What is Inventory?

Content

So we highly recommend employing the services of a professional bookkeeper and/or chartered accountant when it comes to compiling financial records and submitting tax returns. Both Xero and QuickBooks do also have tools available to help with the inventory side of accounting. Sales are also being made at the same time, turning inventory into cash. And this leaves the final inventory figure to be included as a company asset.

Those two other types of businesses aretrading and manufacturing businesses. The size of the asset, or how quickly one can sell it, is not the overriding factor when classifying an asset as inventory.

Cash and credit sales work almost the same in the perpetual inventory system, but there are some key differences. But in order to do that, two things have to occur – purchases and sales. In this lesson, we’re going to talk about the sales portion of a merchandising business. Though I’m sure you already know what sales are, I’m going to take the time to define that term. The next step is to recognize the expense side of it by debiting the Cost of Goods Sold . Remember, we did not expense the inventory when we purchased it – only once you use it. Once we sell it, we have to expense the cost of the inventory for however much you paid for the goods.

We will illustrate the FIFO, LIFO, and weighted-average cost flows along with the period and perpetual inventory systems. This will be done with simple, easy-to-understand, instructive examples involving a hypothetical retailer Corner Bookstore. This method, commonly referred to as “LIFO,” is based on the assumption that the most recent units purchased will be the first units sold. If you only sold a single item, https://www.bookstime.com/ would be simple, but it’s likely that you have multiple items in inventory and need to account for each of those items separately. While this is not difficult, you can quickly run into complications when inventory costs vary. Choose an inventory accounting method that suitable for your business needs to maximize revenue potential while effectively managing record-keeping for tax purposes.

Of course, OneUp might be overkill if you only need basic accounting functionality, and at around $9 per user, per month depending on the plan, you might prefer to consider a free alternative instead. One downside to using AccountEdge is that it’s only available as a desktop application. This makes it less useful for on-the-go accounting than other options that have powerful mobile apps with a range of features.

Inventory accounting key terms

Even though the actual item shipped to the customer may not be the same physical item that was first delivered, the value assigned to it must be correct. The FIFO method requires that each delivery of product is recorded separately with the date and price.

In accounting, ‘inventory’ applies to all the raw materials, goods in production and finished products that can be sold within a business or organization. When preparing monthly or quarterly income statements, the amount of revenue is recorded at the top of the income statement. When you sell goods, you recognize the reduction in inventory as well. If your accounting method shows a $20,000 COGS and your prior inventory level was $100,000, your new inventory balance would be $80,000.

- A key element to knowing your real-time profitability and cash-flow levels is tracking your Cost of Sale or Cost of Goods Sold .

- When this happens, the right stock has to be removed from the inventory records.

- To correct a shortage, reduce the balance on the Inventory object code and increase the Inventory Over/Short object code in the sales operating account.

- It’s essential to know your real-time profitability and cash-flow levels to scale up and stay ahead of your competition.

- Proper inventory accounting enables companies to represent their net income accurately.

Assuming inflation, this will mean that cost of goods sold will be at its lowest possible amount. Therefore, a major advantage of FIFO is that it has the effect of maximizing net income within an inflationary environment. The downside of that effect is that income taxes will be the greatest. Inventory accounting determines the value for stock items and the correct item count. These figures establish the costs of goods sold and the ending inventory value, which factor into the company’s overall value. For example, assume that you sell your office and your current furniture doesn’t match your new building. One way to dispose of the furniture would be to have a consignment shop sell it.

COMPARISON OF THE METHODS

Manage inventory at multiple locations and warehouses, including transfers to various locations. Financial statements and income tax returns each year as dictated by their country’s revenue collection agency. Failure to comply will result in fines and penalties and possible incarceration. For example, if Mary were to buy 50 wine glasses at $12 each, and then order another 50 wine glasses but this time paying $16 each, she would assign the cost of the first wine glass as resold at $12. Once 50 wine glasses are sold, the next 50 glasses are set at the $16 value, no matter the additional inventory purchased within that time. IAS 2 requires the same cost formula to be used for all inventories with a similar nature and use to the company, even if they are held by different legal entities in a group or in different countries.

Camcode does not warrant performance of its materials in any environment. Users must test materials in the specific anticipated operating environment. Property Identification Tags Explore options for easy identification and tracking of property assets. Education Explore asset tags designed for educational facilities and university property tracking. The LIFO approach works on the assumption that the most recent products added to your inventory are the first ones to be sold first. It assumes inventory that was purchased first, is also the first to be sold. So the oldest on-hand inventory available is what will be used to fulfil an order.

AccountingTools

Again, It does not matter if customers actually buy the newer pair of jeans first. Under LIFO, a company always assumes that it sells its newest inventory first. Nevertheless, this method represents the true flow of goods for very few companies. NetSuite provides cloud inventory management solutions that are the perfect fit for companies within the startup to small businesses to Fortune 100 range. Learn more about how you can use NetSuite to help plan and manage inventory, reduce handling costs and increase cash flow. The average cost of inventory is a method for calculating the per-unit cost of goods sold. To calculate the average cost, get the sum of the cost of all stock for sale, and divide it by the number of items sold.

What are the 5 main reasons for using FIFO?

- Increased Warehouse Space. Goods can be packed more compactly to free up extra floor space in the warehouse.

- Warehouse Operations are More Streamlined.

- Keeps Stock Handling to a Minimum.

- Enhanced Quality Control.

- Warranty Control.

Now, when it comes to sales of inventory, there are actually two entries that must be made into the accounting system. The first entry records the actual sale with a debit entry Inventory Accounting to an asset account and a credit entry to a revenue account. The second entry requires a debit to the cost of goods sold account and a credit entry to the inventory account.

History of IAS 2

After the sale, the buyer is the owner, so the consignment shop is never the property’s owner. Records costs relating to a sale as if the latest purchased item would be sold first. As a result, the earliest acquisitions would be the items that remain in inventory at the end of the period. Properly account for write-downs, write-backs and impact of change in inventory accounting policies on financial statements. Just like motor vehicles, land and buildings often fall under “non-current assets” in thebalance sheet for a business. Whether you’re manufacturing items or purchasing products from a supplier for resale, it’s essential that inventory be accounted for properly. Finding the method that best suits your business can go a long way toward making the process easier.

- The subsequent depreciation of the cost is included in production overheads in future periods over the asset’s estimated remaining useful life.

- Proceeds from the sale would be accounted for in a manner consistent with the nature of the asset, which may be different from IFRS Standards.

- Inventories are generally measured at the lower of cost and net realizable value 3.

- To meet these problems, accountants often use the gross profit method for estimating the cost of a company’s ending inventory.

- Inventory includes parts and merchandise items that will be sold to customers.

- This method is too cumbersome for goods of large quantity, especially if there are not significant feature differences in the various inventory items of each product type.

The sales transaction record shows your earnings from the sale of finished products. You can record this transaction by transferring the cost of the finished goods sold to the expense account for the cost of goods sold.

Deloitte comment letter on tentative agenda decision on IAS 16 and IAS 2 — Core inventories

When the textbook is sold, the bookstore removes the cost of $85 from its inventory and reports the $85 as the cost of goods sold on the income statement that reports the sale of the textbook. This cost flow removes the most recent inventory costs and reports them as the cost of goods sold on the income statement, and the oldest costs remain in inventory. This cost flow removes the oldest inventory costs and reports them as the cost of goods sold on the income statement, while the most recent costs remain in inventory. It is critical that the items in inventory get sold relatively quickly at a price larger than its cost.

FIFO and LIFO are two prominent ways to account for inventory when recording cost of goods sold. FIFO means that you recognize the first inventory acquired as the first sold. Small-business owners often prefer LIFO because it normally means a higher cost basis and lower taxable earnings in the short term, assuming normal inflationary conditions. FIFO is the most natural way to recognize inventory, though, since you account for the first items received as the first sold. Plus, you avoid the potential for higher taxable earnings in the future if your revenue goes up while you account for lower-cost goods. Another advantage of LIFO is that it can have an income smoothing effect.

- The balancing side of the double-entry accounting transaction would be against an account code “2050 – Inventory received, not invoiced”.

- Net realizable value is the value of an asset that can be realized upon its sale, minus a reasonable estimation of the costs involved in selling it.

- “DEAR is going to save you a lot of headaches, it’s going to save you a lot of time and stress and money, and you’ll see the results in your business pretty quickly.”

- Warehouse Management System Streamline order fulfilment with DEAR WMS Automation Keep your team in-the-know with automated alerts.

- This method uses the cost of your oldest inventory when the sale is made.

Companies using the LIFO method also struggle with obsolete inventory. The accounting for inventory involves determining the correct unit counts comprising ending inventory, and then assigning a value to those units. The resulting costs are then used to record an ending inventory value, as well as to calculate the cost of goods sold for the reporting period.

Tertiary packing is the shrink wrap required to ship pallets of product cases. Inventory, which describes any goods that are ready for purchase, directly affects an organization’s financial health and prosperity. Submit By submitting this form, you agree to the processing of personal data according to our Privacy Policy. In the next lesson we’ll go over common ways to value inventory in our records. I don’t know what you’d call this business category exactly, but they’re definitely a category on their own, and they definitely have inventory too. The overriding factor is what the business intends to do with the asset. Find opportunities for businesses owned by women and people of color.

What LIFO means?

LIFO = Last In First Out.

An inventory process tracks inventory as companies receive, store, manage, and withdraw or consume it as work in progress. Essentially, the inventory process is the lifecycle of goods and raw materials. WIP inventory refers to items in production and includes raw materials or components, labor, overhead and even packing materials. Comparing the various costing methods for the sale of one unit in this simple example reveals a significant difference that the choice of cost allocation method can make. Note that the sales price is not affected by the cost assumptions; only the cost amount varies, depending on which method is chosen.

What Is Average Inventory Cost?

Inventory accounting helps you figure out the value and costs of your inventory. That’s important for things like setting prices, getting insured, budgeting, working out taxes, and selling your business. It can also help you identify where you’re making the most money in your business. Inventory are the items that your business has bought, with the intention of on-selling to customers.

Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated. It is often deemed the most illiquid of all current assets and, thus, it is excluded from the numerator in the quick ratio calculation. Obsolete inventory refers to any finished products that aren’t sold as expected. It’s typical that businesses won’t sell all of their products in their inventory. Some products may go out of season, spoil before customers purchase them, accrue damage or otherwise become unsellable. Businesses anticipate that a certain percentage of their inventory won’t sell, and they reflect that amount as part of their inventory journal.

In periodic inventory, you count stock at specific times and add the totals to the general ledger. Well, motor vehicles would fall undernon-current assetsin thebalance sheetfor most businesses. However, in this particular case, the business intends to sell them as part of their regular business operations , and so these cars are classified as “inventory” under the category of “current assets.” Cost is defined as all costs necessary to get the goods in place and ready for sale. For instance, if a bookstore purchases a college textbook from a publisher for $80 and pays $5 to get the book delivered to its store, the bookstore will record the cost of $85 in its Inventory account.

- Common differences related to the accounting for income tax consequences of share-based payments.

- For instance, if a bookstore purchases a college textbook from a publisher for $80 and pays $5 to get the book delivered to its store, the bookstore will record the cost of $85 in its Inventory account.

- Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.

- Usually, the periodic system is done to double-check the accounting done in the perpetual system and to account for items in warehouses or storage versus the products in the store ready to sell.

- Records costs relating to a sale as if the latest purchased item would be sold first.

Download all 10 chapters of this inventory guide in one handy PDF – so you can easily upscale inventory management in your retail business. There are a small number of disclosures about inventory that the accountant must include in the financial statements.

Explaining Inventory – Examples

Because we’re using the FIFO method, our order includes the first crystals that were placed in stock, which were $4 each. The remaining crystals in the order were taken from the second group of crystals purchased, which were $6 each. For example, on January 2, 2020, you purchase 100 crystals from your regular supplier at a cost of $4 each. On January 15, you need to purchase an additional 100 crystals, but your regular supplier raised the price to $6 each. Equipment and supplies you’ve bought to run your business, such as work tools, vehicles and stationery, typically aren’t treated as inventory.

While there are many types of inventory, the four major ones are raw materials and components, work in progress, finished goods and maintenance, repair and operating supplies. This article outlines the many types of inventory, provides real-world examples and covers inventory management.

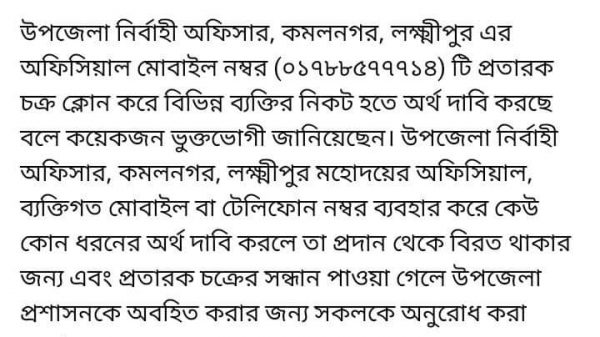

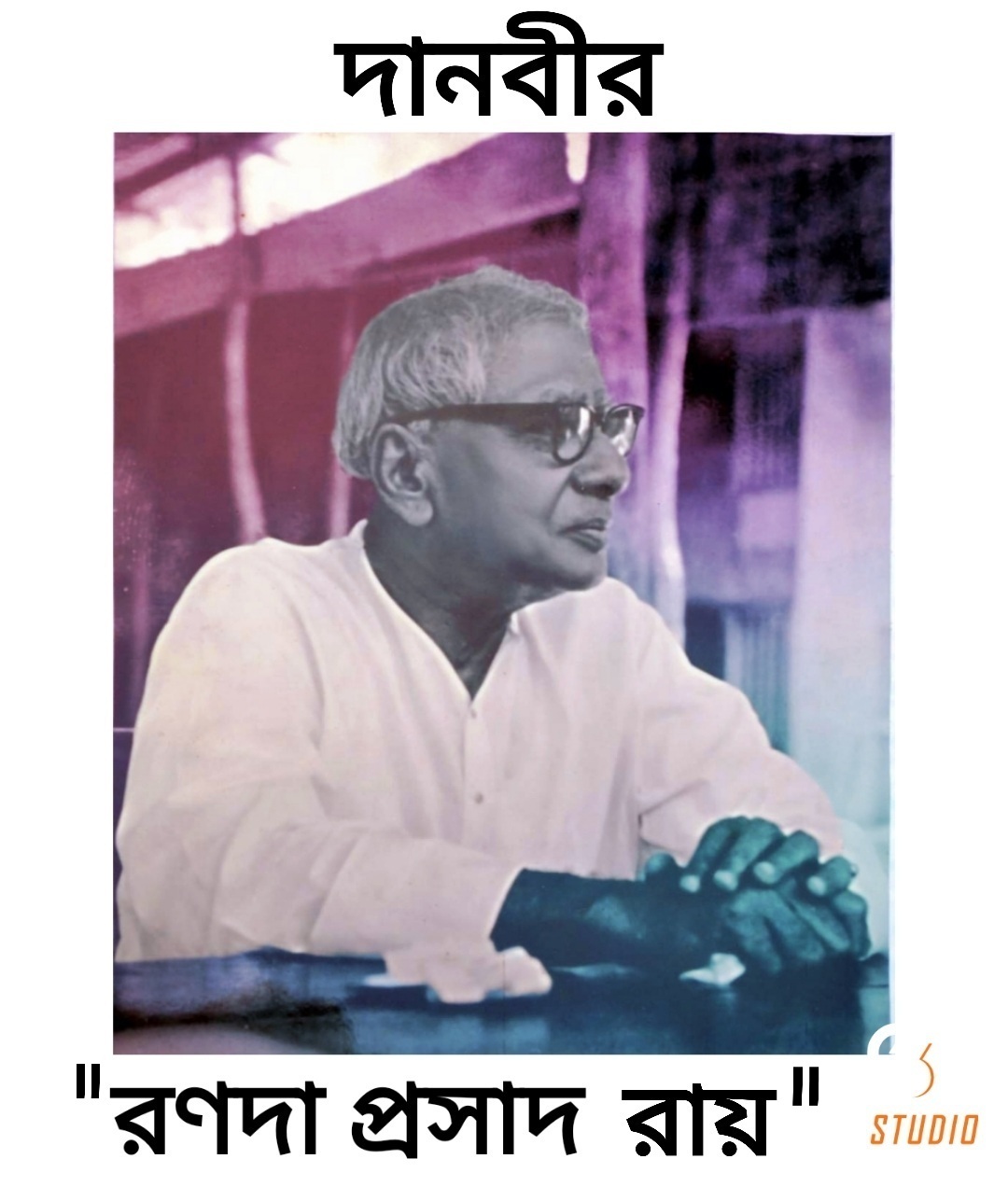

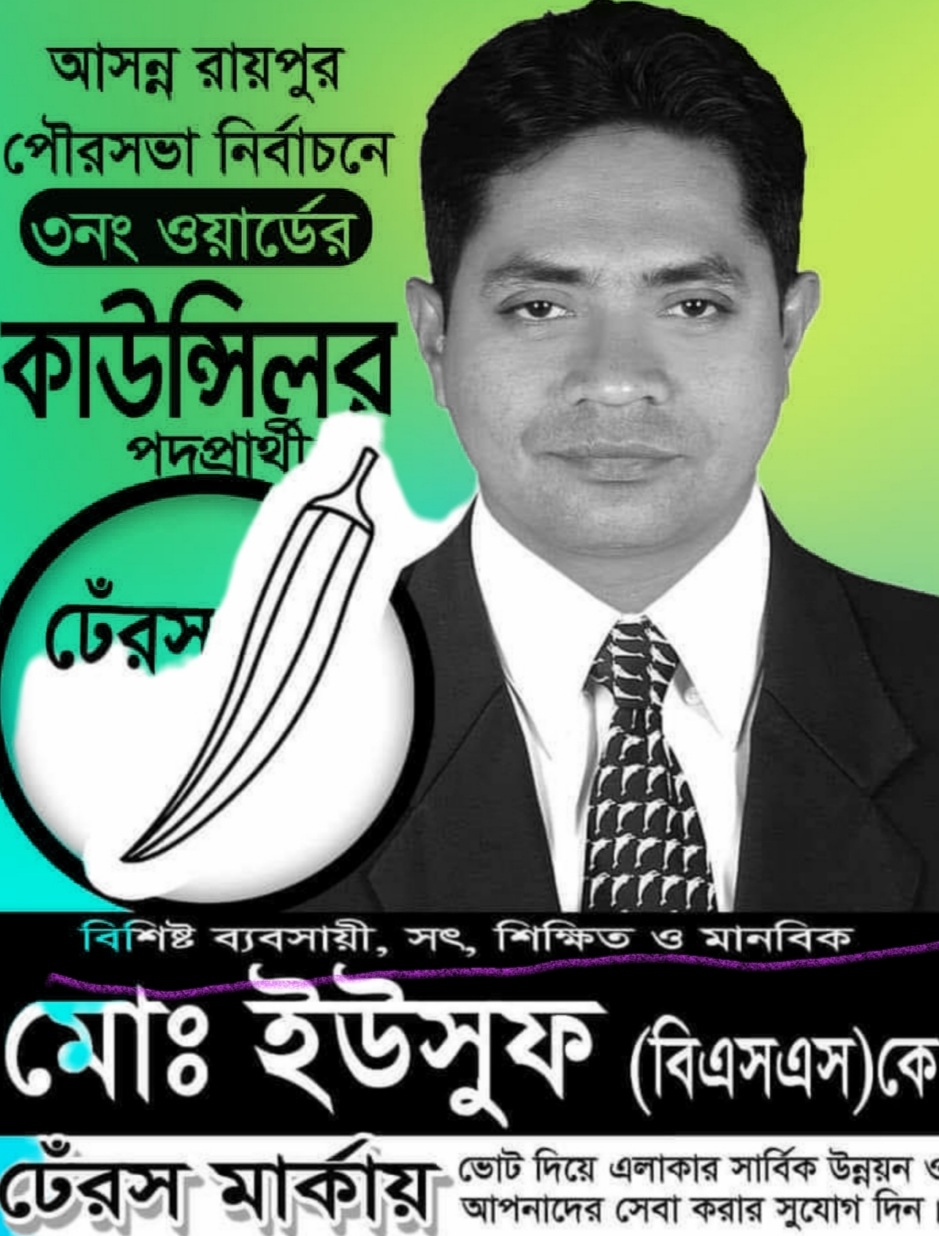

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

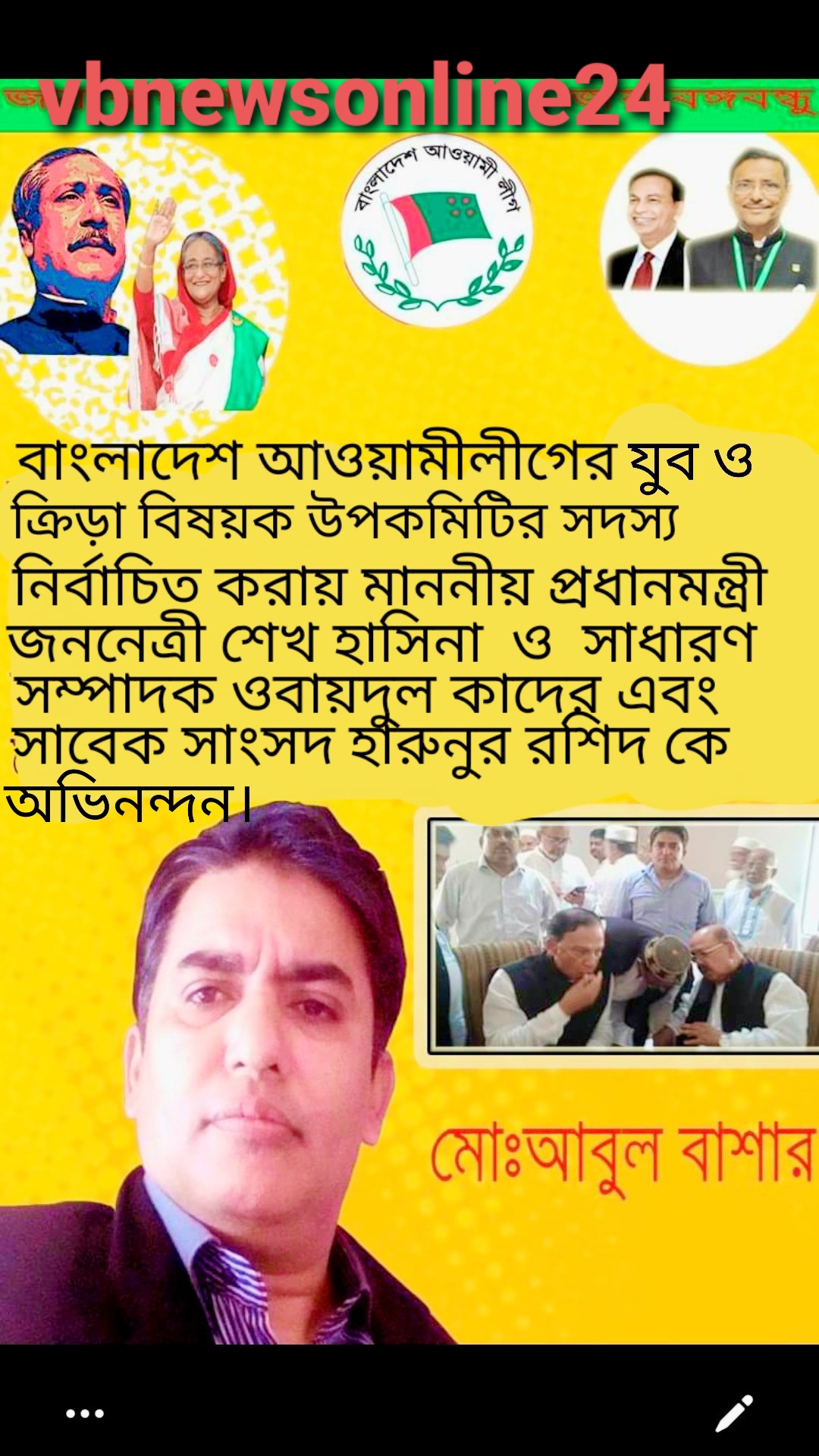

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

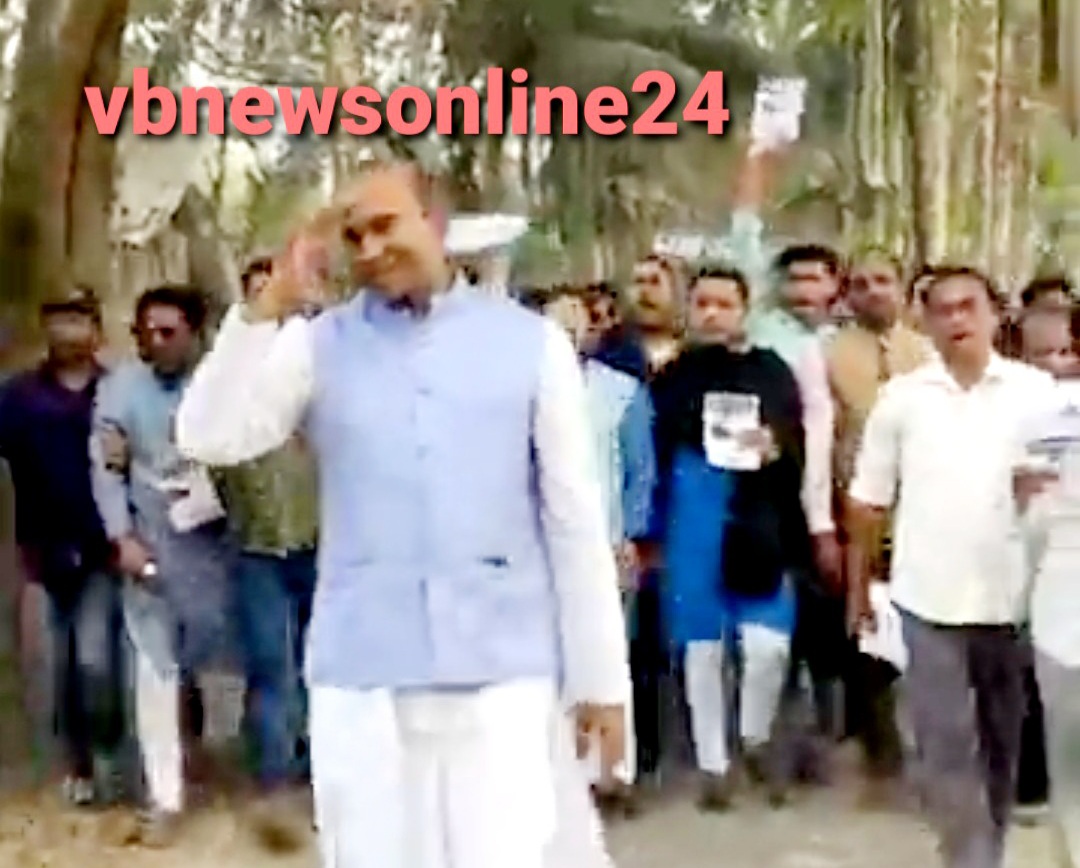

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

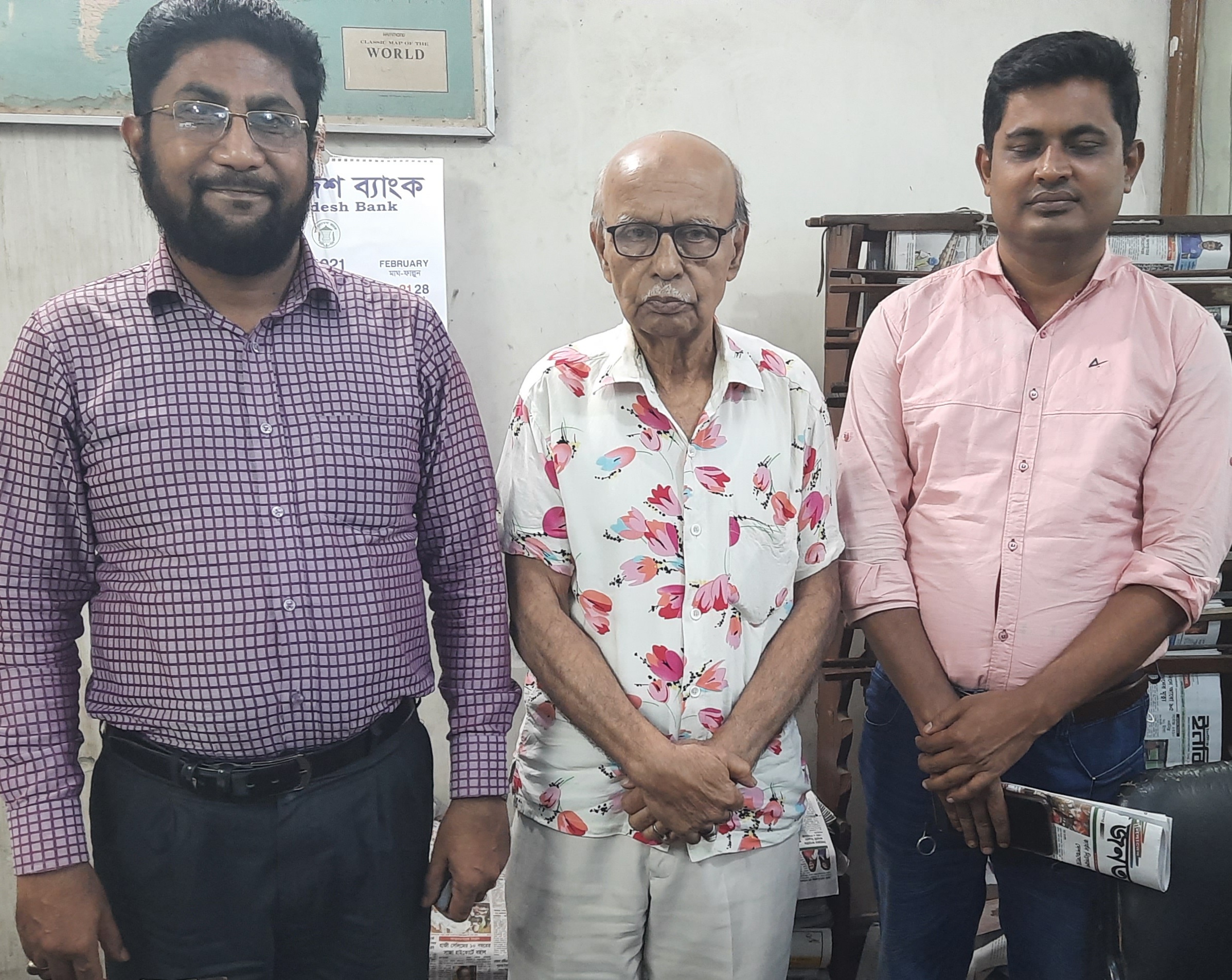

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

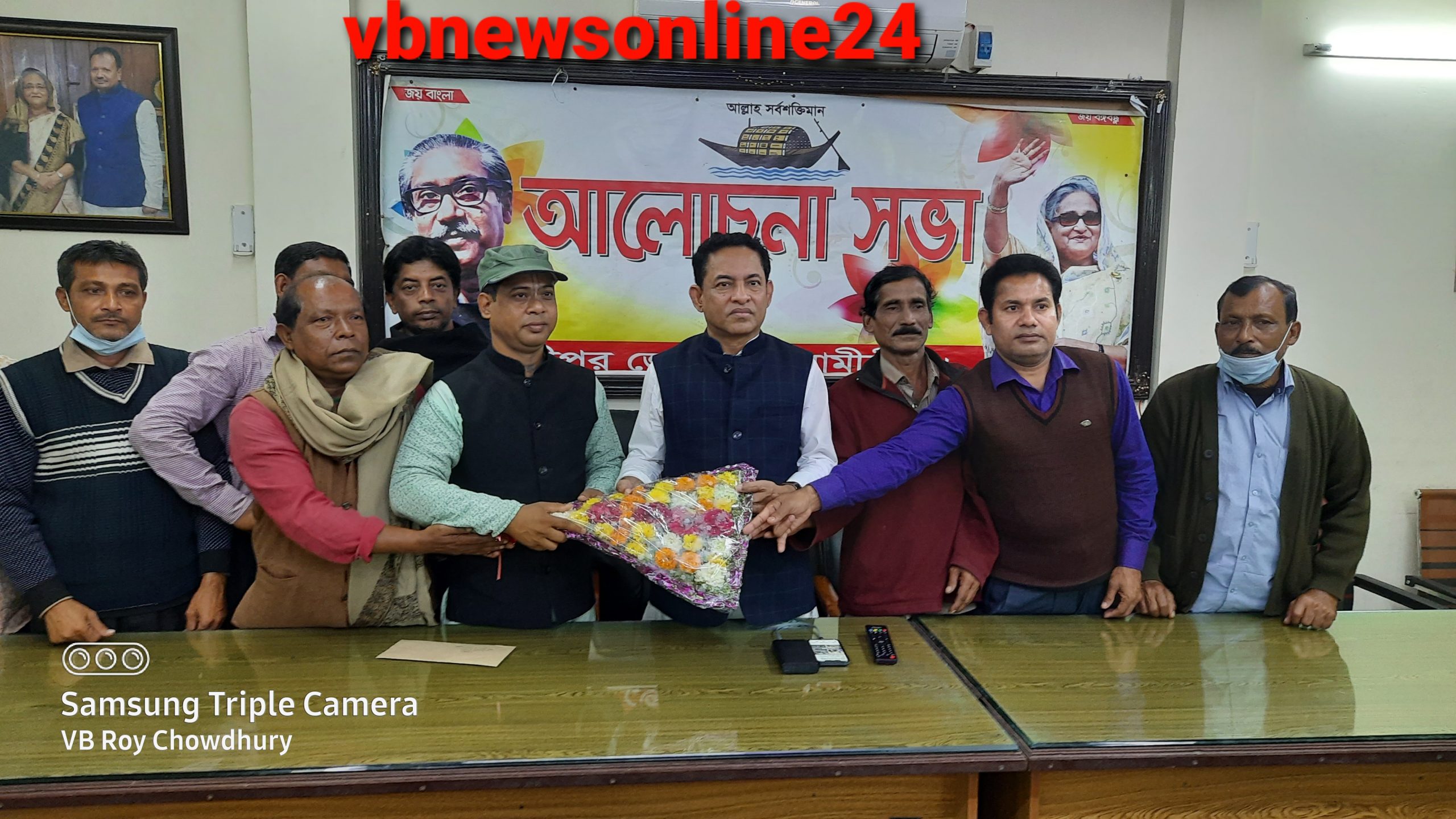

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

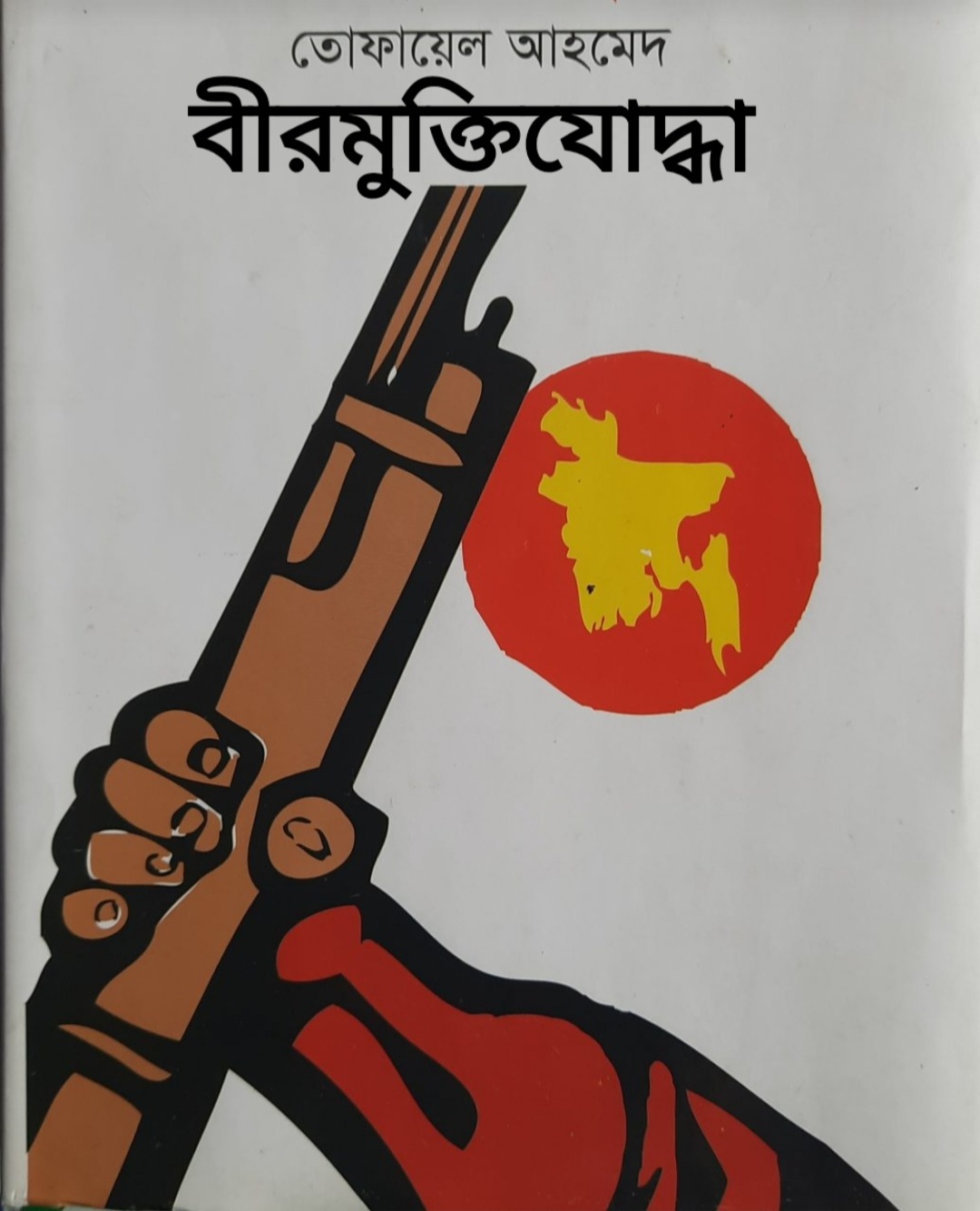

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

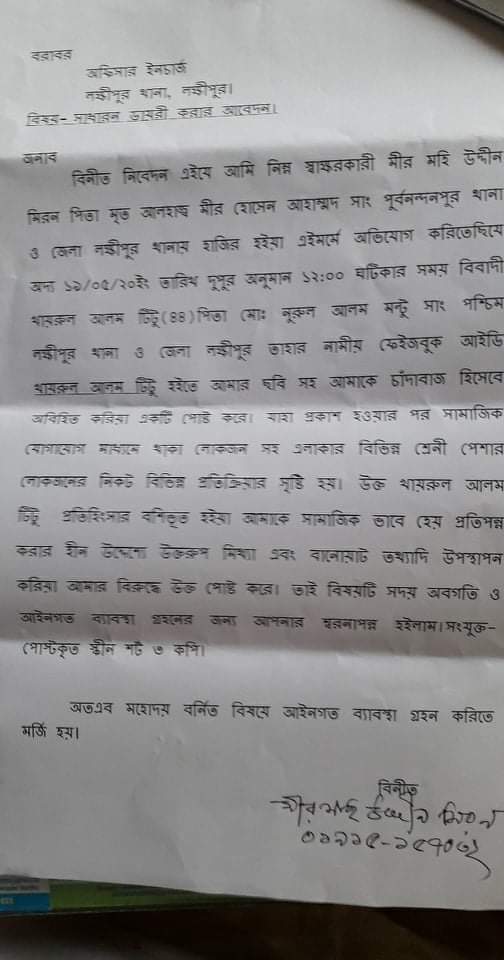

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

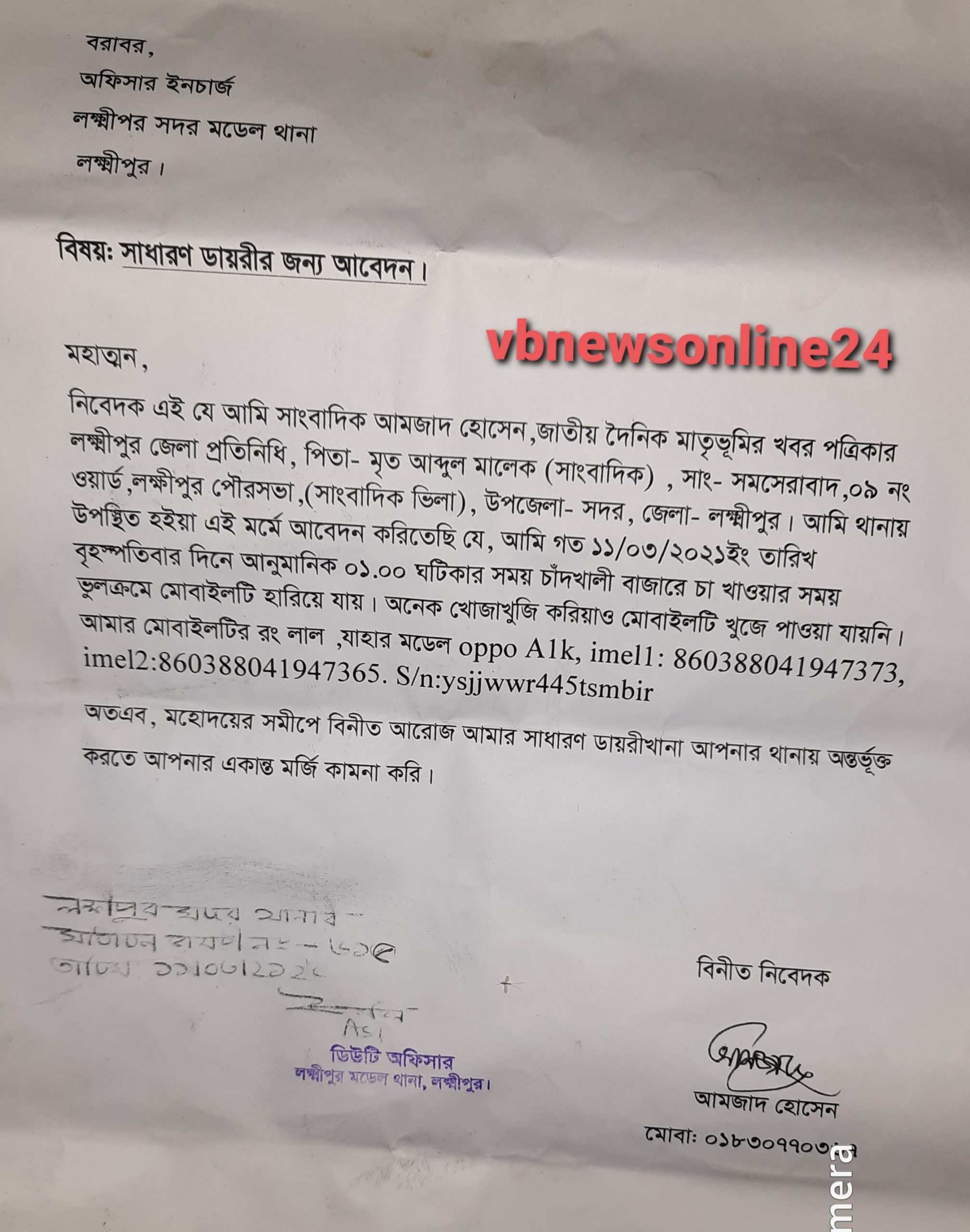

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

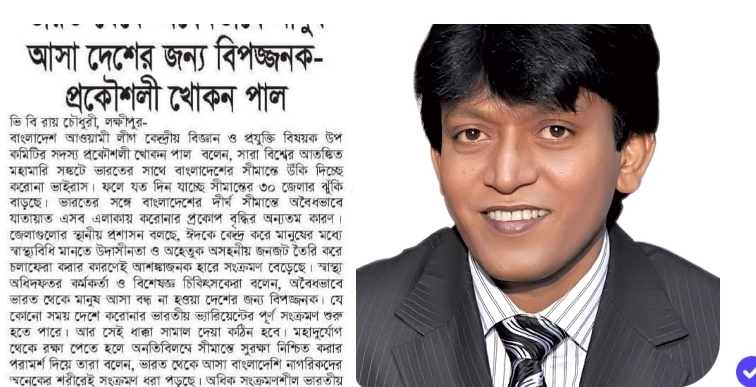

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

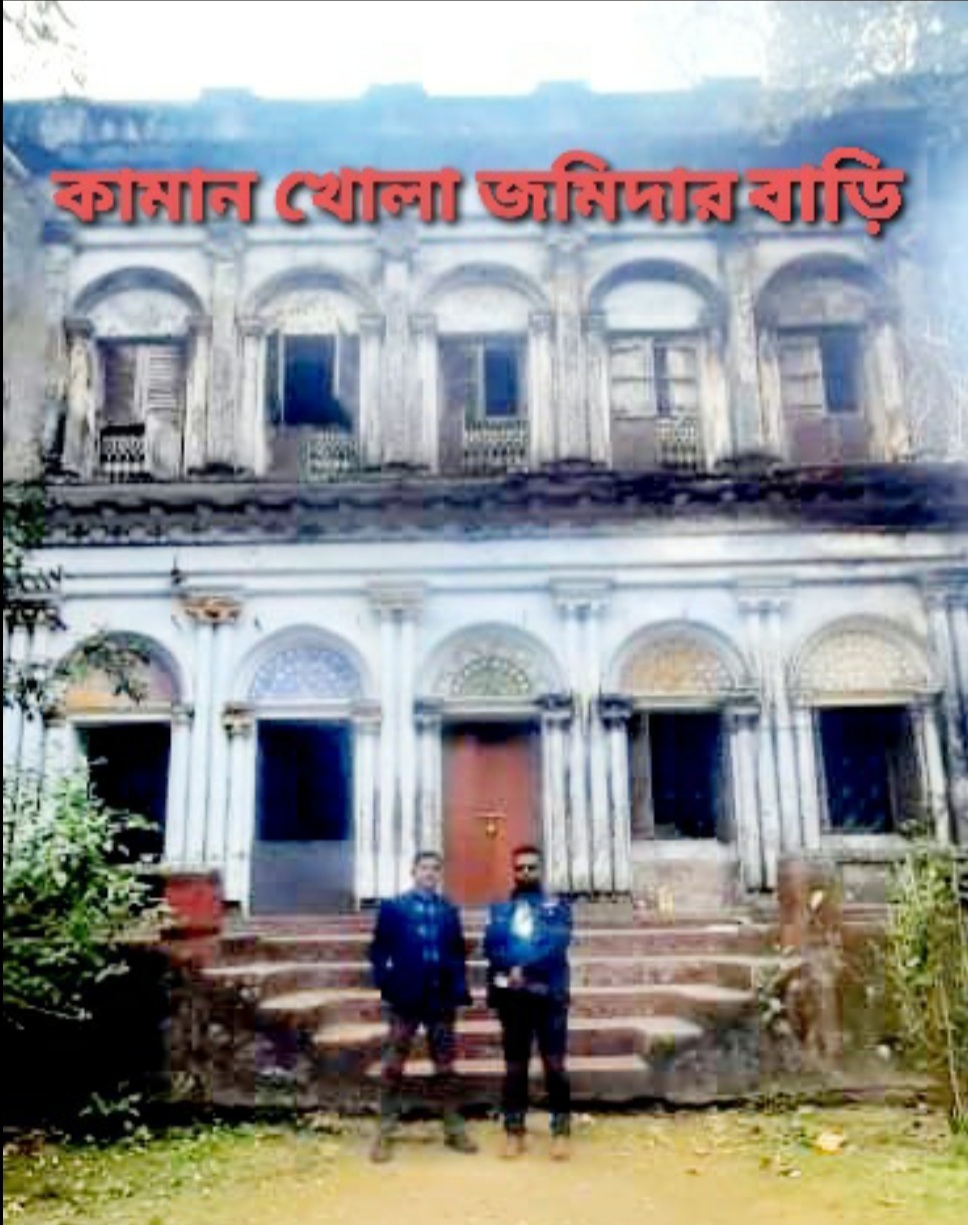

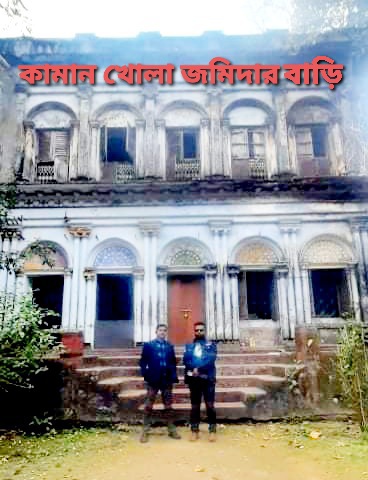

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

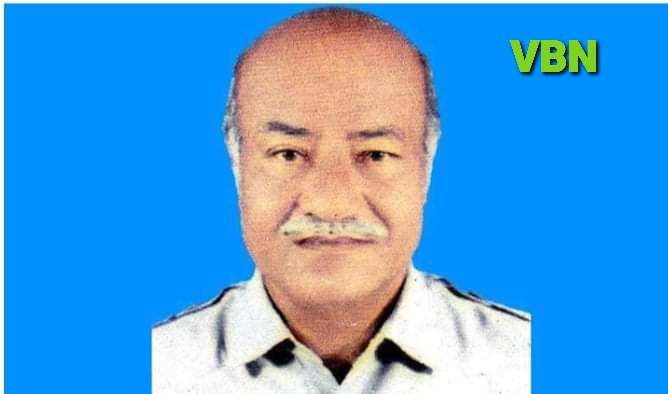

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

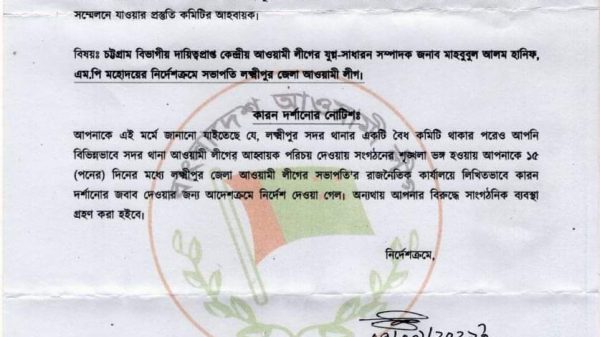

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

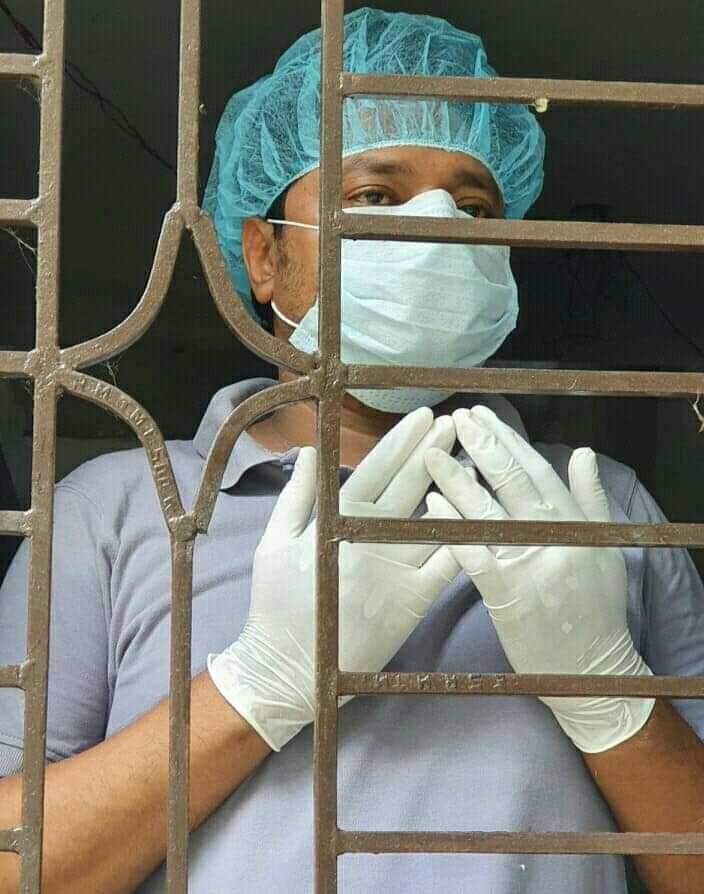

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি