Installment Loans For Bad Credit In Nebraska

In case you want to deal with the debt faster, a short term can save you a significant amount of money in the long run. Customers are able to keep driving their automobiles while paying back a title loan. While the lender technically assumes ownership of the car during the repayment period, the car remains in possession of the https://cashnetusa.biz/ borrower during repayment. Once the loan agreement reaches a successful conclusion, the borrower should regain full ownership of their car. Vehicle title loans are another opportunity to receive emergency financing. The borrower backs the loan using their car, meaning the lender takes on less risk when approving an applicant.

For some organizations, the rates can be less than 100% per year, while others offer credits with interests that can reach up to 700% or 800%. If you want to avoid such overpayments, you ought to read the requirements carefully when you are choosing the lender to get your cash. Otherwise, there will be a risk in your situation when you cannot pay off in time. So, it is possible to have debt in other organizations and still get the sum you require in the form. Nevertheless, it’s better not to cooperate with those lenders that guarantee that they won’t check this information at all.

How To Pay Off Car Title Loans Murray?

And, if approved, you could see the money in your bank the next working day. Several factors determine whether you can get quick approval or not. Before you start looking for a reliable organization, be sure you meet the required criteria. Otherwise, you may end up wasting a lot of time and effort.

Quick cash – it is mostly connected with no credit check installment loans Nebraska NE is required. It saves a lot of time, which is normally spent on the approval processes. Also, the money could be funded directly to the banking card online and no need to show in person to pick them up. Many people across the world think that payday advance loans Nebraska no credit check should be illegalized. The problem is that they rely on myths to push their agenda. Humans have perfected the art of taking risks to achieve their goals. As such, the fact that payday loans are not just what the doctor ordered cannot override all their benefits.

Murray Payday Loans Online: What Is It?

If you want to get your payday loan approved, ensure that you give accurate information and provide any supporting documentation. Some of the documents that lenders require are payslip or proof of income, personal identification, and address. Remember that some lenders partner with other services such as Yodlee, which provides your account details. The first thing lenders do when they receive your payday loan application form is checking through to see if you meet the basic requirements. You must meet all the qualities discussed above to get your application for the loans approved. You must be a resident of Murray in Nebraska NE with a steady source of income and an active checking account. There’re lots of people who try getting several installment loans online Nebraska in different organizations in a limited period.

Do banks offer installment loans?

Online lenders, banks and credit unions offer installment loans. An installment loan is funding you get in a lump sum and pay back over a set period. … Loan amounts for unsecured installment loans, also called personal loans, range from $100 to $100,000, depending on the lender and the loan you qualify for.

Considering the online installment loans Nebraska NE, it is a must to learn about some drawbacks connected to it. Get up to $5,000 in minutes at any Dollar Loan Center location or online. You don’t need a checking account, no collateral is required and there are never any early payment fees. First Dakota Loan Production Offices is one more payday loan provider in Nebraska as evidenced from borrowers’ feedback. Typically, the loan provider makes a verdict urgently. We analyze your application online and connect you to the most suitable online payday lender in a matter of minutes. You will obtain the requested money as quickly as the same day. Thanks to the internet, you can help yourself without leaving your place. These are the very first reasons for the online installment loans in Nebraska NE.

Choose Your City:

However, in a case in the future, your job will improve, you can shorten the time of repayment and increase the monthly payment if the conditions allow. Applying for a loan from a direct lender makes the whole process more straightforward. Basically, you avoid any third parties, which allows you to earn interest rates less and speed up the money lending. If you Installment Loans Murray Nebraska apply for a loan within the direct lender, the agreed amount of money can lend just directly to your account. If you have particularly bad credit apply for a small loan that you can easily repay, and this will begin the process of rebuilding your score. Each time you will be able to borrow higher amounts and soon new loan products will be available to you.

Some even use them to lower their high-interest credit card debt. An installment loan is also a short-term loan, but it is paid back in small pieces over time. While the loan amount is higher, most lenders can get the money in the borrower’s account just as fast as with a smaller loan. And, although we do not make lending decisions ourselves you will soon know the interest rate offered if you’re approved by a lender. The only thing in common among all lenders is the fact that the rate gets lower when the borrower gets a bigger sum. That’s why if you want to save money, consider bigger Nebraska installment loans no credit check. Although payday options are used more frequently, installment loans in Nebraska online are more profitable. The main reason for this is that with a payday credit, it’s possible to get only from $300 to $1,000, while with installment ones, you can get sums that can reach up to $10,000 . A payday loan is a short-term loan that can give you some relief in tough situation. It is usually repaid on the day you get your next paycheck.

Keep reading for more information about where to find a lender in your location. Are governed by the state’s lending laws, regulatinghow much you can borrow, how much can be charged in interest, as well as other terms and conditions to protect the borrower. We fully believe in the services we provide our clients — day and night. We are happy to know how many consumers have already appreciated our services and returned for more. We are proud to offer the best loan referral service in the industry.

In case if you want everything to be so fast, it’s recommended to request for the loan on working days. Otherwise, if you send the application on holidays or weekends, it will get checked only after several days. Installment loans in Nebraska for bad credit aren’t the same as other options used by people who are suffering from a lack of money and need to get cash fast. Moreover, clients don’t have to provide any legal documents to confirm the information sent to the lender. That’s why the process itself doesn’t require much time. No credit check installment loans are the standard type of loan that most lenders offer. This is good news because it means you do not have to pay any extra fees or penalties in order to receive your money.

- They will inform you about interest rates, fees and places where you can get a cash advance whether it’s a payday or a personal loan.

- It shouldn’t only fully satisfy your financial needs and allow getting sums with low APR but also ought to have not as many requirements as others.

- Most of the time, people are desperate for money and mostly unaware of their absolute times of need.

- However, you can also qualify if you have any consistent source of income.

- The first one is mostly about repairing and replacing broken things.

Apart from that, applying for a larger loan, you protect yourself from getting multiple loans to cover your previous debts. Usually, direct lenders are more open to the borrowers, and they are ready to discuss installment loans in Nebraska online in person. Once you have done due diligence and discovered that you meet the requirements, you can now fill out the application. To get online payday loans Nebraska with ease, you must be 18 years and above.

You need to prove that you’re a legal resident of Murray, Nebraska . Before getting an installment loan in any state where money landing is allowed, a borrower must confirm their resident status first. Once you do that, you’re almost guaranteed to receive the loan. Despite that a small cash advance can spare you a lot of troubles, it’s not always the best solution. But here are five reasons why you might consider getting an installment loan. Make not of the repayment dates because payments are taken automatically from your bank account. Of course, when we say “bad credit loan” what we mean are loans that don’t automatically discriminate against consumers with a poor credit history. Thank you for helping me through the process in a professional & very caring manner, much appreciated. Also, a very big thank you for helping and advising me in the loan repayment. Firstmark Services LLC and First Northeast Bank of Nebraska are other low-rated payday loan companies in Nebraska.

Get to know about non-profit organizations and special governmental programs. Nebraska has numerous options for you that can be a nice alternative to no credit check installment loans Nebraska. You will take a few minutes filling in the application form and attaching the required documents. The application form will require that you fill in your details, such as name, date of birth, and address. You will also fill in your financial information, such as expenditure, income, and checking account details.

The car must be registered to you, and you need to prove that the car is yours. Additionally, RISEcredit.com has tools and resources that everyone can use to improve their financial knowledge. Perhaps your tire blows out on the way to work or a loved one needs to visit the emergency room. No matter the circumstances, money can be a major concern. Murray allows a single rollover, but your debt may accumulate collection fees of $20. Legal violations of the set statutes and regulations by the lender should be reported straight away. Reach out to the Murray Department of Commerce Division of Financial Institutions. Note that if the claim is justifiable, you will not be legally tied to pay back anything, including the principal or interest. Relatively cheaper in terms of lower interest charges. Firstly, start by ensuring you are working with a licensed lender.

Content and images on this website may not be reproduced without explicit permission. When an unanticipated breakdown or the need for an unforeseen repair arises, it can result in more than just stressing about getting your vehicle back on the road. AAMCO’s financing programs let you get that fix taken care of now, even if you have little or no credit. At AAMCO Indianapolis, IN, we put the CARE back in car care to help keep you on the road…without breaking the bank. Apply in the morning during the working week to stand the best chance of seeing the cash in your account the following morning. And adhere to all the same regulations as the banks and lending shops. Choosing this option you add Car Title Loans as an additional way of getting the necessary funds.

Such a ban is needed to avoid situations when a particular person gets several credits that finished in one month. As a result, he cannot make all of the payments before the period is finished, and he will have obligations or even issues with the government. Moreover, there’s a lower chance of becoming bankrupt. On this page, you can also find out if the company you want to choose has all of the licenses, and if all of them are active. In case if you are going to feel absolutely protected, it’s better to cooperate with those lenders who have both licenses, including not only a federal but also a state one. The first document doesn’t have strict rules and can be formalized for almost all companies. Nonetheless, the license that is provided in a particular state is more severe because the lender ought to follow the law of Nebraska NE. Approval depends upon meeting legal, regulatory and underwriting requirements. The main thing is to select the right one and apply for a payday loan in Nebraska. If you are having a difficult moment, you may take out an installment loan or a payday loan — and there are several differences between the two.

It’s also beneficial to anyone who needs money quickly because lenders attempt to deposit funds within one working day – ideal if you are in a financial emergency. Residents of some states may not be eligible for some or all short-term, small-dollar loans. Residents of Arkansas, New York, Vermont and West Virginia are not eligible to use this website or service. The states serviced by this website may change from time to time, without notice.

Consider the amount that you require and your ability to repay it within the stipulated time and contact the best provider to help you get back your peace of mind. If you are looking for fast payday loans in Nebraska NE, you are in the right place. Get acquainted with all the information regarding these short-term credits to get instant approval. That’s why borrowers can always find out the sum they have to pay off. In this case, they only need to visit the website of their lender and go to their account. An installment loan is a type of loan you repay with predetermined and monthly payments over a specified period of time. Loan amounts vary from several hundred to several thousand dollars. Installment loans may also have other names when they’re given for a specific purpose, such as car loans, student loans, mortgages, and personal loans. An installment loan application usually entails a credit check. Another important thing about online installment loans Nebraska regulations is the existence of unsecured installment loans.

While regulations vary from state to state, most cities follow the lending restrictions issued by their particular state. That involves rules about maximum loan amount, maximum finance charge, loan term limitations, and finance charges. If you are searching for legislation for Murray payday loans, you should start by looking at the rules for the particular state. You need to save time and show that you respect them and are willing to work with them again in the future. If possible, call your provider and ask to waive late fees.

The main reason why no hidden fees are compounded is the fact that such activity is under the law. If the company decides to charge additional rates that aren’t mentioned in the documents, there is an enormous risk that it will lose the licenses allowing it to work in the state. All you need to do is to complete a short application form on our online referral platform and wait for response. To get a loan, you do not need to go anywhere, do paperwork or search for collateral. But there is a phenomenon called «unlicensed tribe loans.» And it’s not even illegal! This phenomenon is possible due to federal laws regarding Native American lands. These lands are sovereign and regulated by their own laws. No Nebraska NE restrictions could be applied to tribal lenders. Installment loans in Nebraska online requirements can be met by almost every person, as we can see. Prepare all the necessary data to make the whole process even faster.

You can get your money fast after filling out the simple form on the “Apply Now” page! Our lenders cannot guarantee the approval, but they could approve your loans, even if you are unemployed, receiving government benefits. Only in instances of overboard bad credit scores, multiple debts, or bankruptcy do we turn down customer’s requests. Similarly, customers who need to make urgent payments at home or cater for bills that cannot wait also approach us. Since our loans are affordable, we receive online requests from persons who generally don’t want to dig into their savings plan.

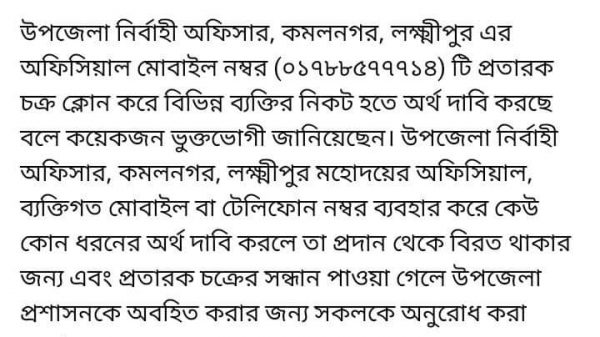

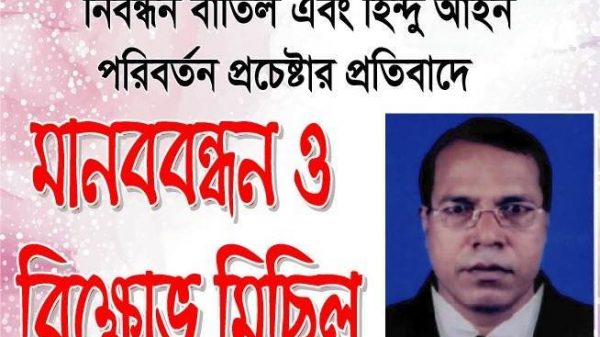

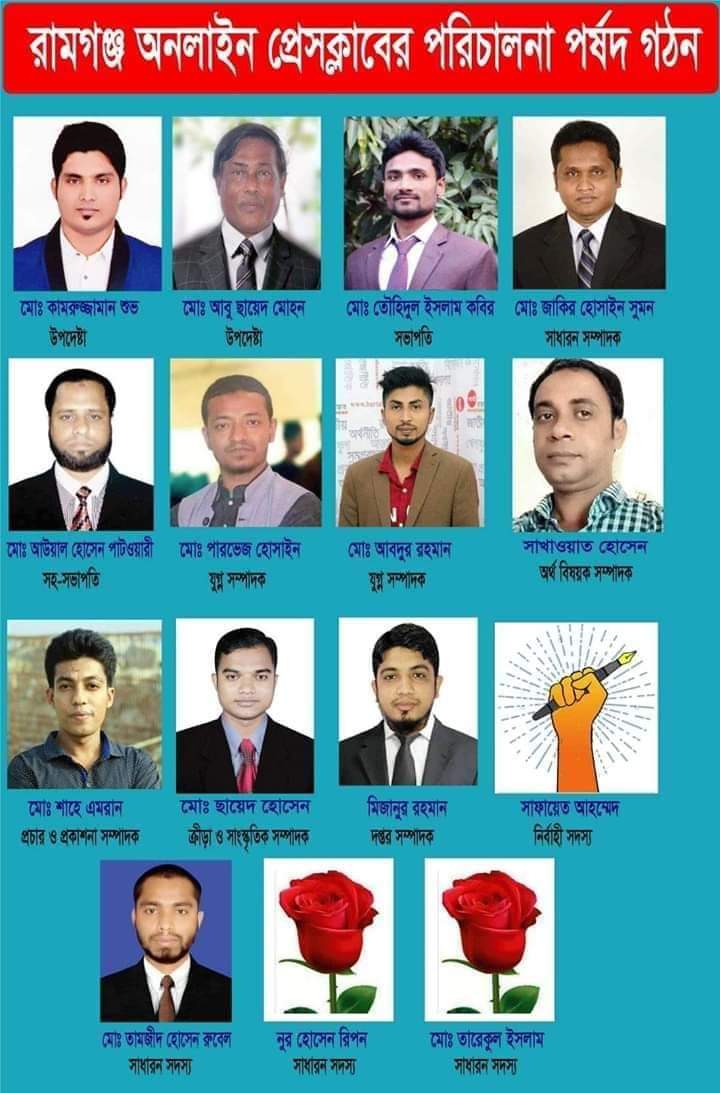

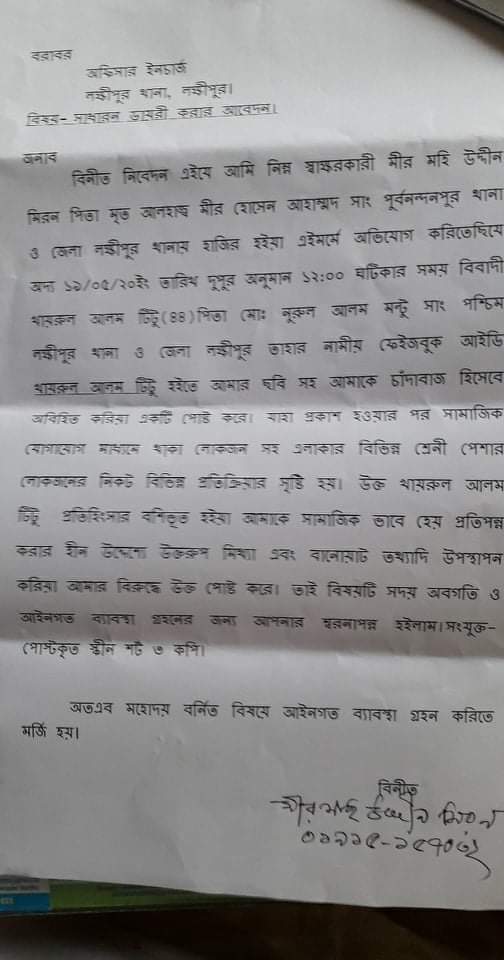

লক্ষ্মীপুরে গ্রামীন সড়কে ড্রামট্রাকে মেম্বারের বালু ব্যবসা, জানতে চাইলে সাংবাদিকদের চাঁদাবাজি মামলা দেয়ার হুমকি

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়নে স্কুল শিক্ষক ও শিক্ষিকার অনৈতিক সম্পর্ক, শিক্ষিকার স্বামীর অভিযোগ

আলিফ মীম হাসপাতালের শেয়ার হোল্ডারদের সাথে মতবিনিময় সভায় প্রধান অতিথি জেলা বিএমএ ও স্বাচিপের সভাপতি ডা: জাকির হোসেন

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

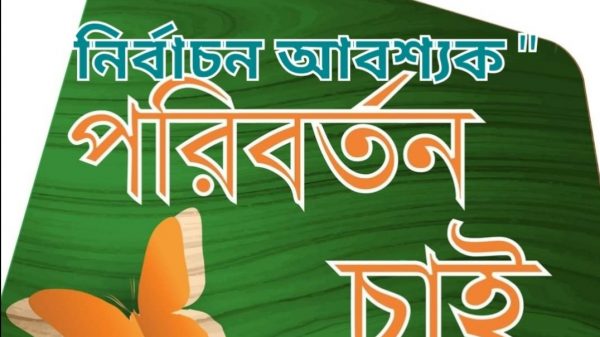

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

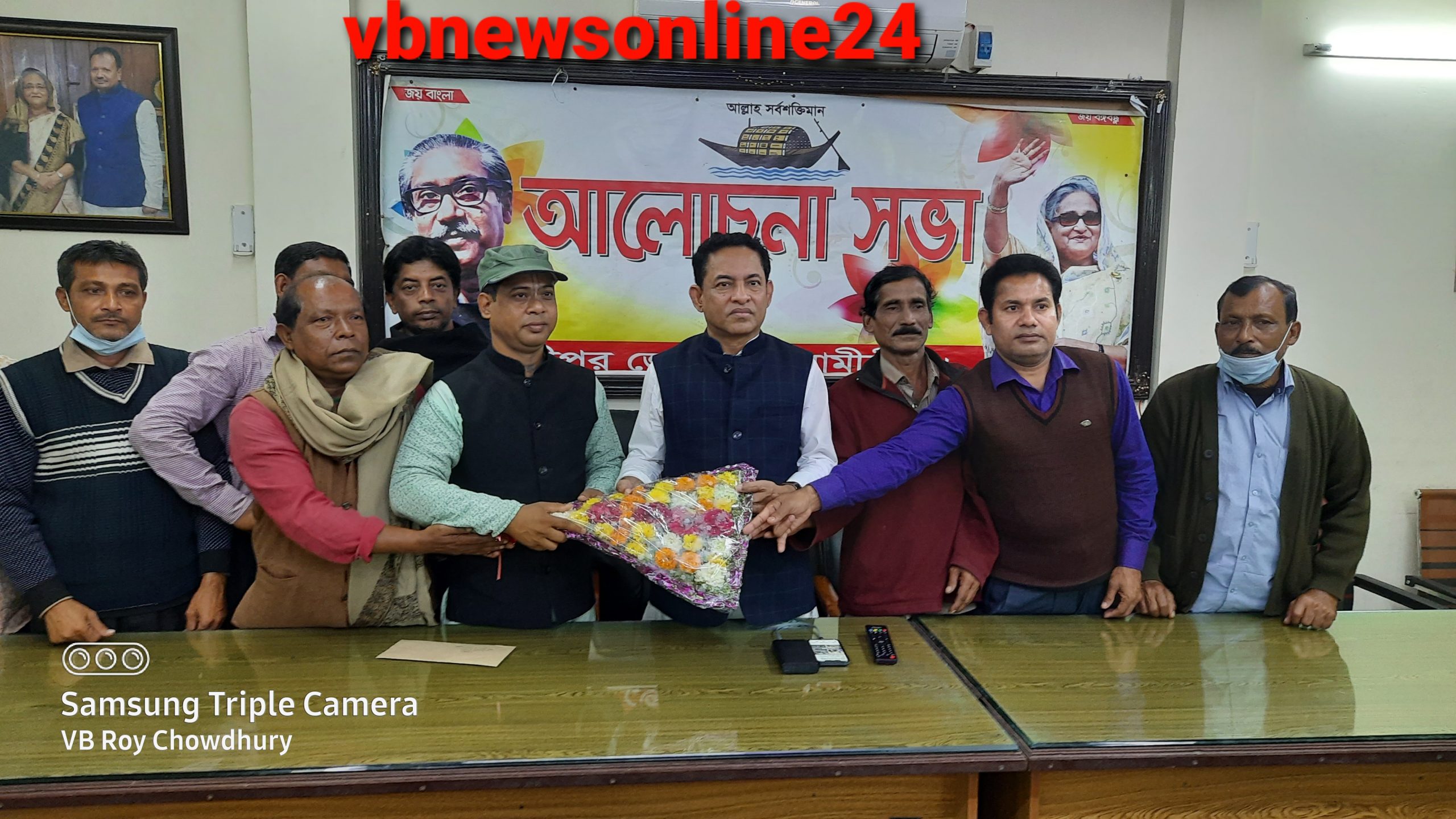

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

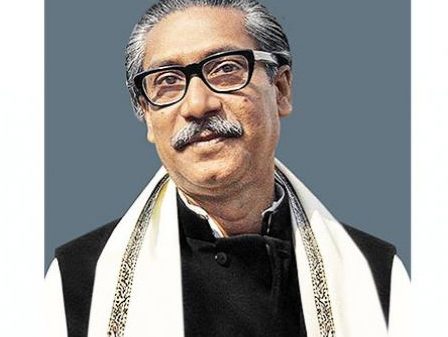

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

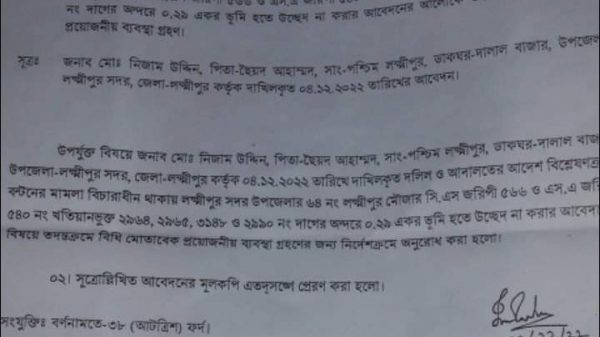

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

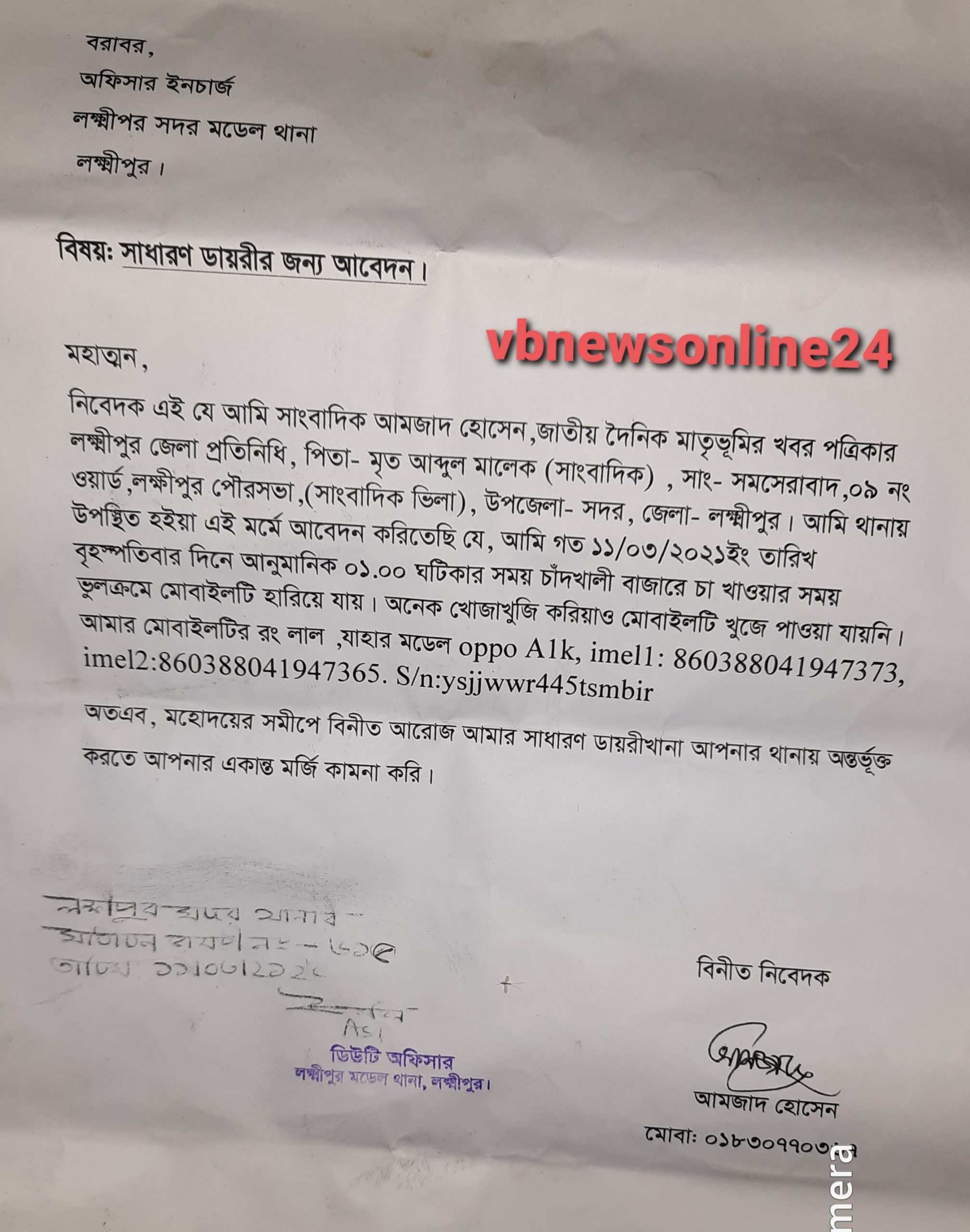

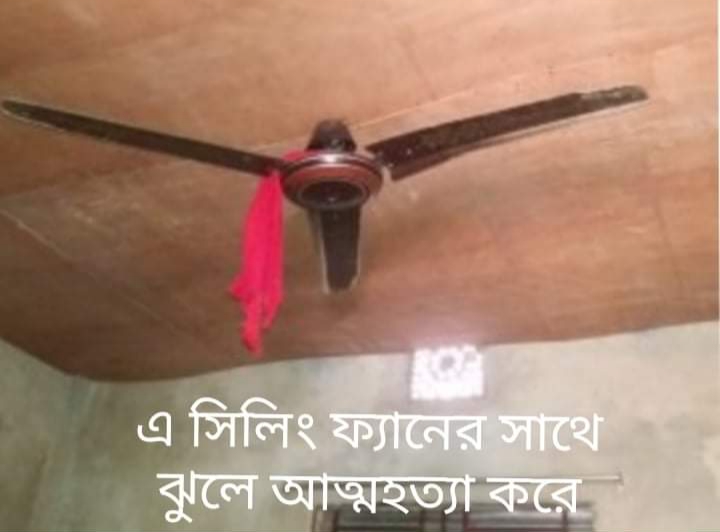

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

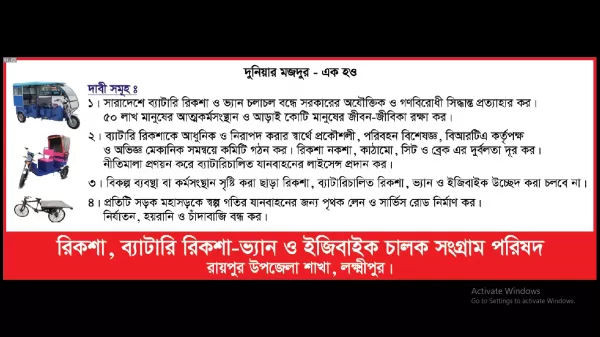

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

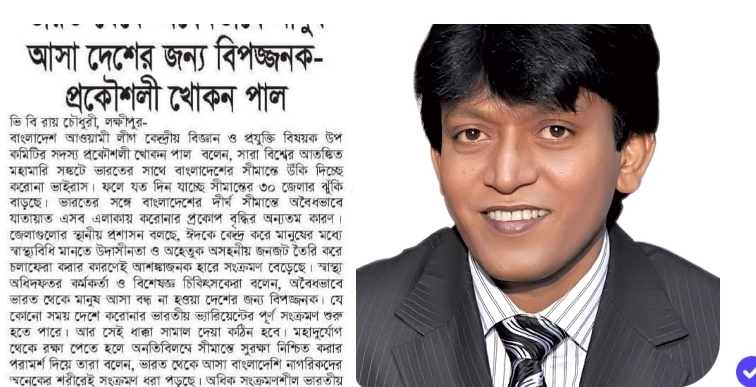

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

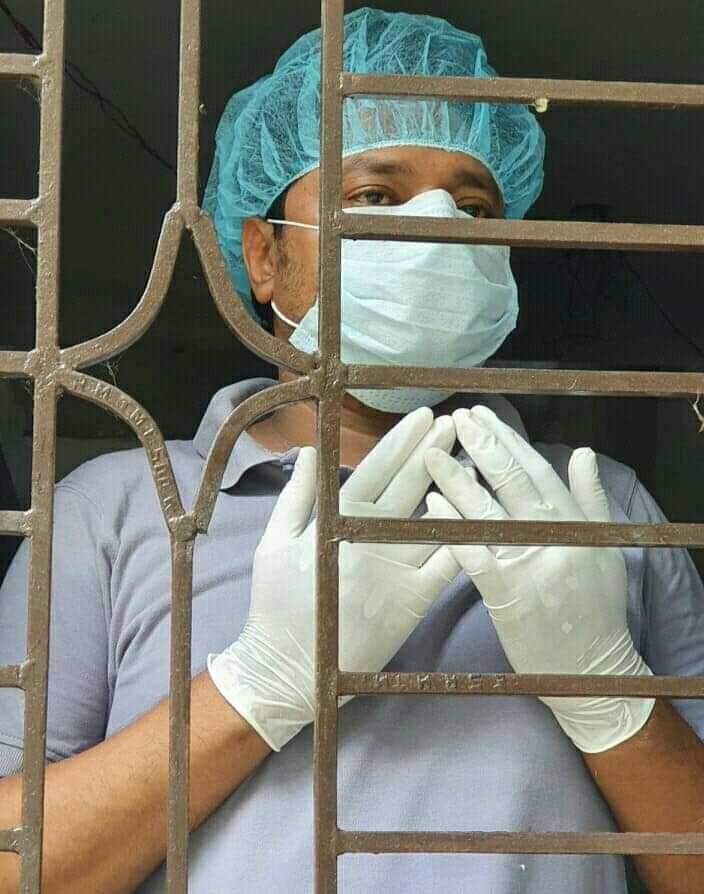

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

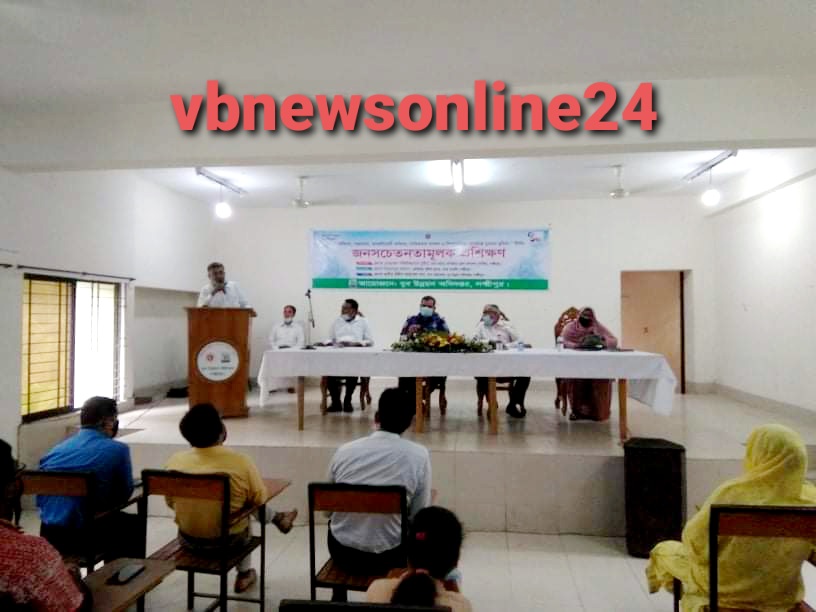

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

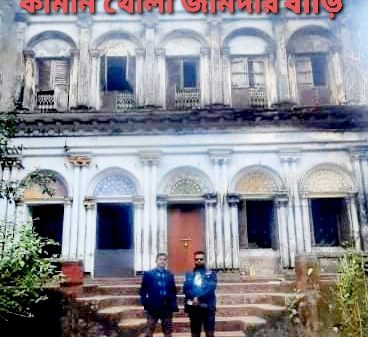

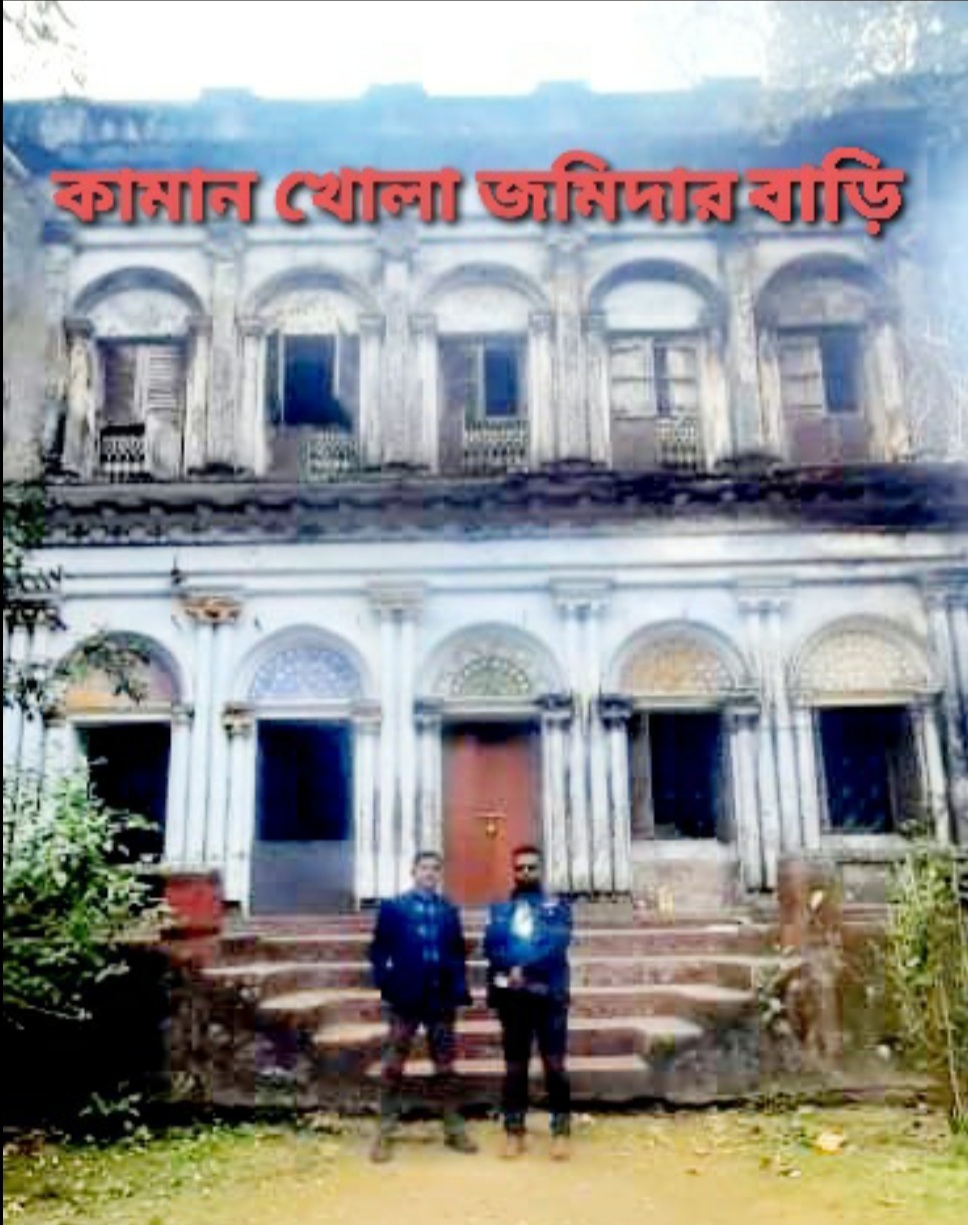

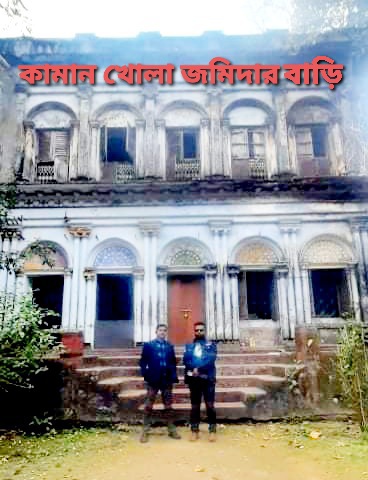

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

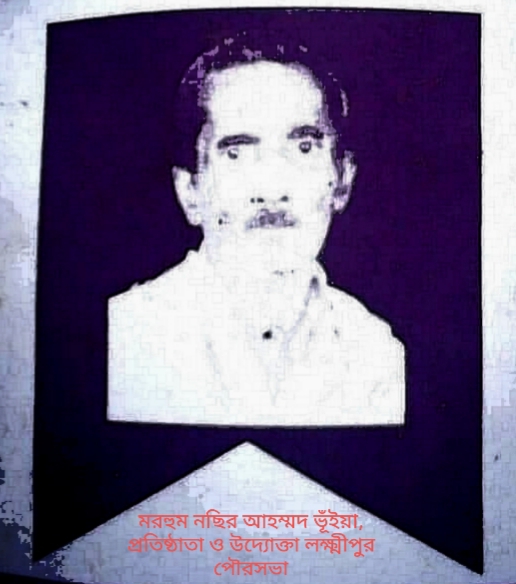

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

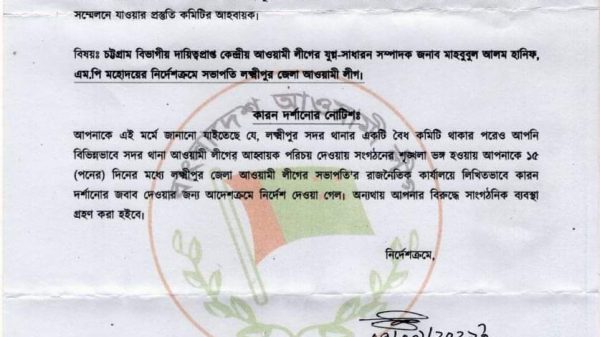

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি