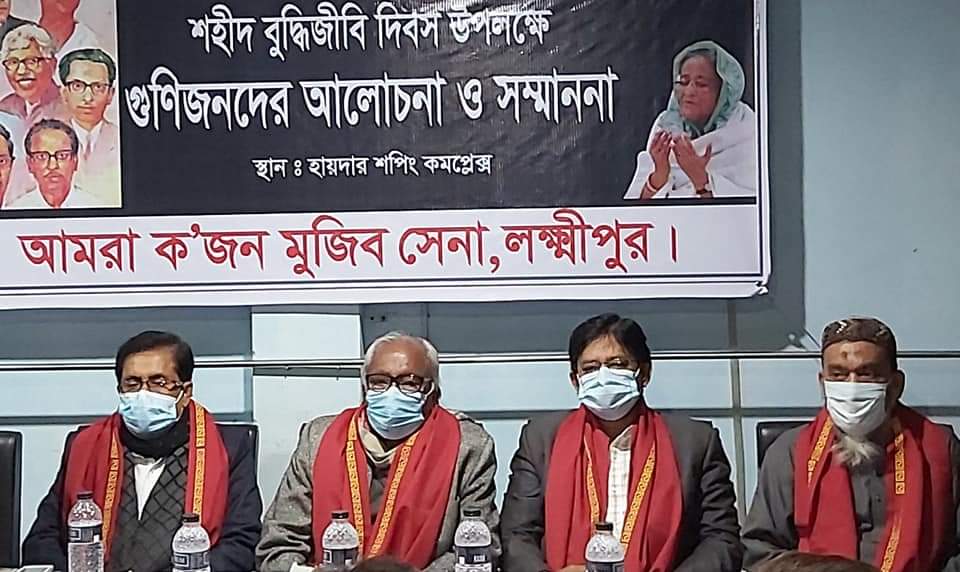

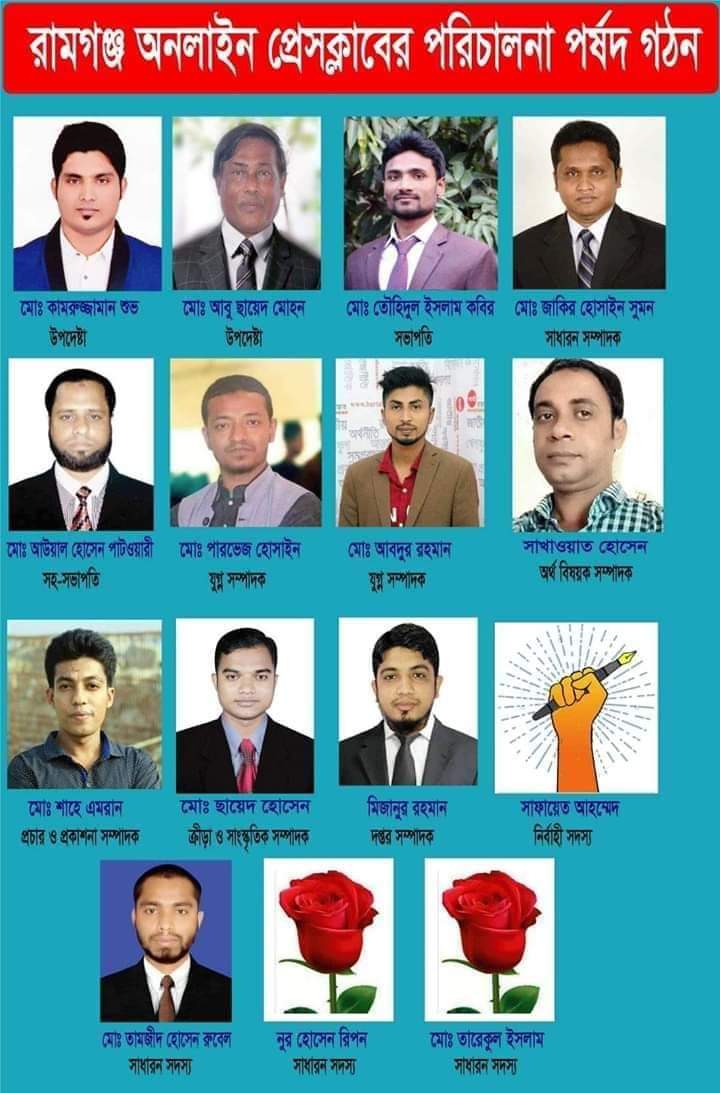

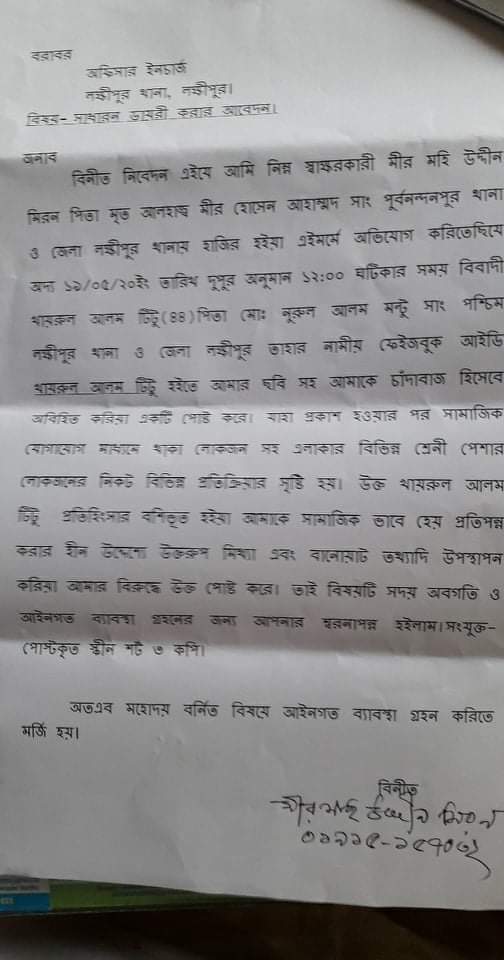

লক্ষ্মীপুরে গ্রামীন সড়কে ড্রামট্রাকে মেম্বারের বালু ব্যবসা, জানতে চাইলে সাংবাদিকদের চাঁদাবাজি মামলা দেয়ার হুমকি

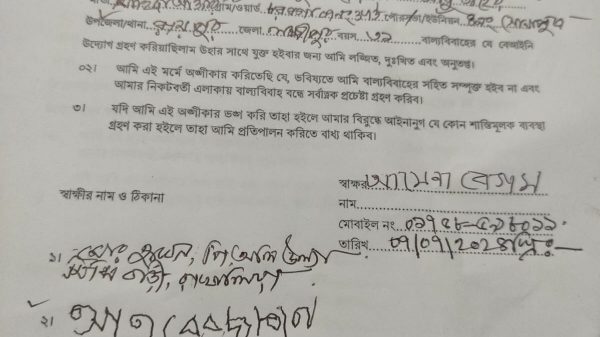

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়নে স্কুল শিক্ষক ও শিক্ষিকার অনৈতিক সম্পর্ক, শিক্ষিকার স্বামীর অভিযোগ

আলিফ মীম হাসপাতালের শেয়ার হোল্ডারদের সাথে মতবিনিময় সভায় প্রধান অতিথি জেলা বিএমএ ও স্বাচিপের সভাপতি ডা: জাকির হোসেন

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

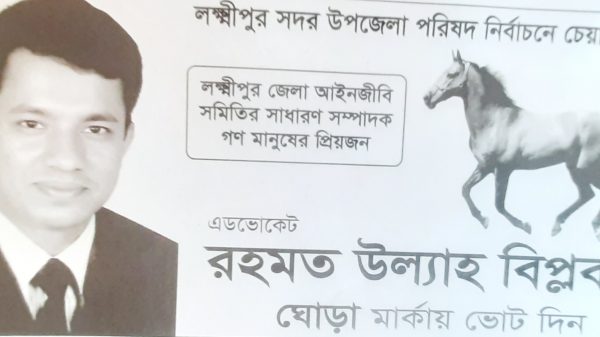

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

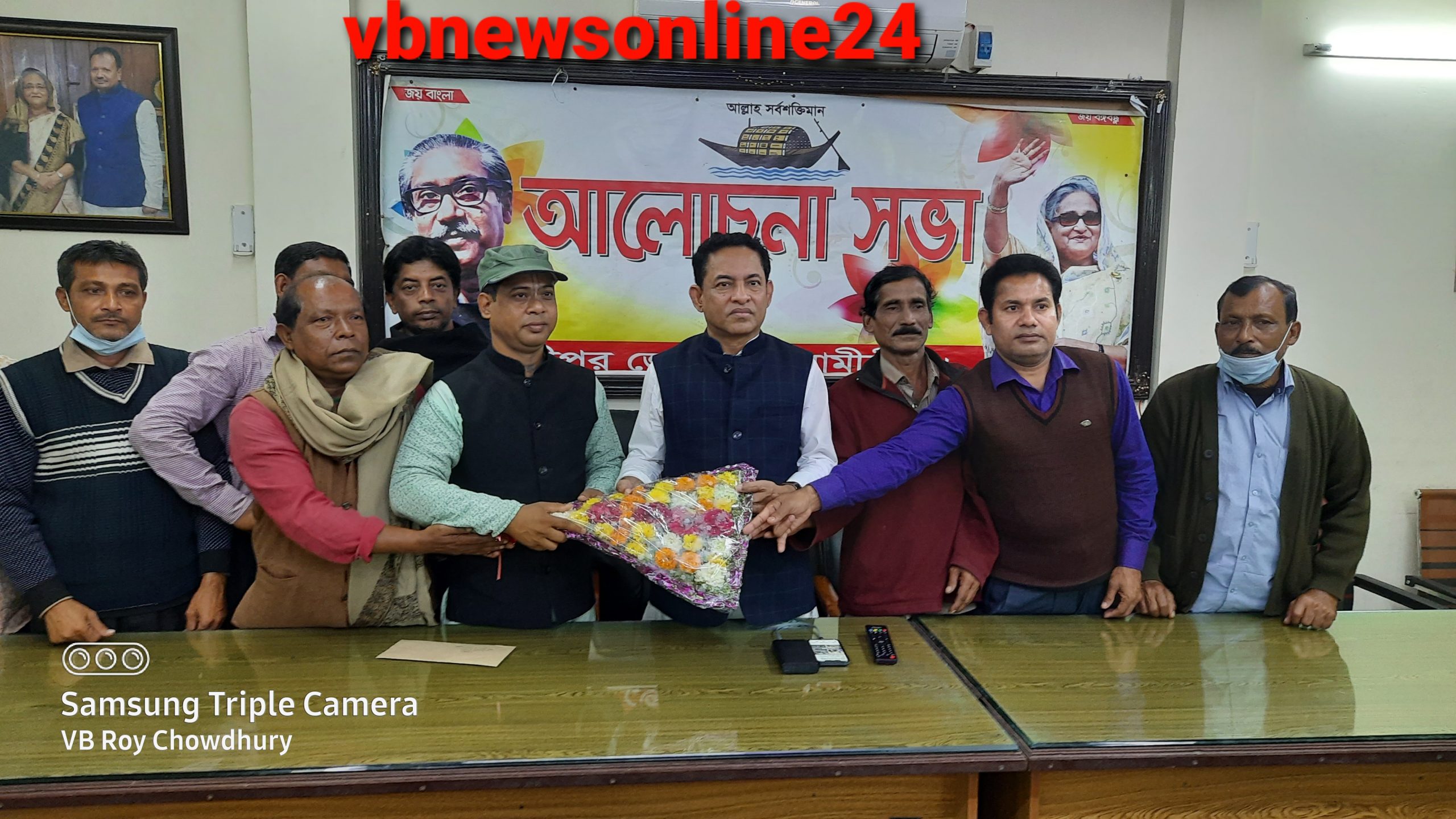

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

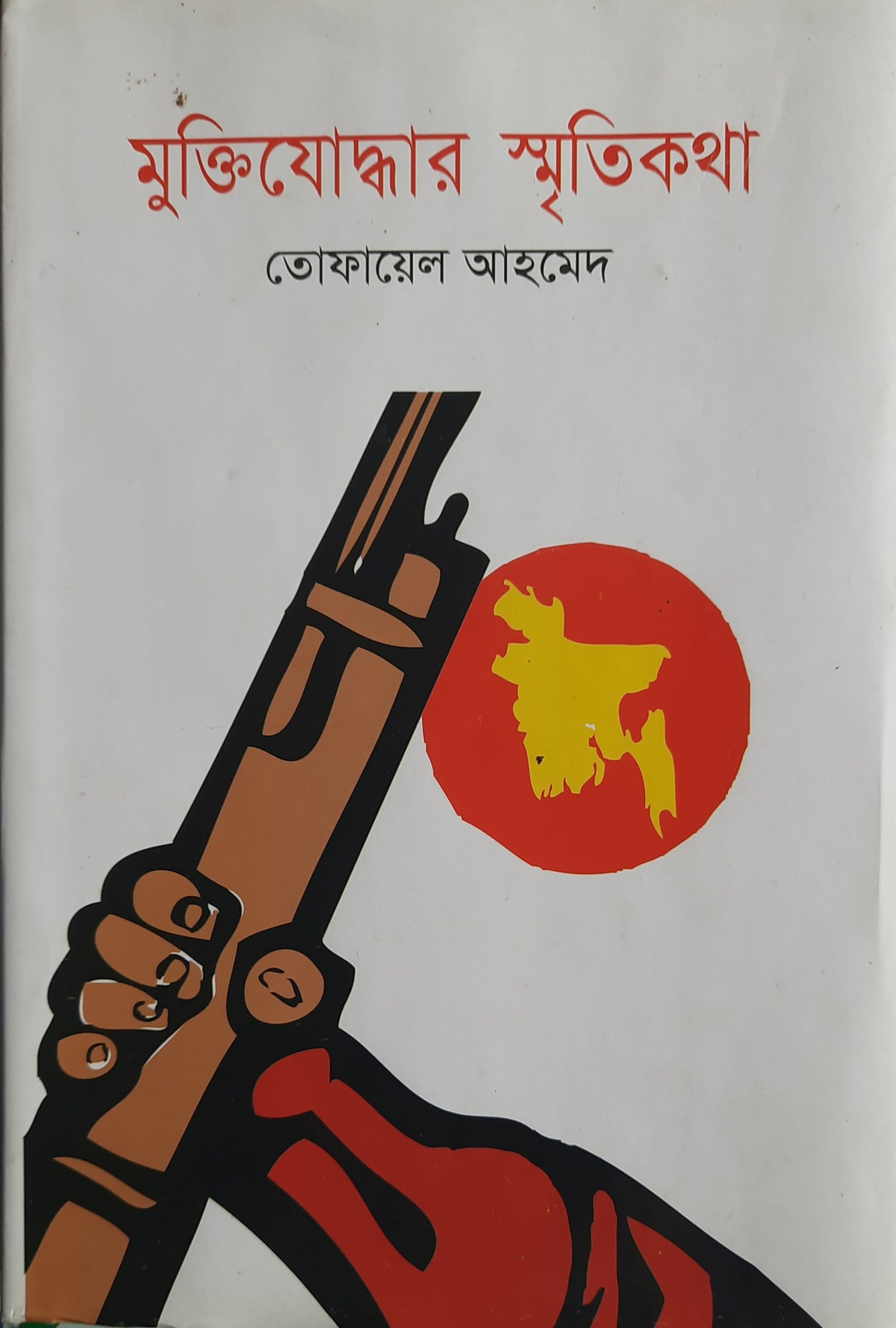

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

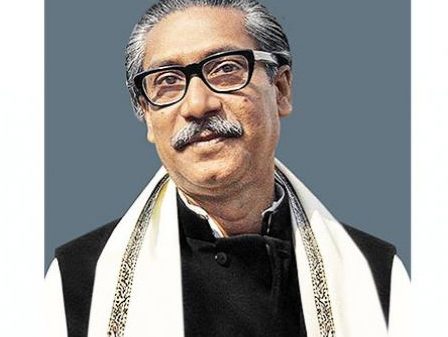

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

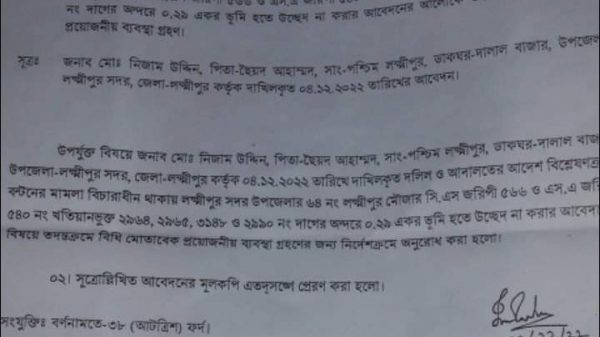

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

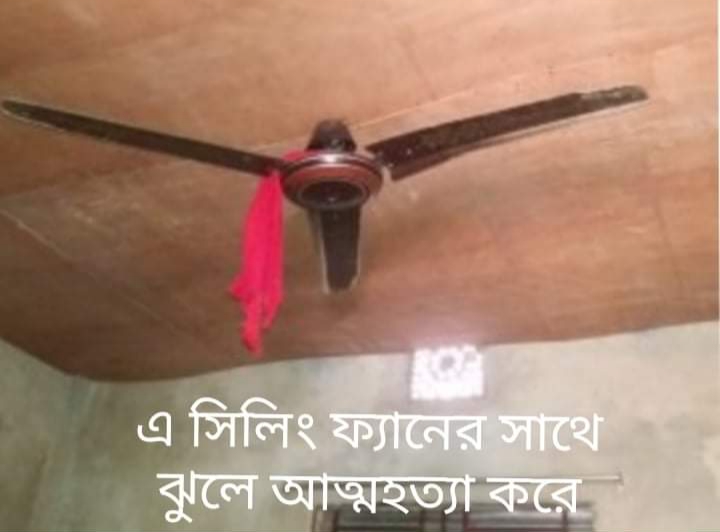

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

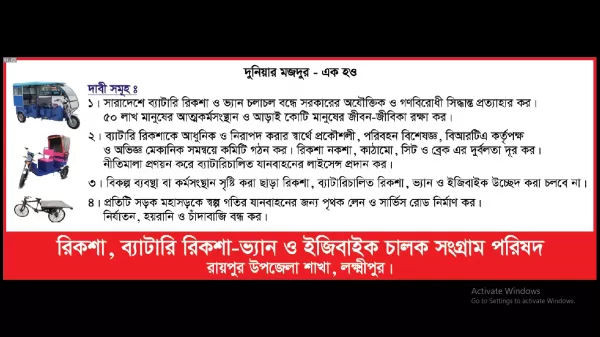

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

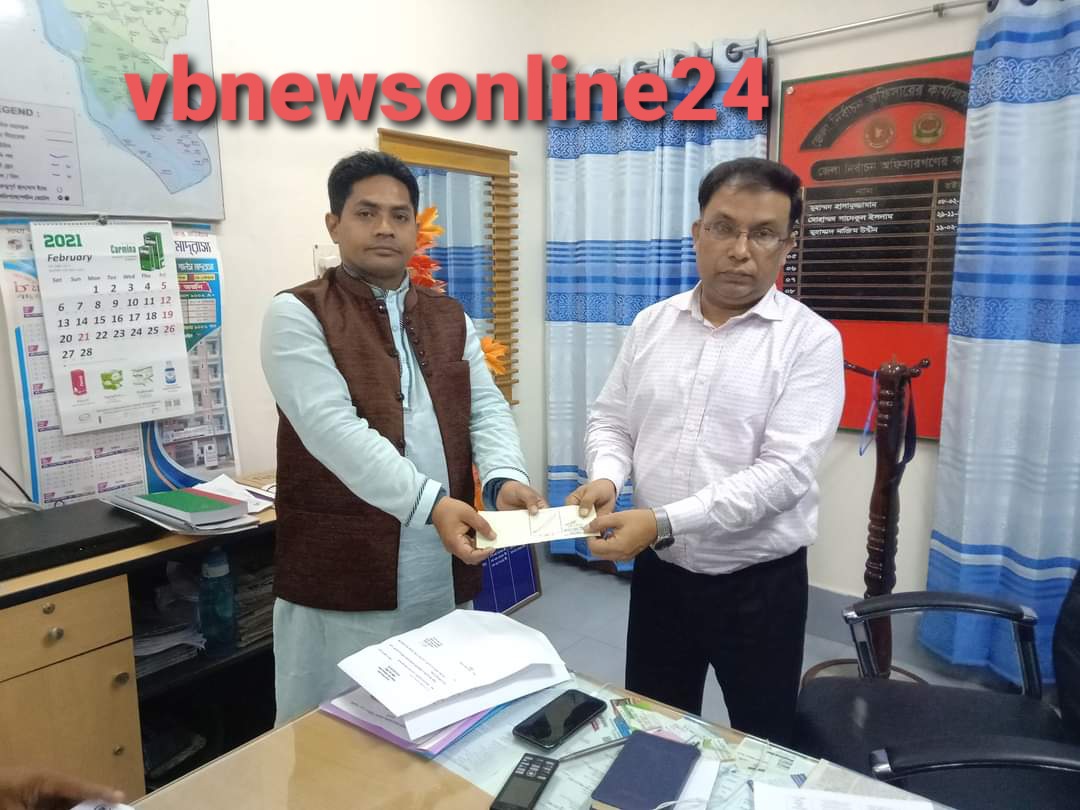

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

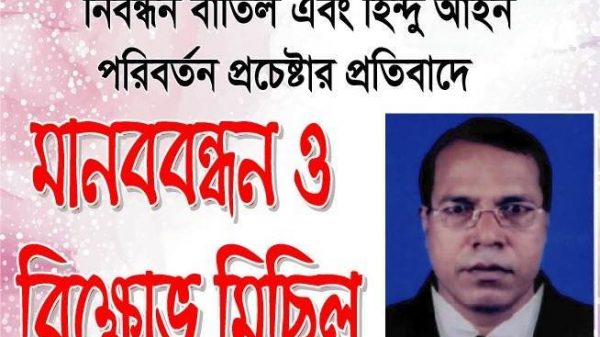

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

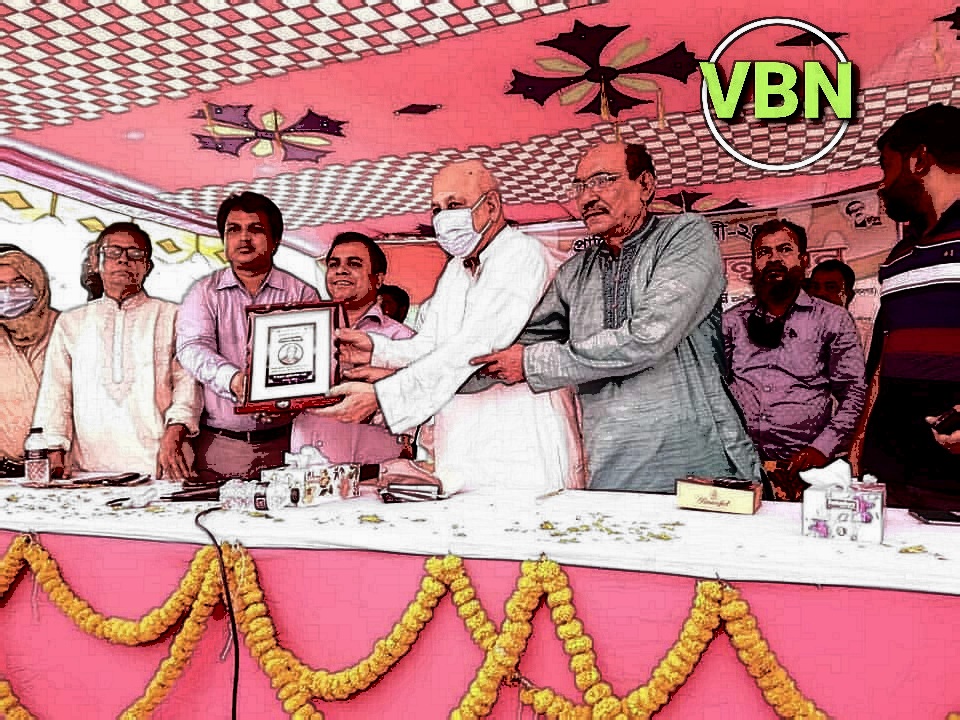

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

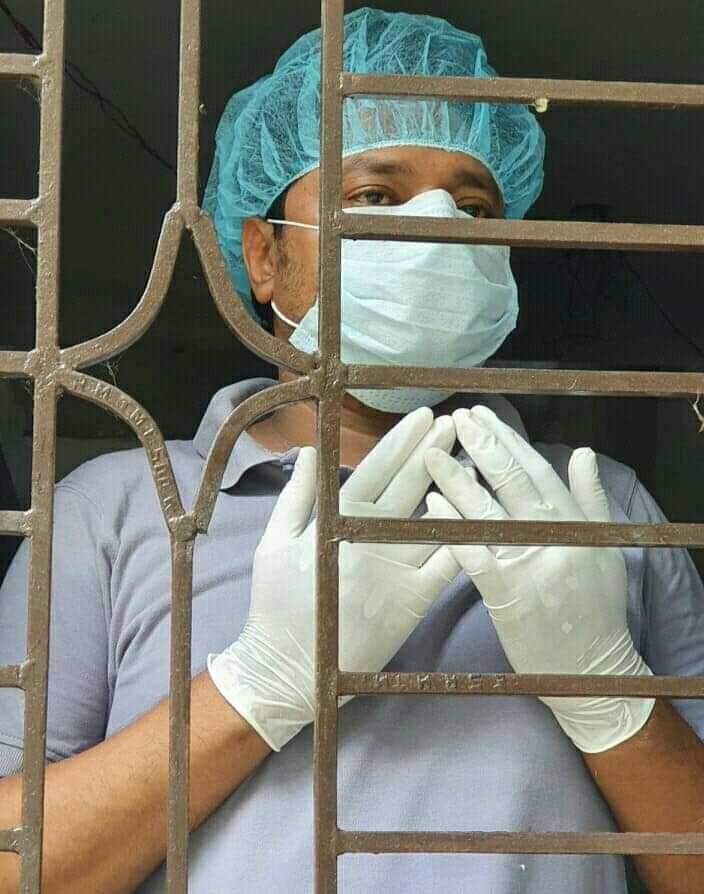

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

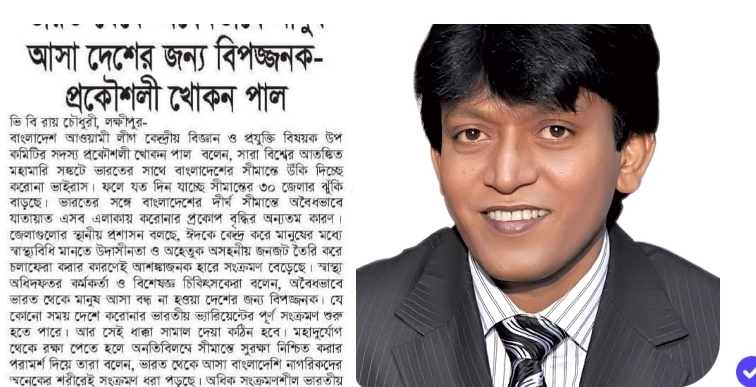

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

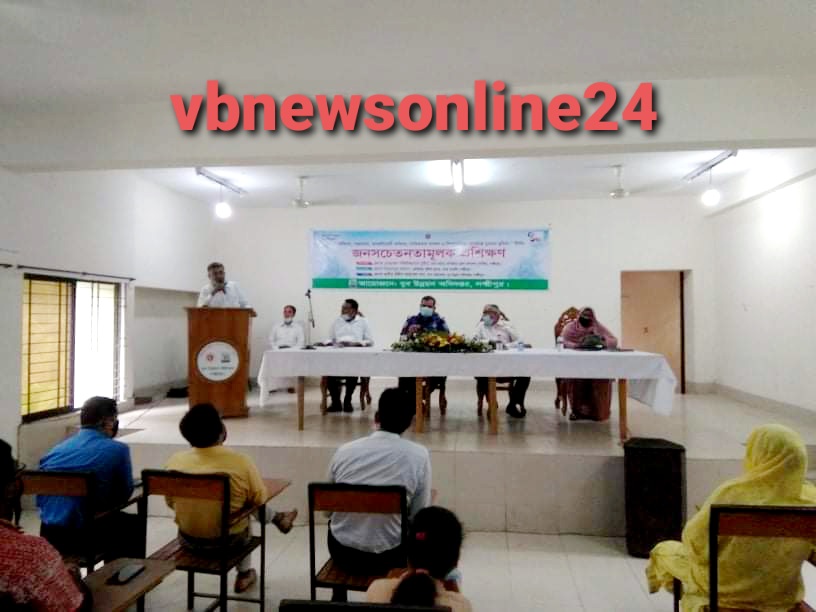

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

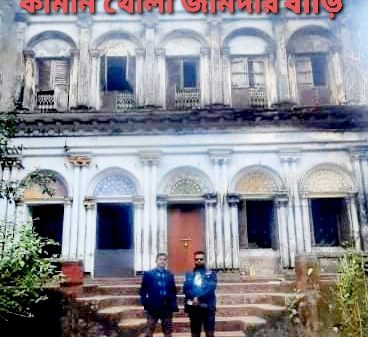

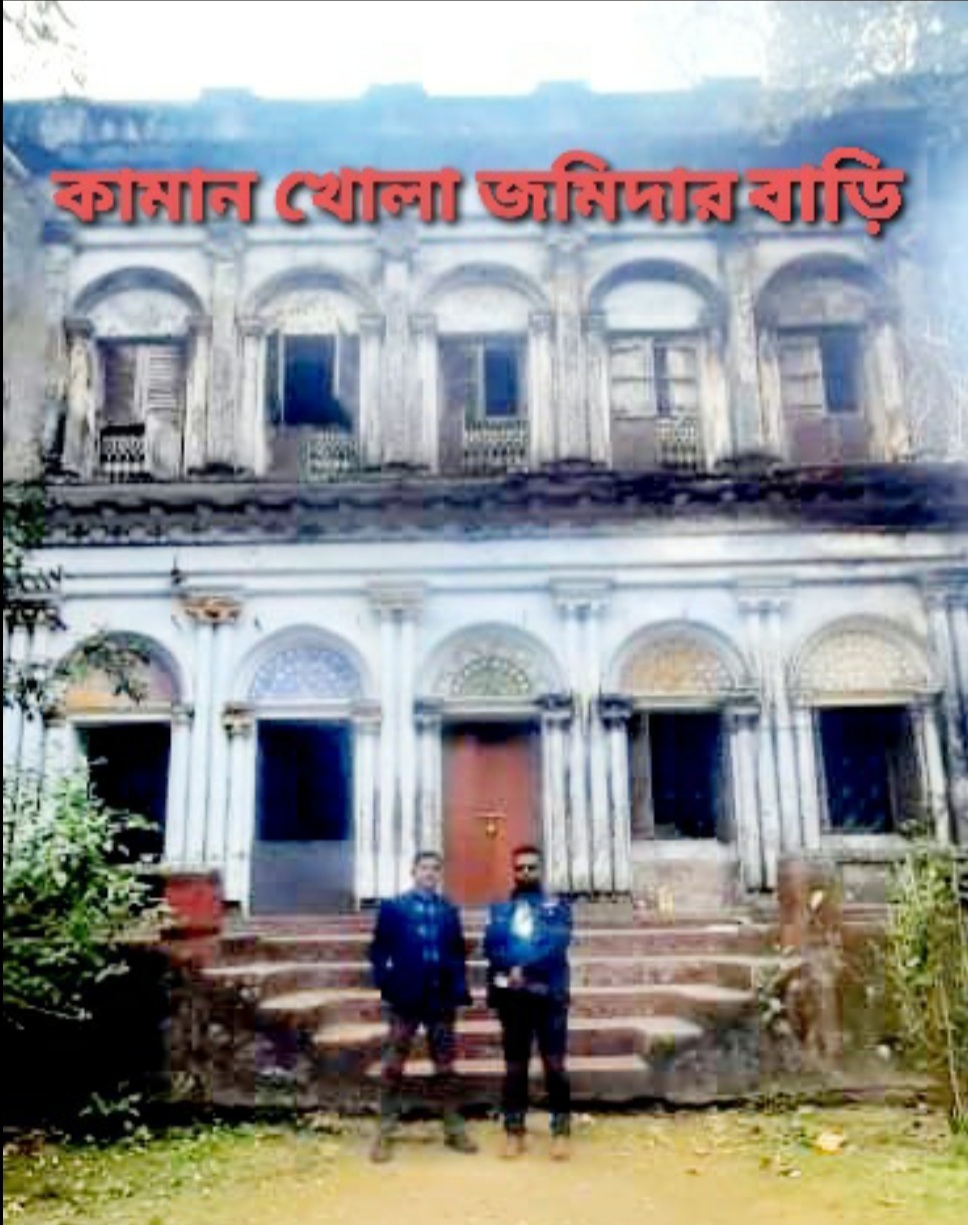

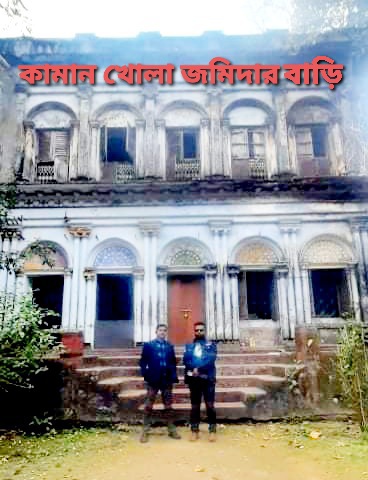

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

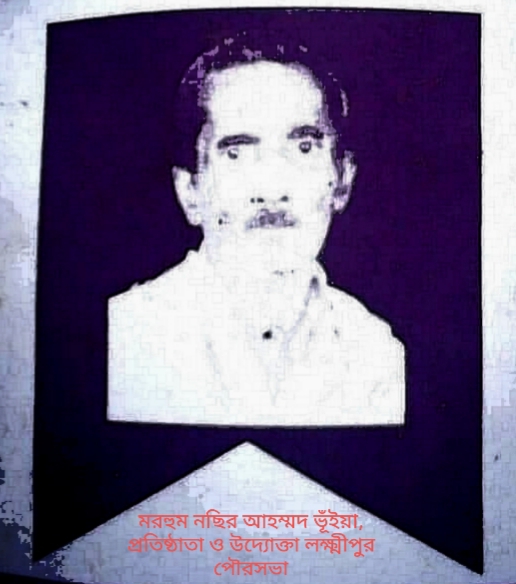

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

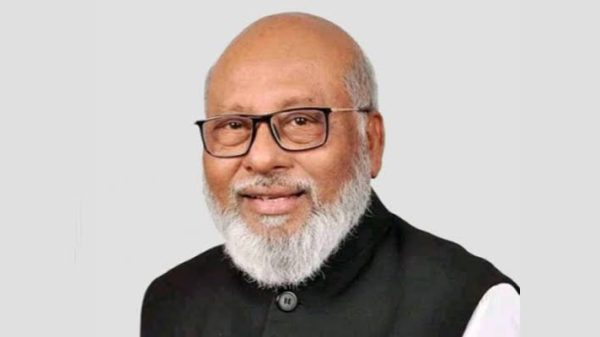

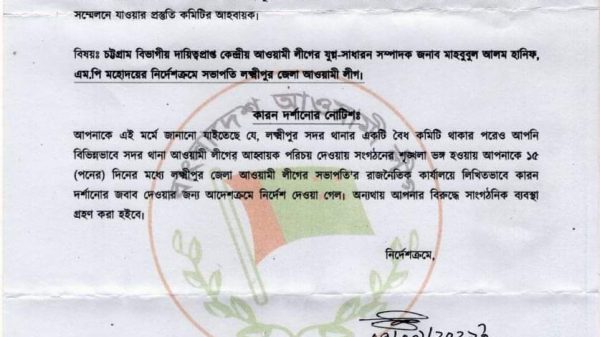

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি