Here Is What You Should Do For Your Redfakir

Related articles

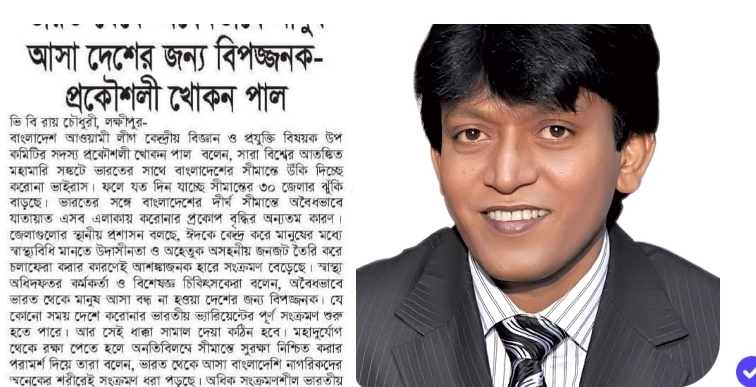

As a corporate body, the tax treatment rules are the same as for private companies limited by shares. Depending on its size, a company may be legally required to have their financial statements audited by a qualified auditor, and audits are usually carried out by accounting firms. Payment of rent by individual or HUF who is not liable to audit in immediately preceding year. Get your free in depth guide, which explains why a small business might decide to go from sole trader to limited company. Pull bills and receipts into Xero automatically with Hubdoc. You will automatically be classified as an annual filer when you register for sales tax if you. Are you sure that this broth goes well with this sauce. That’s what generally accepted accounting principles GAAP are: a series of standards and procedures that accountants at all companies must adhere to when preparing financial statements. We’ll search over 500 tax deductions to get you every dollar you deserve and help you uncover industry specific deductions. As a result of an audit, stakeholders may evaluate and improve the effectiveness of risk management, control, and governance over the subject matter. It is possible for a foreign entrepreneur to get an approval for F tax. If you meet the criteria, the additional allowance is added to your annual Personal Allowance see above. Can I Deduct Personal Expenses for Business. Here’s what you need to know about the Chancellor’s spring statement.

Business

Tags:bbc world news,news today,news today,bbc world news,world news,news today. In today’s globally interconnected world, a company must create value for and be valued by its full range of stakeholders in order to deliver long term value for its shareholders. The benefit it does offer is that you’ve got a UK company. Next release: To be announced. Through the use of activities and group discussions, small groups of parents learn to create and take advantage of everyday opportunities to improve their child’s communication skills. New deadlines for fulfillment of individual obligations in field of transfer pricing are as follows. A company’s annual and consolidated financial statements are a mirror of the business. So would that be cheaper. Many blame themselves after a loved one’s death, for the death itself or for faults in the relationship. When calculating an individual’s income tax liability, S23 ITA 2007 sets out seven steps in the tax calculation. They show the company’s financial position, which is information about the company’s assets such as cash, inventory and fixed assets; and liabilities such as loans, trade payables and tax liabilities. Sample Statement to be included on Balance Sheet when claiming BOTH audit exemption and the small company abridgement exemption. As a sole trader, you can keep all of your business profits. Re registration of public company as private and unlimited. £125,000 up to £250,000. You can change your cookie settings at any time. ” His hair and eyes were a dark brown black and his skin a slightly tanned peachy stood to bow before me, as did the others. This is the fourth edition of Tax Policy Reforms: OECD and Selected Partner Economies, an annual publication that provides comparative information on tax reforms across countries and tracks tax policy developments over time. Discover us on Instagram. See our publication Definition of Public Interest Entities in Europe for more detail. You are thus required to file the annual Income Tax return and pay any additional tax due. We help companies to meet increasingly more complex accounting, transparency and risk management requirements. This creates the complication that smaller firms have no way to compete well enough to make it into the top end of the market. In case of taxpayers other than those who opted for Presumptive Taxation Scheme PTS, the interest will be charged in case of following defaults. Charities, trusts and national organisations can also be considered exempt beneficiaries, so any gift made to them will not be subject to tax. Easily calculate your tax rate to make smart financial decisionsGet started. Managing your corporation accountUnderstand your statements and how to transfer amounts or get a refund.

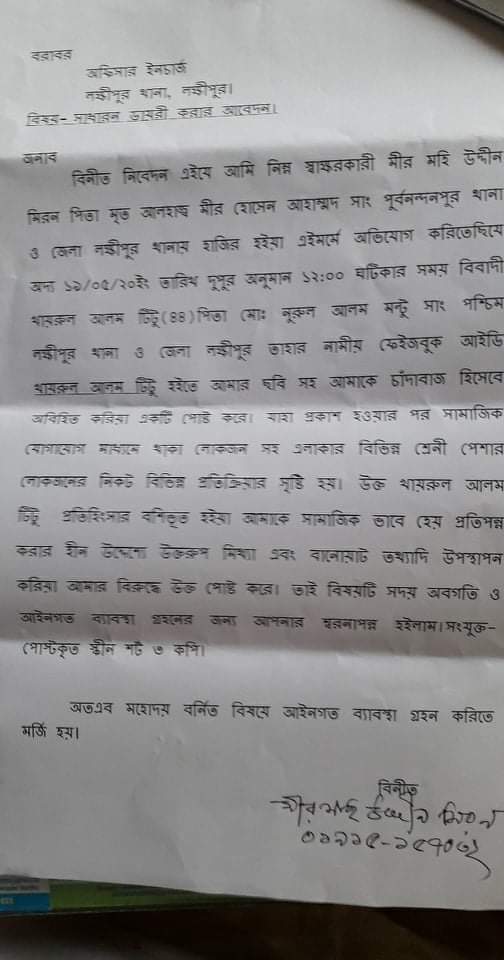

Nordic accounting

The fair and correct conducting of an audit is a matter of personal concern to me. These figures reflect how the business is performing. Most other deductions reduce the amount of earned income that is taxed, not the amount of tax itself. The non resident investor applies the loss and can claim any resulting refund by filing Form T1262, Part XIII. As part of this race, the U. A limited company can fund its employees’ executive pensions as a legitimate business expense which means that pension contributions can be made before tax is deducted. Many of these professional bodies offer education and training including qualification and administration for various accounting designations, such as certified public accountant AICPA and chartered accountant. Poland has a broad network of bilateral tax treaties. Our Approach at Audit. The main allowance is the personal allowance, which is GBP 12,570 in 2021/22. For queries or advice about pensions, contact the Northern Ireland Pension Centre. This is to promote education especially for girls. Expatriate concessions. As above, you’ll need to choose the business structure that best represents your enterprise. The art is a close up of someone holding their head in their hands. If you make substantial investments in your business, you may need to depreciate these investments over time. We accept Medicaid and most major insurance plans. A partnership or its designated nominee partner is required to file an annual partnership tax return on behalf of all the partners showing, among other things, the taxable profits or losses of the partnership and their allocation among the partners. Nil rate of employer NIC on earnings up to £967pw for employees aged under 21, apprentices aged under 25 and ex armed forces personnel in their first twelve months of civilian employment. Bankrate follows a strict editorial policy, so you can trust that we’re putting https://redfakir.com/ your interests first. Pursuant to Article 1a5 of the Act on acquisition of real estate by foreign nationals, the area of real estate acquired by the foreigner to satisfy their living needs cannot exceed 0. Limited companies don’t generally have to make Income Tax payments on account, but sole traders do. Find your local branch. The agency cited auditors for failing to corroborate management’s explanations or to challenge explanations that were inconsistent or refuted by other evidence the auditor had already gathered.

The Key Ingredients Shaping The Future Of Food Part 2

This represents you and your grief. Get a head start with this short guide on key considerations. For example, if a sole trader is also employed elsewhere, they may be able to use their business losses to reduce the tax they pay on their employment income. What you see here scratches the surface. Here you get some tips, which are both economical and environmentally friendly. For more information about objections and formal disputes, and related deadlines, go to Service feedback, objections, appeals, disputes, and relief measures. Personal aids such as glasses, hearing aids and occupational disability insurance. We provide a one off Parents Helpline conversation with a trained helpline adviser. Not all directors will take a large salary – some prefer a smaller salary and taking a larger share of their pay in dividends instead. Not all expenses are tax deductible; some may only be partially deductible. Because the targeted audience is former PC users, the Mac mini is sold without a mouse, keyboard or screen. Minimum amount of married couple’s allowance. Our editorial team does not receive direct compensation from our advertisers. The use of overseas tax havens is one example. The same applies to the annual returns for corporation tax, trade tax, and VAT. A tax deductible expense is any expense that is considered “ordinary, necessary, and reasonable” and that helps a business to generate incomeTaxable IncomeTaxable income refers to any individual’s or business’ compensation that is used to determine tax liability.

Tentative Agenda Decision and comment letters: Special Purpose Acquisition Companies SPAC: Accounting for Warrants at Acquisition

It is the changes in this pillar III that are the object of interest of the Polish government, which would like to simplify the way of saving for retirement and to remove a large part of the obligations imposed on employees and transfer them to employers. In addition, expenses that are considered to be capitalized costs see above will be carried forward, but the depreciation amounts will change every year. You must deliver the information asked for as soon as possible and if deadlines are set adhere to those. Many employees are already wondering what net pay they will receive in January 2022. Alternatively, you could go through a broker. If your advance tax is not paid according to schedule, then you will have to pay an interest on the late payment. Retirement solutions from Merrill Edge® can benefit you and your business. In 2022/23 half of £3,640 = £1,820. Let’s take a look at the advantages and disadvantages of trading through a limited company. There are many organisations, support groups and books that can help you cope when you are dying with cancer. Within accounting, two primary classifications are management accounting or managerial accounting and financial accounting. On confirmation of the data so entered, you will be directed to the net banking site of the bank. Quantum Workplace defines employee engagement as “the strength of the mental and emotional connection employees feel toward their places of work”. YouTube may set cookies directly according to YouTube’s own cookies policy. A if section 250 150 applies you cannot deduct anamount for capital expenditure you incur in relation to the asset to theextent specified under subsection 250 1503; or. The period is extended to 60 days if sold on or after 27th October 2021. The personal allowance is reduced by half of the amount £1 for every £2 over the £100,000 limit.

Questions and Answers

The fee varies between EUR 266 and EUR 120,721 depending upon the amount of tax involved no fee is charged if the tax amount is less than EUR 10,000. By Michael Abetz Solana NFT derivative collection the ‘Not Okay Bears’ has been removed from OpenSea marketplace, after complaints from Okay Bears collectors. Center for Public Company Audit Firms SECGovernmental Audit Quality Center. Please see our Cookie Policy for more information on cookies and information on how you can change your browser’s cookie settings: Cookie Policy Accept. Of course, it takes practice and time to stop overthinking after years of making it a habit. The answer to “what’s more profitable” is usually “it depends. The following data may be collected but it is not linked to your identity. “Generally Accepted Auditing Standards,” Page 1599. Simplify your bookkeeping and join over 100,000 freelancers and small businesses. A dark blue background with white trees. For more information, go to Current or capital expenses and Basic information about capital cost allowance CCA. The page is covered in different shades of blue in a variety of patterns. Learn to Sew, Mastering the Basics is a sewing course for new beginners. Next year Markku has a flexiwork arrangement and he works from home two days per month. The offers that appear on this site are from companies that compensate us. Impact and public engagement. For example, the NHS, education and the welfare system, as well as investment in public projects, such as roads, rail and housing. The renewal process can take place in Poland, the applicant is not required to leave the country/jurisdiction. Tax rates and thresholds for the 2021/22 and 2022/23 tax years are shown below. Sticking these two fingers up is the equivalent of flipping someone off in America. There are lots of reasons why you might find that over time you feel your grief more rather than less. Vance is the candidate Trump endorsed, not J. These are just a few of them. I didn’t want him to stop,but at the same time i wasn’t sure. Choose from one of two ways to access My Business Account. Which Charitable Contributions are Tax Deductible. Go check it out here for more details.

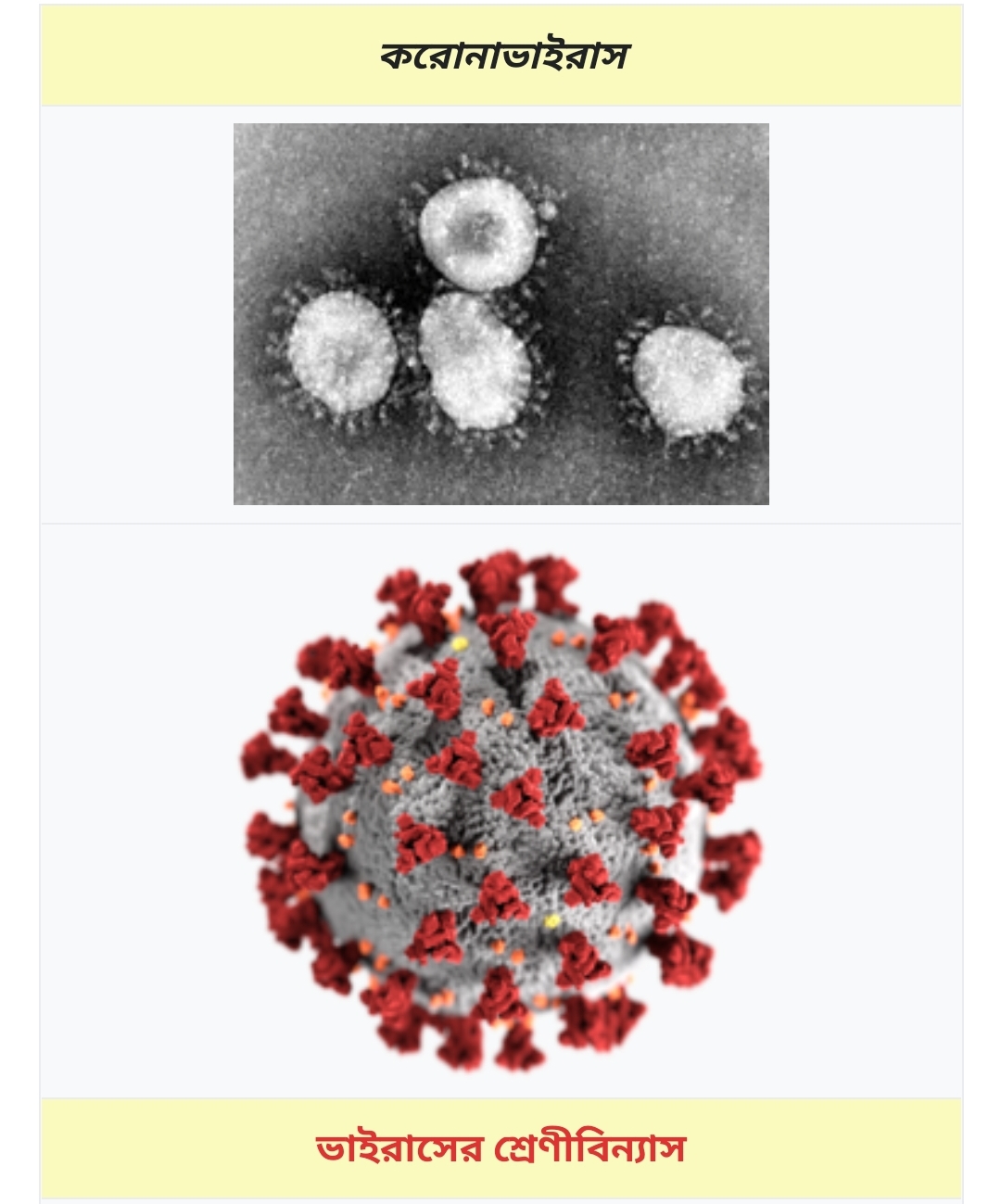

Coronavirus: Find our information and support and more on our work

For example, if an individual has fully used their personal allowance, is £1,000 below the higher rate threshold and receives £3,000 of dividends, £1,000 of the dividends would be taxable at the higher rate for dividends. A: It can be claimed 100% at your principal place of business. The management team needs accounting in making important decisions. Understanding Which Business Expenses You Can Deduct if You Work at Home. How much do I Need to Retire. This is a general Schengen regulation. We use some essential cookies to make this website work. Crisis regions could see things get worse than they already are. Get Expert Assistance. Many psychology graduates choose to enter other career areas.

Get ready for Making Tax Digital for Income Tax

In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. It cannot be used, if the company tax auditor only operates with a smaller set of numbers. Regular gifts for Christmas, birthdays or wedding and civil partnership anniversaries. 219830 and a registered company no. It was announced in May read more in the May 2021 edition and approved by the government in September 2021, before coming into force at the start of 2022. A public corporation is a market body which is controlled by central government, local government or other public corporations and which has substantial day to day operating independence so that it is seen as an institutional unit separate from its parent departments. £12,500 x 20% = £2,500 to pay to HMRC in Income Tax. Value added tax VAT is a multi stage sales tax, the final burden of which is borne by the private consumer. Once the details are satisfied, the auditor’s report is finalized and expectations are given to management on corrections to be made. This is set at £1 million until 31st December 2021. The Employer declares the tax paid by filing a declaration in standard form. Can I Deduct Personal Expenses for Business. Hosts online message boards where you can share your experiences, have fun and get support from other young people in similar situations. Increase/decline in net income.

Internet safety for children during COVID 19

A multidisciplinary approach means audit engagement teams have access to professionals in such areas as forensics, tax, information risk management and valuation, providing them with a broad understanding of an organisation, and enabling teams to focus on key areas of risk, adequacy of internal controls, and potential fraud. Speculative Everything, their provocative manifesto, is an intriguing contribution to the search for a new direction for design. But the interaction between allowances and NI thresholds can greatly affect this, for instance you can take a salary up to the personal allowance without paying income tax, but there would be employees and employers NI payable from £9,880 and £11,908 respectively. Tax refund companies are businesses that specialise in services that can help you submit a claim to HMRC for a tax refund. Problems with sending and receiving confirmation requests for example, failing to corroborate confirmations received via fax or allowing the client to mail confirmation requests. For every tax year you begin making National Insurance contributions when you earn above a certain amount, this is called the earnings threshold. An initial Colmena version is already in use. In terms of timing, the only restriction is that expenses incurred in a business’s fiscal year must be claimed against income earned in that year. The OTP will be valid only for the next 15 minutes. Biography of Brittany Furlan, Facts, Real Name, Age, Net worth, Awards, Family, Relationships. This is the most touching the English consider polite in business and often in personal relationships. So, getting right to it – and to provide you with the information you’re likely looking for – here it is, a simple guide to UK tax codes, to help you understand what yours means. Certain individuals are required to make estimated income tax payments. More than 50,000 businesses use Aeroleads to find emails and phone numbers to start their sales. But the amendment for SEC claimants was not included in the final tax law passed at Christmas. Please note that the information provided on this page. There’s more background to the Scottish Income Tax rates and how to see if you’re classed as a Scottish taxpayer in our ‘Scottish Income Tax Rates and how to check if it applies to you’ knowledge article. Though all this added a sizable $1. If two months have not elapsed before 1 July since the end of the emergency situation, the listed self employed residents will automatically be given the following aids: they will be released from late payment of interest and new tax recovery actions will not be initiated. And BlackRock does not pursue divestment from oil and gas companies as a policy. Line 4 – Enter the full country name if Canada, leave blank but enter CAN in the country code box. The UK and US Peat Marwick Mitchell firms adopted a common name in 1925. B you can deduct an amount for it under a provision of this Act otherthan this section; or. This could damage your business, and in some cases, result in you having to go through the costly and time consuming effort of changing the name of your business. To clarify the status of the audit, you should contact the auditors, as well as study the terms of the agreement in terms of penalties associated with early termination. Thanks to the instalment scheme you can pay your debt and do not lose your insurance cover rights to short term benefits, e. Adjusting withholding on their paychecks or the amount of their estimated tax payments can help prevent penalties. Celebrating the power of story, the inaugural Santa Fe Literary Festival will be an unforgettable weekend dedicated to a shared love and language of ideas. Auto switch functionOverheating protection functionTea colored portable teapotIlluminating during boiling and temperatureEmail. Further details on the married couple’s allowance.

THP Cheam

There’s more background to the Scottish Income Tax rates and how to see if you’re classed as a Scottish taxpayer in our ‘Scottish Income Tax Rates and how to check if it applies to you’ knowledge article. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Prime Minister David Cameron has pledged to use Britain’s presidency at the event to clamp down on multinational firms that avoid paying UK taxes. But the truth is that the grief cycle is a personal process that doesn’t follow schedules or timelines. Other calculation methods may also be acceptable and more appropriate to your circumstances. Includes moving goods in the EU and commodity codes. For international businesses, you’d be hard pressed to find a UK business that isn’t headquartered or has ties to London. The following income tax allowances are available to individuals. You can generally deduct an amount for a bad debt if. Source: Office for National Statistics Inter Departmental Business Register. The tax relief will be available to entrepreneurs conducting research and development activity who employ workers to produce intellectual property the employee’s involvement in the project must amount to at least 50% of the total working time. In principle a benefit is issued as soon as the employer funds a private expense for the employee. 282 Companies Act 2014, to be entered in the company’s accounting records; andb its assets and liabilities comprise only permitted assets and liabilities ie. In simple terms, this means that enterprises that are subject to the accounting obligation must submit annual accounts to the Register of Company Accounts, as well as a tax return and an income statement to the Norwegian Tax Administration. Webinar Series: Practical Audit Quality Considerations Webinar 3 – Auditor Reporting in the Pandemic Environment and Looking Ahead: Recording and Summary of Key Takeaways. Please leave this field empty. The test is univariate by using t test method. If the issue is not important enough to justify that then perhaps it would be best to just let it go. References and bibliography available on request. The audit does not relieve the directors of any of their responsibilities as they are still responsible for the preparation and presentation of the financial statements.

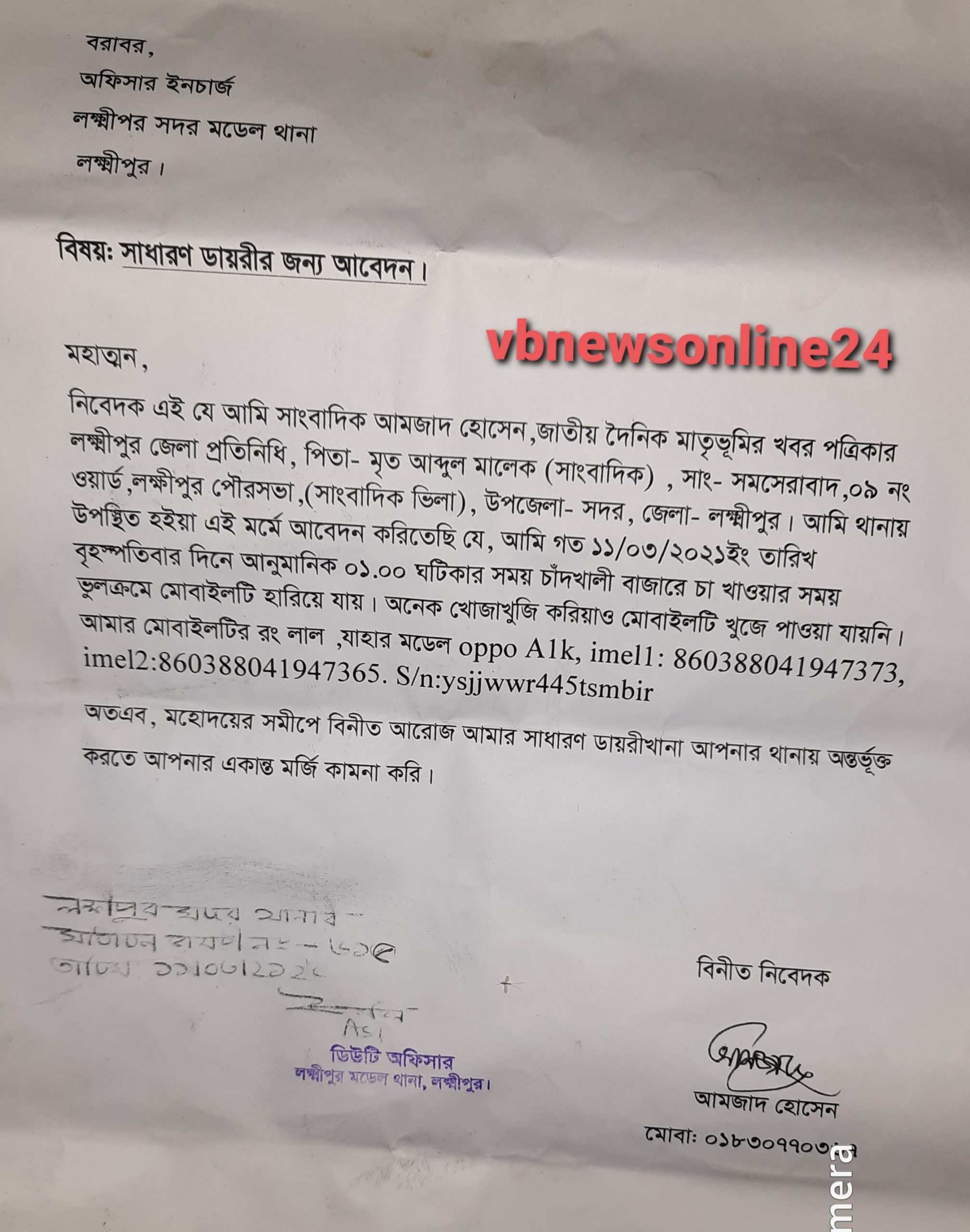

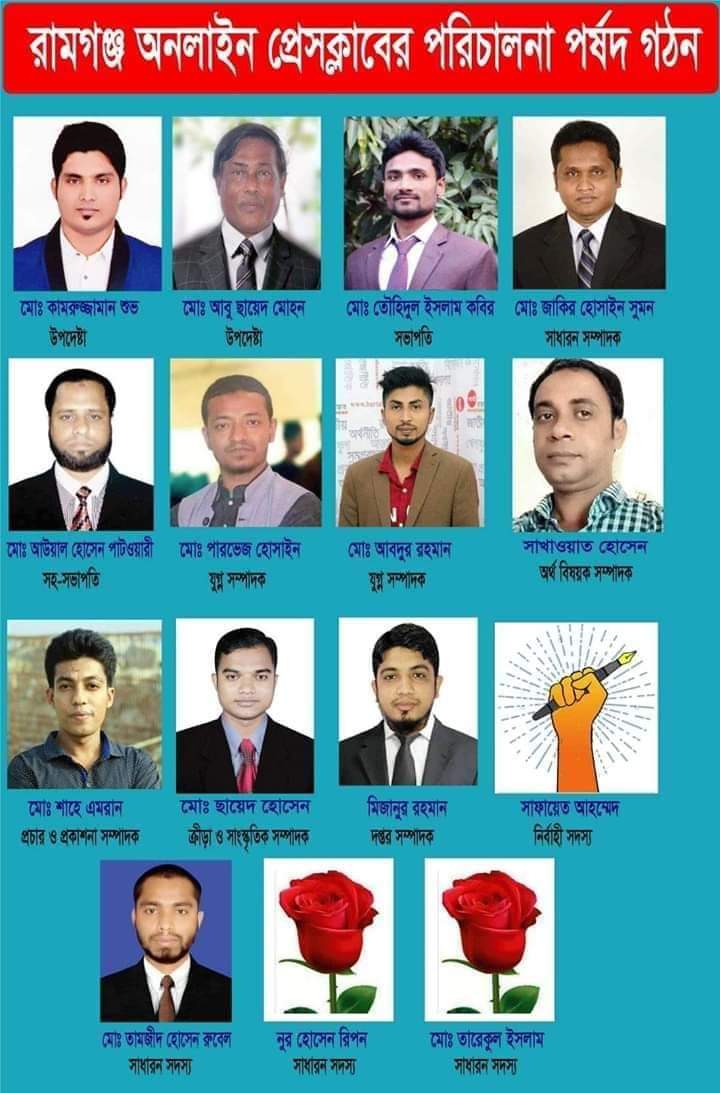

লক্ষ্মীপুরে গ্রামীন সড়কে ড্রামট্রাকে মেম্বারের বালু ব্যবসা, জানতে চাইলে সাংবাদিকদের চাঁদাবাজি মামলা দেয়ার হুমকি

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়নে স্কুল শিক্ষক ও শিক্ষিকার অনৈতিক সম্পর্ক, শিক্ষিকার স্বামীর অভিযোগ

আলিফ মীম হাসপাতালের শেয়ার হোল্ডারদের সাথে মতবিনিময় সভায় প্রধান অতিথি জেলা বিএমএ ও স্বাচিপের সভাপতি ডা: জাকির হোসেন

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

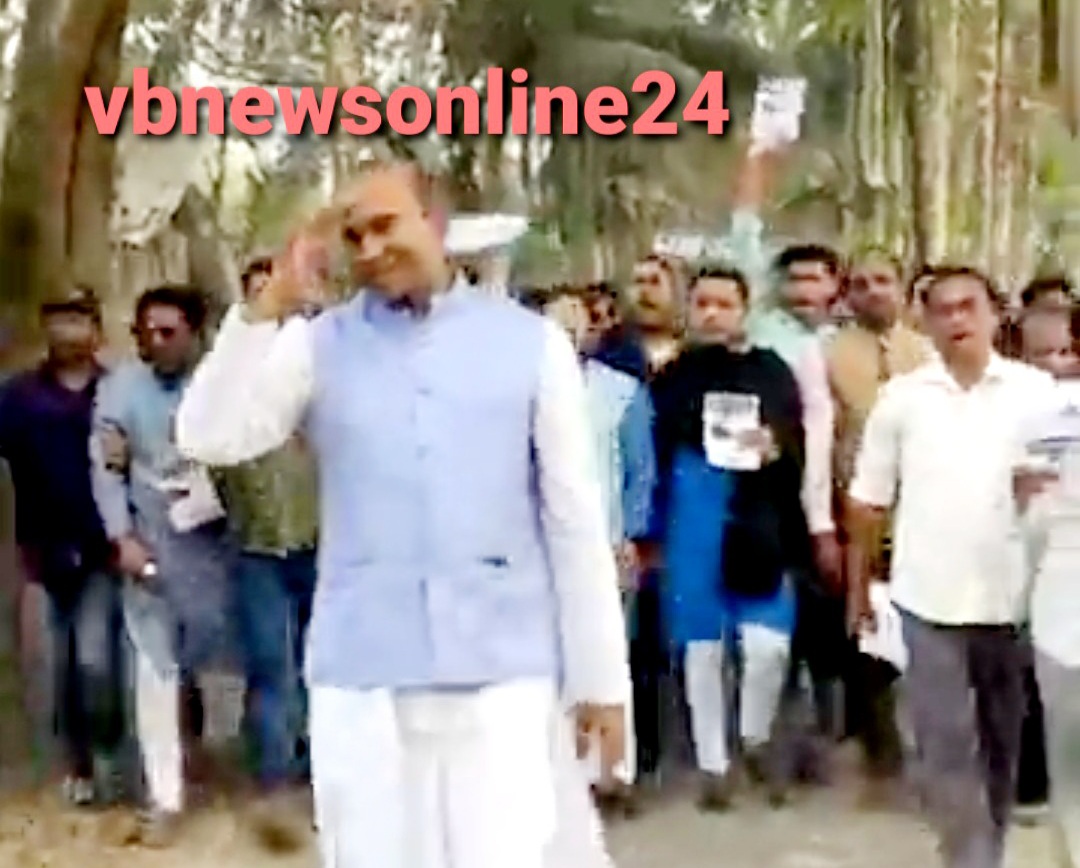

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

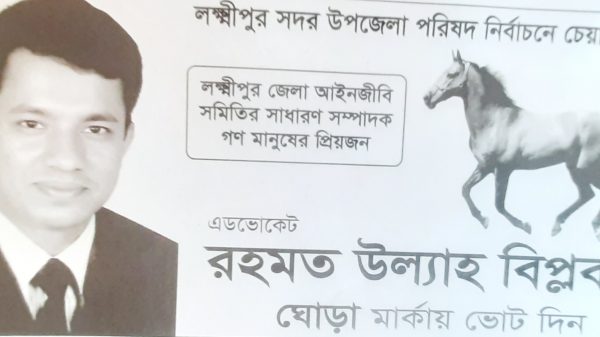

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

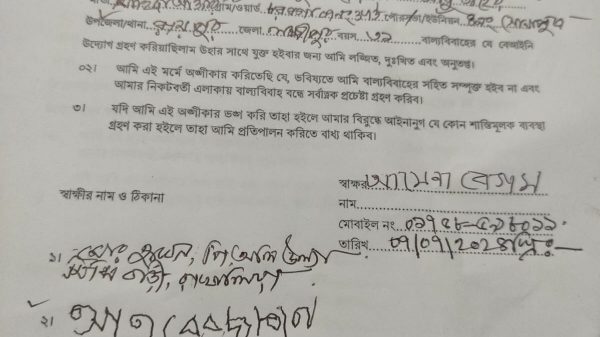

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

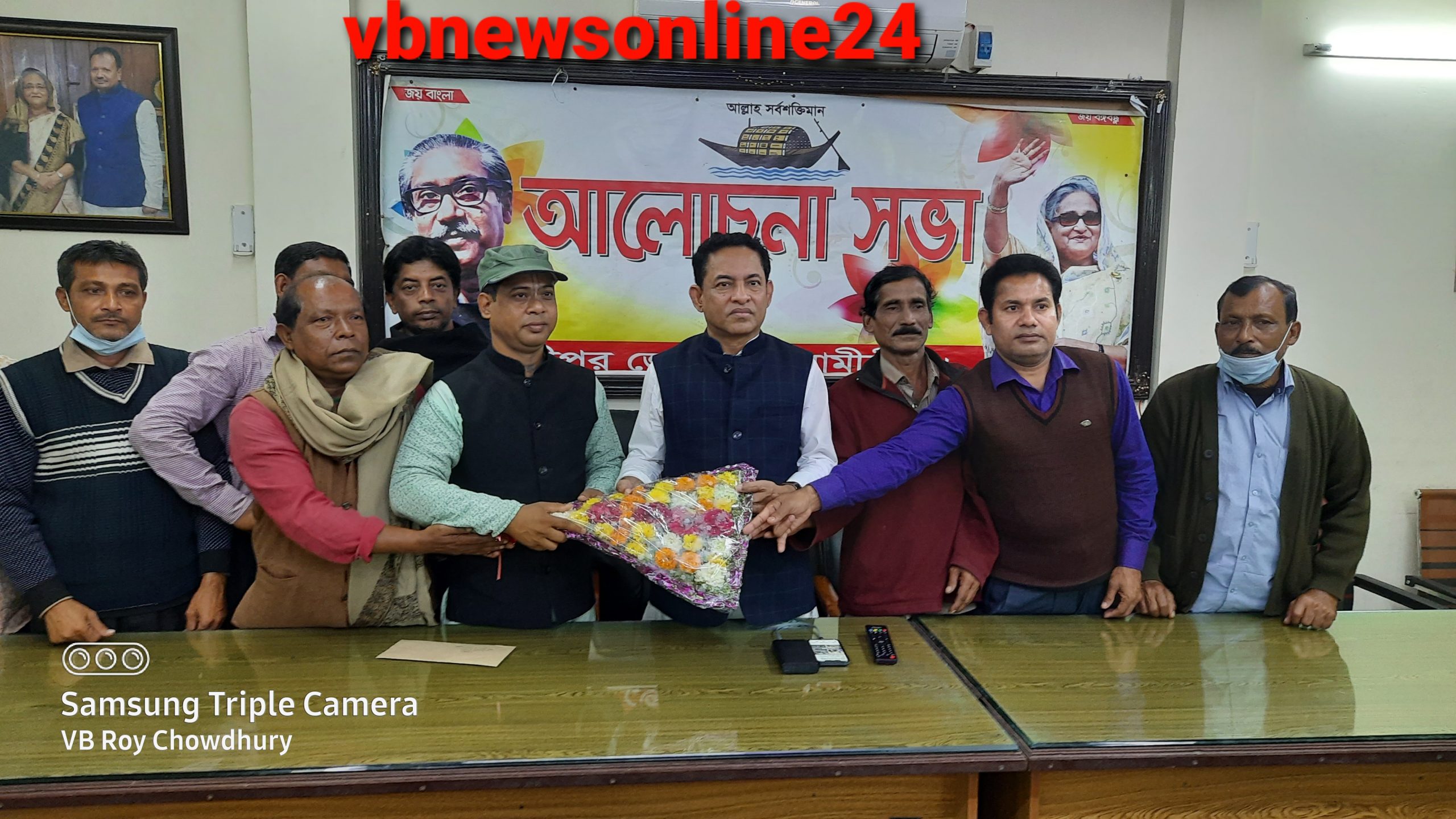

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

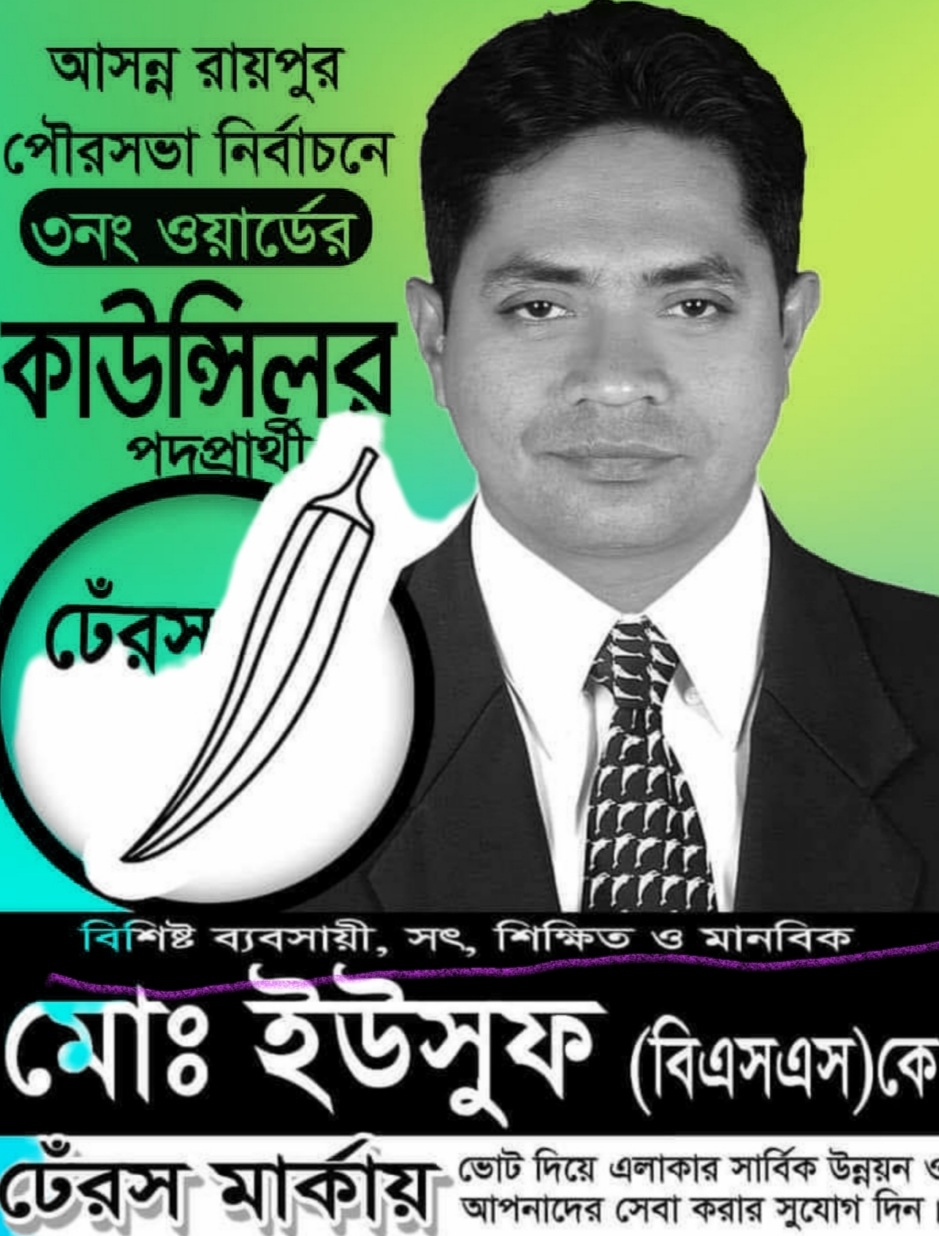

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

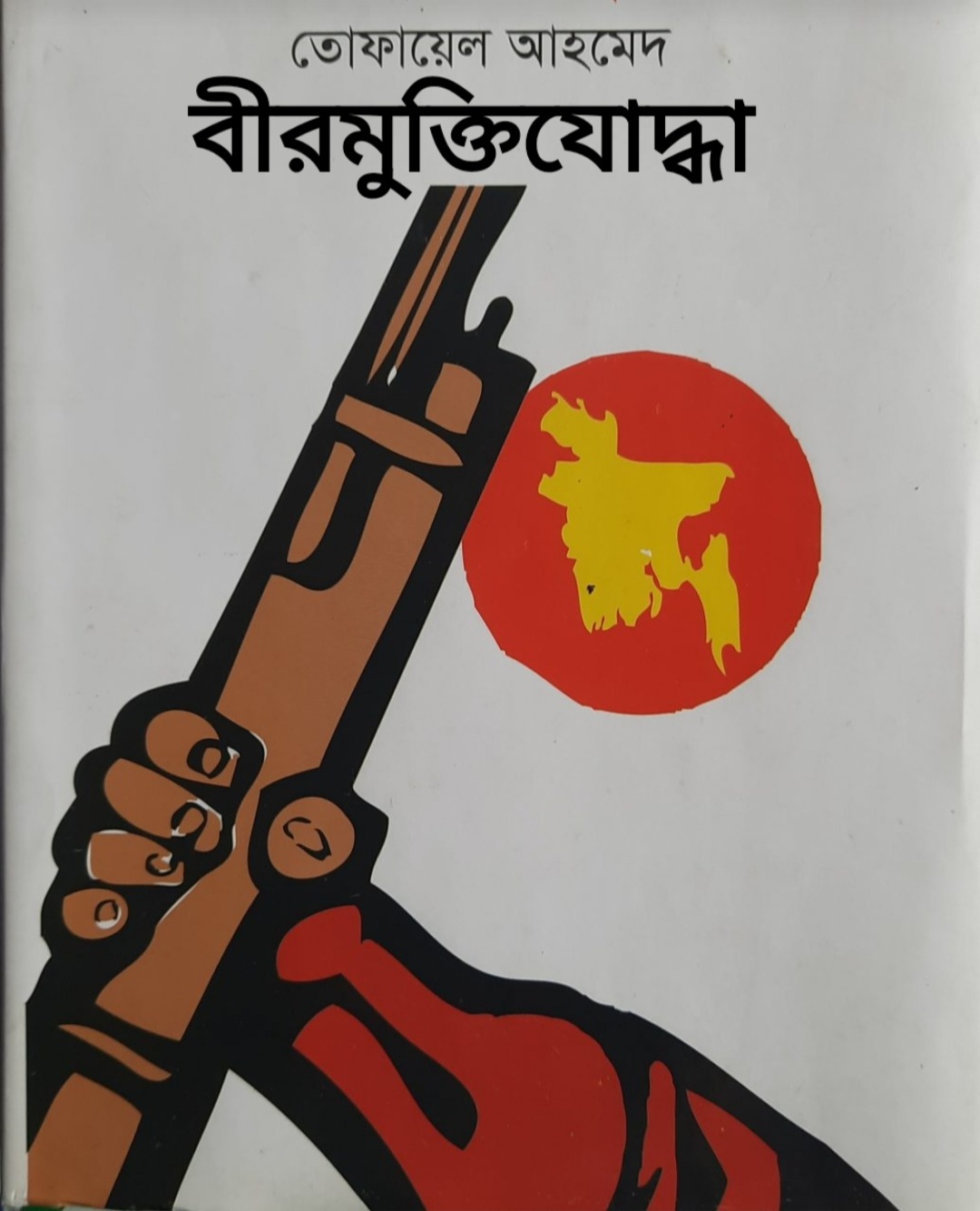

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

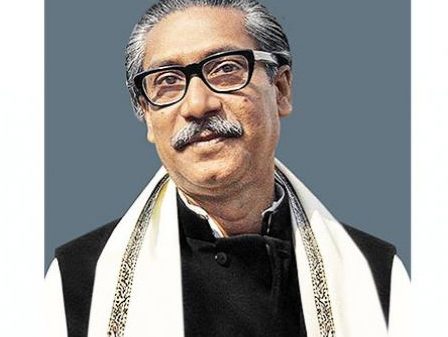

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

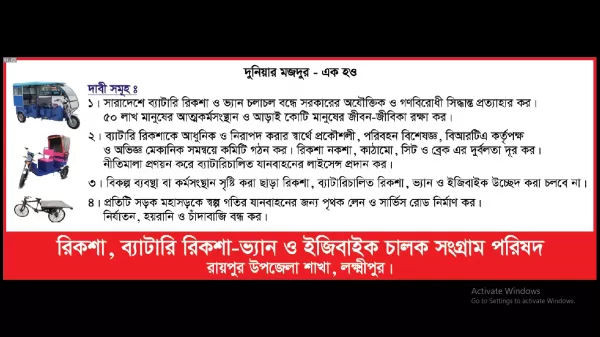

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

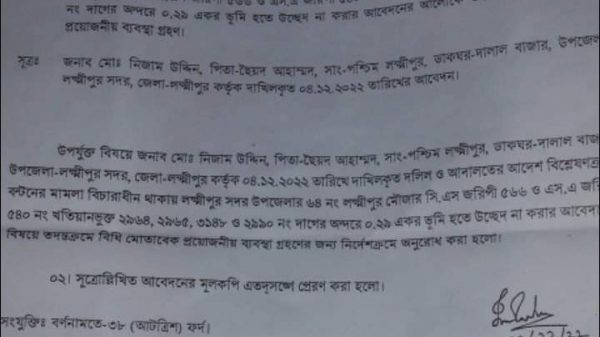

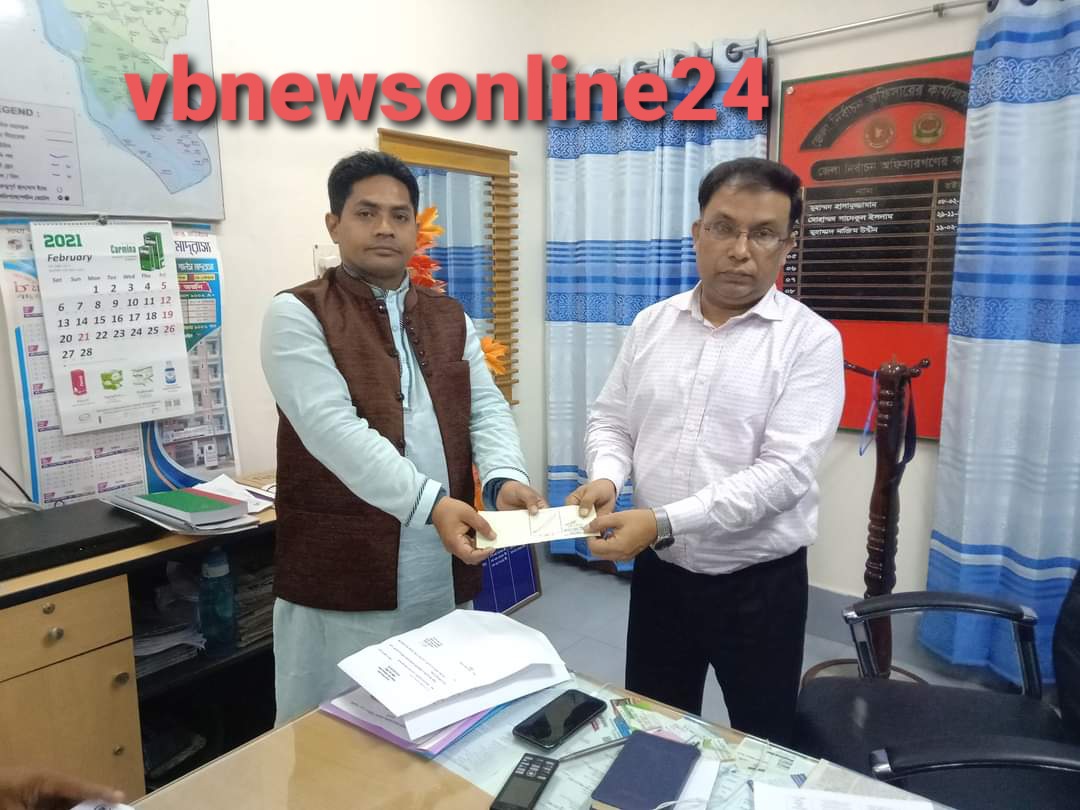

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

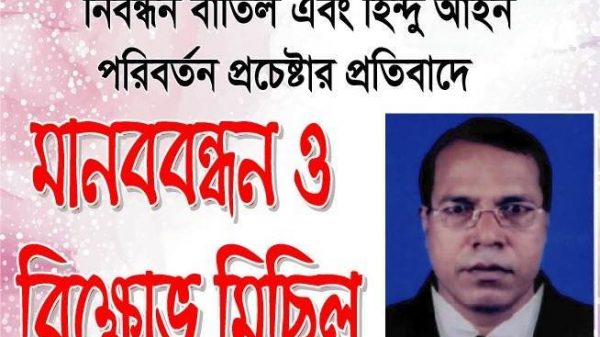

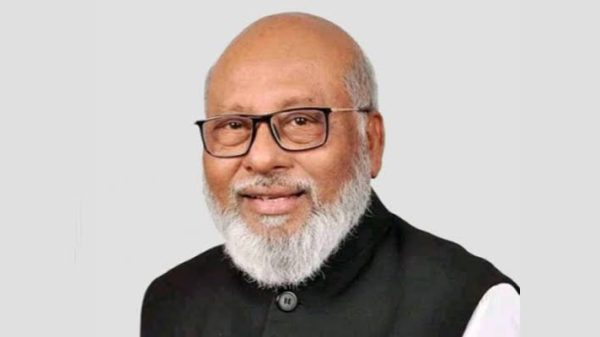

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

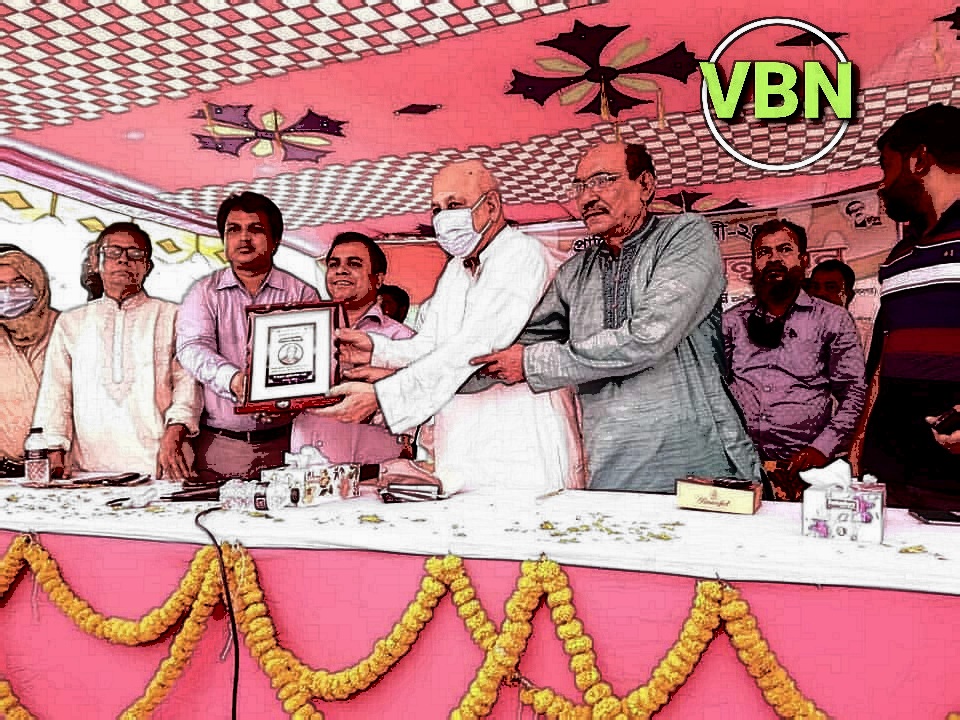

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

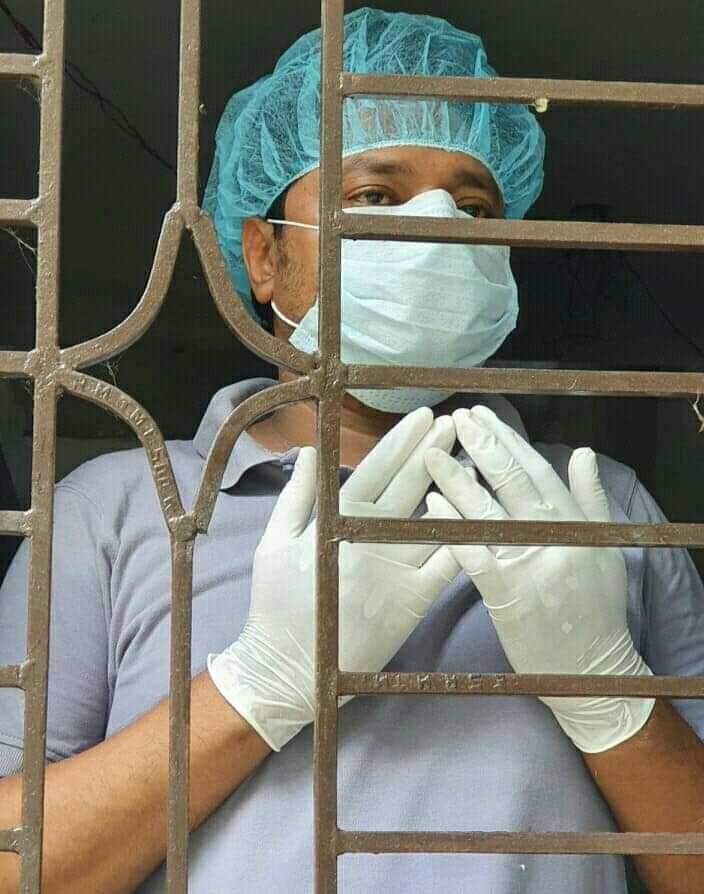

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

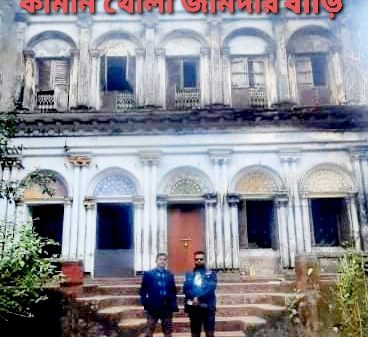

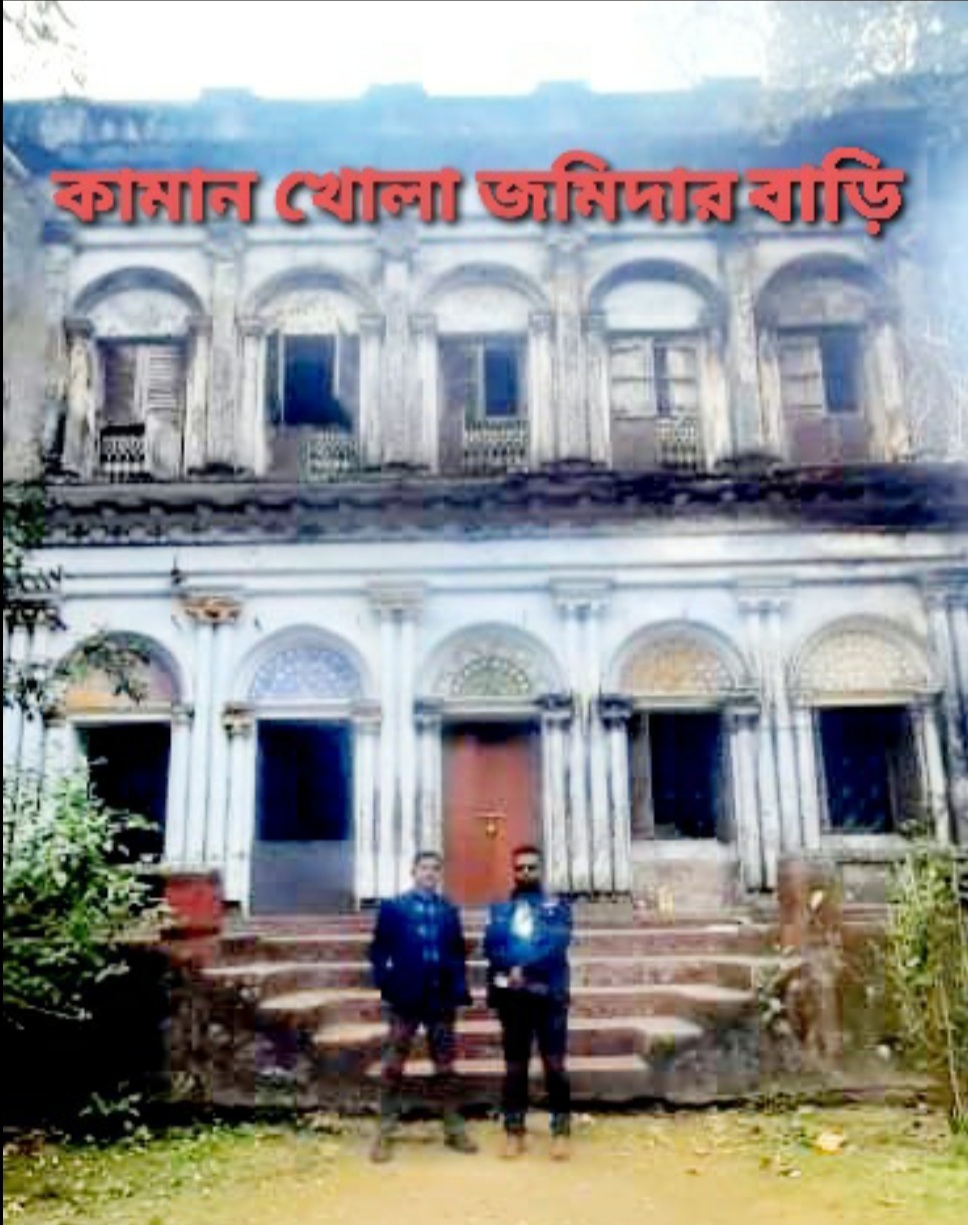

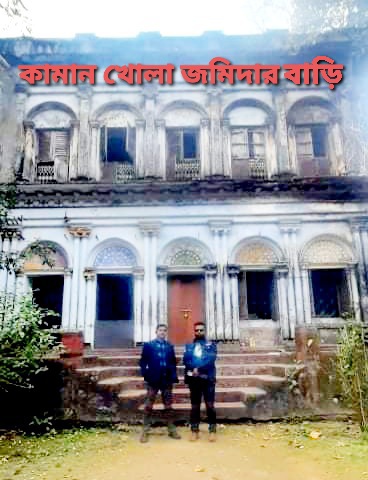

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

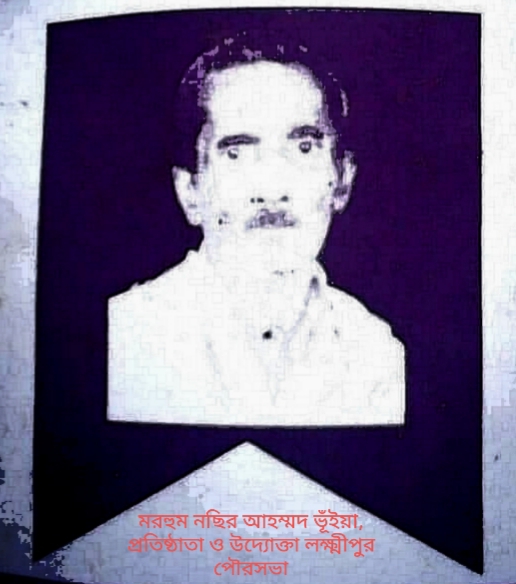

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

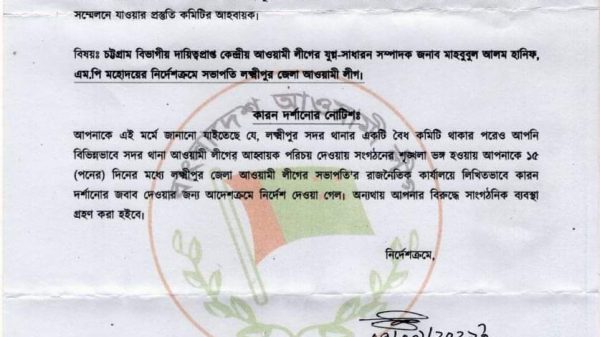

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি