Guide to Insurtech Innovation and Utilization Philippines Asia Pacific Insurance – Fxclearing.com SCAMMERS!

https://www.fxclearing.com/ (FXCL) Markets Ltd. – Forex SCAMM Company! Be carefull!

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. You should make sure you understand the risks involved, seeking for independent advice if necessary.

Registered by the Financial Services Authority (‘FSA’) number 1637 CTD 2018. FXCL Markets Ltd. registered office: Suite 305, Griffith Corporate Center, P.O. Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines.

Base information about Fxclearing.com Forex SCAM company:

Real adress in Philipines and company name is:

Company Name: Outstrive

Address: 3rd Floor 399 Enzo building, Makati, Philippines

Phone: +1 (347) 891-7520

Top managment of stealer who scam money of clients:

Juan Belleza Jr

Team Leader

2056 D Kahilum 1 Barangay 870 Zone 95 Pandacan Manila, Philippines

https://www.facebook.com/theimbachronicler

639776459387 / 639155292409

Lea Jean Belleza

Assistant

2056 D Kahilum 1 Barangay 870 Zone 95 Pandacan Manila, Philippines

https://www.facebook.com/lj.r.belleza

James Tulabot

Team Leader

https://www.facebook.com/jamescuzy

Allen Roel Costales

Sale Manager

522 Tanglaw St. Mandaluyong City Barnagay Plainview

https://www.facebook.com/allennicanor.costales

639565914849

Kristoff Salazar

Sale Team Leader

Unit 1414 Kumagawa Bldg River City Brgy 880 Sta. Ana Manila, Philippines

https://www.facebook.com/Kristoff225

639561355764

Xanty Octavo

Sale Manager

8137 Yabut Street Guadalupe Nuevo Makati City , Philippines

https://www.facebook.com/xanty.octavo

639171031948

Virgilito Dada

Account Manager

https://www.facebook.com/potsdada.antonio

Elton Danao

Sale Manager

https://www.facebook.com/eosnyssa

639175048891 / 639991854086

All of this persons need be condemned and moved in Jail.

!!!!!STOP STEAL Philippines MONEY!!!!!!

A lessee shall depreciate an asset leased under a finance lease in accordance with the relevant section of this framework for that type of asset. If there is no reasonable certainty that the lessee will obtain ownership by the end of the lease term, the asset shall be fully depreciated over the shorter of the lease term and its useful life. A lessee shall also assess at each reporting date whether an asset leased under a finance lease is impaired. This section applies to agreements that transfer the right to use assets even though substantial services by the lessor may be called for in connection with the operation or maintenance of such assets. This section does not apply to agreements that are contracts for services that do not transfer the right to use assets from one contracting party to the other. Measurement of property held by lessees that is accounted for as investment property and measurement of investment property provided by lessors under operating leases.

With the recent promulgation into law of Republic Act No. 8792, or the E-Commerce Law, which provides for the legal recognition and use of electronic commercial and non-commercial transactions, it now becomes imperative for the BIR to introduce this concept into its existing tax administration system. Under the new structure, these two implementing groups account for more than 54% of the revenue goal for CY 2000. The LTS now renders full service to 633 identified large taxpayers, while the ETS accounts for the top 100 excise taxpayers. On the occasion of the BIR’s 96thanniversary, it is worthwhile to look back and assess what the Bureau has accomplished during the first half of the year 2000. This report recounts the BIR’s collection performance and the measures it has undertaken to enhance revenue generation and improve tax administration, in pursuit of the priority actions laid down by Commissioner Dakila B. Fonacier at the start of his administration. As I told the participants of our recent Senior Management Training seminar in Tagaytay some weeks ago, becoming globally competitive does not just consist in being able to produce world-class goods and services. It also involves the fostering of an economic climate that it is attractive to foreign investment, whether foreign or domestic. I know that implementing these programs may not be a cake walk, but I ask you to have faith and trust in our collective efforts. In time, we will all realize the wisdom behind these objectives and overall vision.

Data is refined into more usable forms Explore the data

If actuarial or investment experience is worse than expected, the cooperative’s obligation may be increased, and vice versa if actuarial or investment experience is better than expected. If the estimated recoverable amount of the cash-generating unit exceeds its carrying amount, that excess is a reversal of an impairment loss. The cooperative shall allocate the amount of that reversal to the assets of the unit pro rata with the carrying amounts of those assets, subject to the limitation described in below. Those increases in carrying amounts shall be treated as reversals of impairment losses for individual assets and recognized immediately in profit or loss. A cooperative shall assess at each reporting date whether any inventories are impaired. The cooperative shall make the assessment by comparing the carrying amount of each item of inventory with its selling price less costs to complete and sell. If an item of inventory is impaired, the cooperative shall reduce the carrying amount of the inventory to its selling price less costs to complete and sell. That reduction is an impairment loss and it is recognized immediately in profit or loss.

Financial statements shall present fairly the financial condition, financial performance and cash flows of a cooperative. Fair presentation requires the faithful representation of the effects of transactions and events in accordance with the definitions and recognition criteria for assets, liabilities, income and expenses. Said records and files shall contain the full and true identity of the owners or holders of the accounts involved in the transactions such as the ID card and photo of individual customers and the documents mentioned in Section X806.2.b. For entities, customer information file, signature card of authorized signatory/ies, and all other pertinent customer identification documents as well as all factual circumstances and records involved in the transaction. Covered institutions shall undertake the necessary adequate security measures to ensure the confidentiality of such file. Electronic Submission of reports – The CTR and STR shall be submitted to the AMLC in a secured manner, in electronic form and in accordance with the reporting procedures prescribed by the AMLC. The covered institutions shall provide complete and accurate information of all the mandatory fields required in the report.

Salesforce Webinar: Towards a Customer-Centric Transformation in a Digital-First, Financial Services World

Special attention will be focused on the specific cases filed before the CTA, to ensure the successful prosecution of these cases, and the conviction of tax evaders. We have therefore targeted the computerization of the remaining non-computerized Revenue District Offices by the end of 2008. To date, the Bureau has successfully computerized thirteen District Offices, and we are confident that by the end of 2008, the BIR will truly be a fully computerized public service institution. • Second, the matching of BOC records to countercheck importers’ declarations against VAT input taxes claimed in returns filed with the BIR. First among these programs is the Run After Tax Evaders or the RATE program, which is beginning to prove its worth as a deterrent against tax evasion. VAT revenues in the total amount of P 67.9 Billion were lower than the previous year’s collections of P 72 Billion or 5.7%, and were short of target by P 25.4 Billion or 27.2%.

In the bylaws of the cooperatives applying for registration, items 3 and 4 mentioned above shall therefore be included. For existing cooperatives modified allocation and distribution of net surplus shall be adopted. The existence and carrying amounts of intangible assets to which the cooperative has restricted title or that are pledged as security for liabilities. Expenditure on an intangible item that was initially recognized as an expense shall not be recognized at a later date as part of the cost of an asset. However, the preceding paragraph does not preclude recognizing a prepayment as an asset when payment for goods or services has been made in advance of the delivery of the goods or the rendering of the services. The probability recognition criterion is always considered satisfied for intangible assets that are separately acquired. Technical or commercial obsolescence arising from changes or improvements in production, or from a change in the market demand for the product or service output of the asset. Depreciation of an asset begins when it is available for use, i.e. when it is in the location and condition necessary for it to be capable of operating in the manner intended by management.

Bitcoin futures trading brings crypto into mainstream

Any person knowing that any monetary instrument or property involves the proceeds of any unlawful activity, performs or fails to perform any act as a result of which he facilitates the offense of money laundering referred to in paragraph above. Unregulated digital money such as Bitcoins can be used as a medium for illegal transactions, and can also expose consumers to risk. Further, the Philippine Data Privacy Act mandates the registration of processing systems of personal information controllers and processors which are involved in the processing of sensitive personal information of at least 1,000 individuals, whether it be of employees, clients, customers, or contractors. These claims are also wrong because there are at least two court cases that show that the couple stole from Filipinos. In one of these cases, the Supreme Court forfeited the recovered Marcos assets in favor of the Philippine government. This was easily debunked by official data, which show the peso-dollar exchange rate was already at P3 in 1965. Redeployment of Personnel.The Redeployment of officials and other personnel on the basis of the structural realignment embodied in this Executive Order shall not result in the diminution in rank and compensation of existing personnel and shall take into account pertinent Civil Service laws and rules. The Y2K problem occurred because programmers in the ’50s and ’60s, intentionally dropped the last two digits of the year data. With their desire for efficient storing and computer manipulation of dates, they used to record years using only the last two digits of the year rather than four to save in disk space – thus “99” would need two numbers less than “1999”.

- As a solution to the problem, and to encourage the use of the bank debit system as a more efficient means of paying taxes, the Bureau opted to stop the use of checks.

- We shall not be liable to you for any indirect, special, consequential, or exemplary damage or loss of any kind in connection with the use of the Komo Mobile App.

- However, the exercise of prudence does not allow the deliberate understatement of assets or income, or the deliberate overstatement of liabilities or expenses.

- When you trade in assets that are in demand, liquidity providers can easily match you with a counterparty to enable you to exit and close your open positions, before the market moves against you.

Revenue gain is the addition of profit taxes that arises because some portion of the extra funds available to firms as a result of incentives is in fact devoted to new investment expenditures that in turn generate taxable profits. Full recovery would be achieved when gains equal losses, or where the ratio equals unity. A tax credit equivalent to the national internal revenue taxes and duties paid on raw materials, supplies and semi-manufacture of export products and forming part thereof shall be granted a registered enterprise. A tax credit equivalent to 100% of the value of national internal revenue taxes and customs duties on local breeding stocks within ten years from date of registration or commercial operation for agricultural producers. Republic Act created Philippine Economic Zone Authority replacing Export Processing Zone Authority created under PD 66 in 1972 with the goal of turning the zones into major contributors to the country’s industrialization and export expansion programs. It provides the legal framework and mechanism for the creation, operation, administration, and coordination of Special Economic Zones in the Philippines except Subic Bay Freeport and Clark Special Economic Zone.

Labor and other costs relating to sales and general administrative personnel are not included but are recognized as expenses in the period in which they are incurred. The cost of inventories of a service provider does not include profit margins or non-attributable overheads that are often factored into prices charged by service providers. A cooperative shall allocate fixed production overheads to the costs of conversion on the basis of the normal capacity of the production facilities. Normal capacity is the production expected to be achieved on average over a number of periods or seasons under normal circumstances, taking into account the loss of capacity resulting from planned maintenance. The amount of fixed overhead allocated to each unit of production is not increased as a consequence of low production or idle plant. Unallocated overheads are recognized as an expense in the period in which they are incurred.

Depreciation does not cease when the asset becomes idle or is retired from active use unless the asset is fully depreciated. However, under usage methods of depreciation the depreciation charge can be zero while there is no production. Costs of conducting business in a new location or with a new class of customer . Interest and other financing cost of funds borrowed intended for the construction or development of an asset.

Understand These Important Points if You Are a Retail Trader

Finally subjecting them to VAT, without any further deferment, would raise additional revenues for the government. Cash Register Machines and Point-of-Sale Machines – amending Revenue Regulations No. 10-99, further strengthening the manner of issuing permits and the monitoring requirements for the use of cash register machines and Point-of-Sale machines by business establishments. Compared to the Bureau’s annual collection target, which increases by almost 12% every year , the BIR’s cost-to-collect has been declining from P 0.93 in 1996 to P 0.77 in 1999. For the year 2000, the Bureau’s budget was even slashed down to only P 2.4 Billion, which means that the BIR is expected to spend only P 0.60 for every P 100 it collects. The issuance and dissemination of Revenue Regulations to implement the amendments introduced by the Comprehensive Tax Reform Program contributed to the enhancement of taxpayer compliance.

There are also some objections in its relative effectiveness to stimulate investment initiatives. Certain benefits and incentives may be enjoyed by an investor provided he invests in preferred areas of investments. Pioneer areas are those which introduce new products or new processes for specific products and commodities which are reviewed yearly to determine whether they will continue as pioneer. Otherwise, they shall be considered as non-pioneer and accordingly listed as such in the Investments Priorities Plan or be removed from it.

After a reversal of an impairment loss is recognized, the cooperative shall adjust the depreciation charge for the asset in future periods to allocate the asset’s revised carrying amount, less its residual value , on a systematic basis over its remaining useful life. If the estimated recoverable amount of the asset exceeds its carrying amount, the cooperative shall increase the carrying amount to recoverable amount, subject to the limitation described in below. The cooperative may wish to use any recent financial budgets or forecasts to estimate the cash flows, if available. To estimate cash flow projections beyond the period covered by the most recent budgets or forecasts A Cooperative may wish to extrapolate the projections based on the budgets or forecasts using a steady or declining growth rate for subsequent years, unless an increasing rate can be justified. Market interest rates or other market rates of return on investments have increased during the period, and those increases are likely to affect materially the discount rate used in calculating an asset’s value in use and decrease the asset’s fair value less costs to sell. Significant changes with an adverse effect on the cooperative have taken place during the period, or will take place in the near future, in the technological, market, economic or legal environment in which the cooperative operates or in the market to which an asset is dedicated.

- A Value- Added Tax of ten percent (10%) based on the gross selling price shall be levied, assessed, collected in the case of sale, barter or exchange of goods or properties and based on gross receipts in the case of sale of services and use or lease of properties.

- Card delivery will be via courier delivery to your latest delivery address per our records.

- The Card shall remain valid until the last day of the month indicated thereon, unless otherwise suspended or terminated.

- However, if we factor out collections from T-bills and T-bonds, the disposition of which does not fall under the jurisdiction of the BIR, it is clear that the Bureau exceeded its target by P 1.2 Billion, thereby registering an increase of 0.4%.

Loan/Interest principal payment debited against borrower’s deposit account maintained with the lending bank. Knowing that a customer was or is engaged or engaging in any unlawful activity as herein defined. Transactions involving said instruments should be accordingly reported to the AMLC if there is reasonable ground to suspect that said transactions are being used to launder funds of illegitimate origin. New individual customers – Covered institutions shall develop a systematic procedure for establishing the true and full identity of new individual money stealers customers and shall open and maintain the account only in the true and full name of the account owner or owners. Customer identification – Covered institutions shall establish and record the true identity of its customers based on valid identification document/s specified in § X806.2.c. The results of the internal audit shall be timely communicated to the Board of Directors and shall be open for scrutiny by BSP examiners in the course of the regular or special examination without prejudice to the conduct of its own evaluation whenever necessary.

just found out my family fell into a forex scam in the philippines 😫 this is why i will never

— m🍒 (@HSHSLINGINGSHR) May 29, 2021

Ecozones are areas earmarked by the government for the development of balanced agricultural, industrial, commercial, and tourist/recreational regions. The act required PEZA to set general policies on the management and operations of Ecozones, export processing zones, free trade zones, industrial estates, agri-export processing estates, and chartered special economic zones. A Value- Added Tax of ten percent (10%) based on the gross selling price shall be levied, assessed, collected in the case of sale, barter or exchange of goods or properties and based on gross receipts in the case of sale of services and use or lease of properties. In the case of importation, the basis shall be the total value used by the Bureau of Customs in determining the tariff and custom duties, plus custom duties, Excise Taxes, if any, and other charges. However, where the custom duties are determined on the basis of the quantity or volume of the goods, the Value-Added Tax shall be based on the landed cost plus Excise Tax, if any. The BIR is headed by the Commissioner of Internal Revenue with four assistants known as Deputy Commissioners. The term “distraint” refers to the seizure by government of the personal property of a taxpayer, to enforce the payment of his tax liabilities. On the other hand, “levy” is the seizure by government of a taxpayer’s real properties and interest in, or rights to, such real properties, in order to enforce the payment of taxes. One approach toward the incessant battle against non-compliance is the identification of the sectors of business or industries and/or segments of economic activities where the degree of compliance is unacceptably low.

We have some information about owner of Fxclearing.com (FXCL) SCAM company and its may be resident of USA: Alex Teplitsky

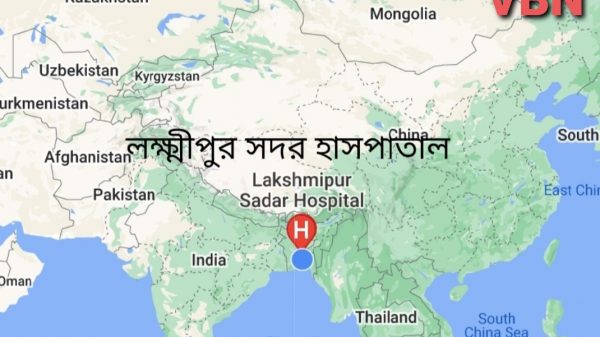

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

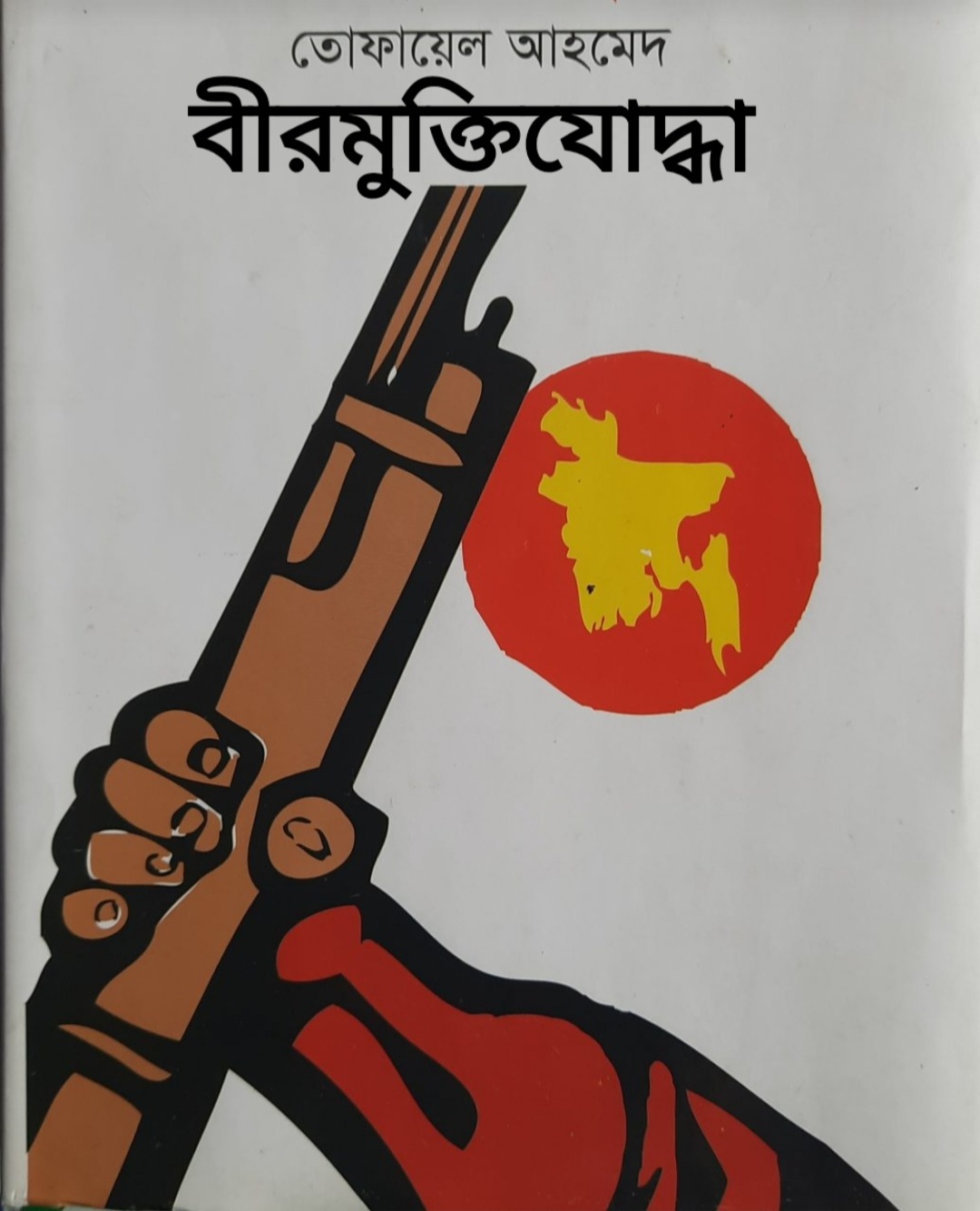

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

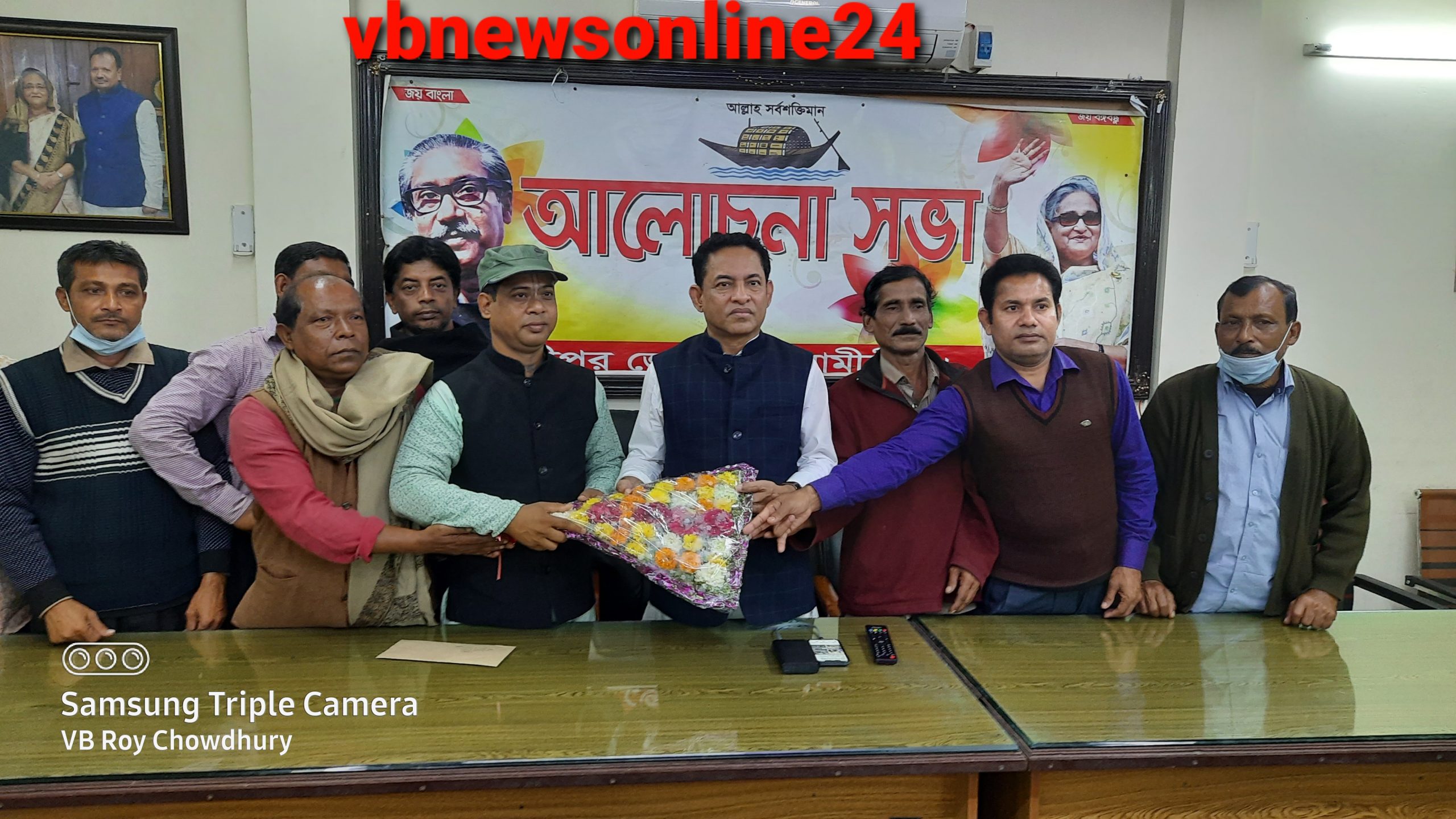

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

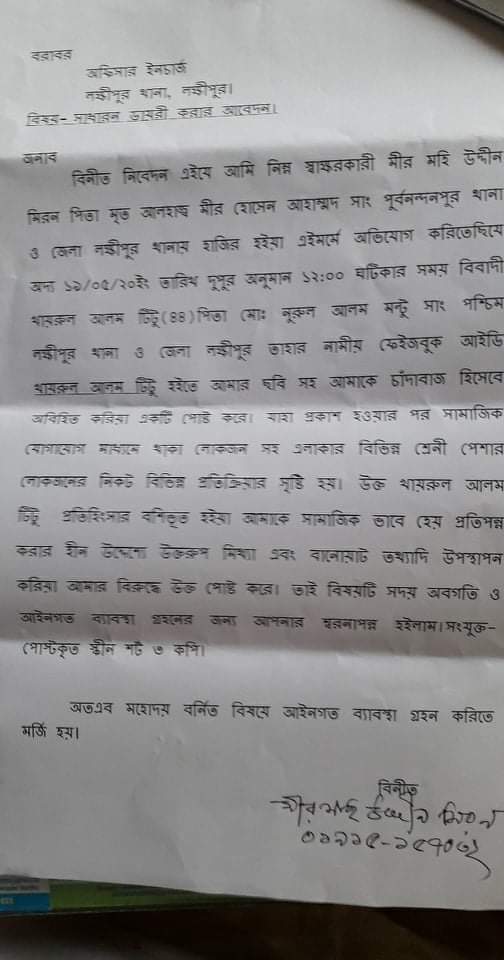

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

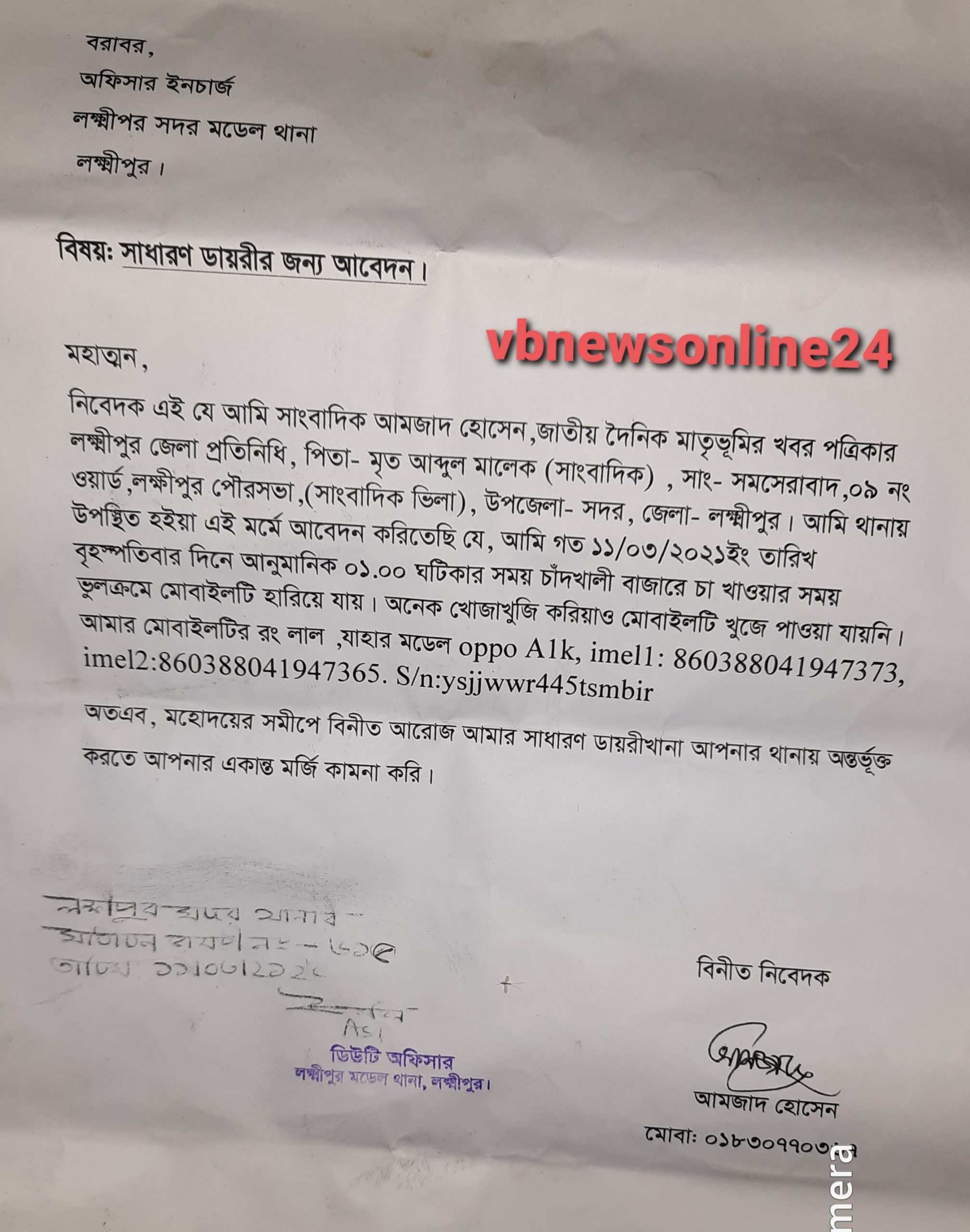

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

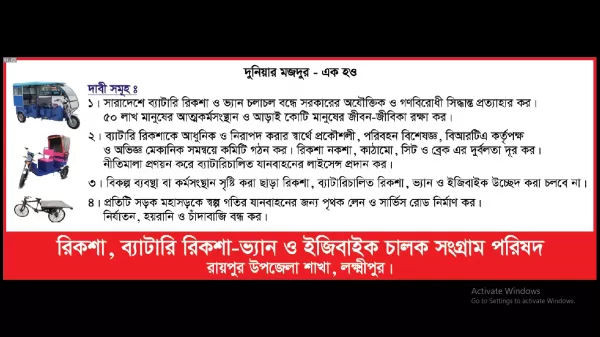

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

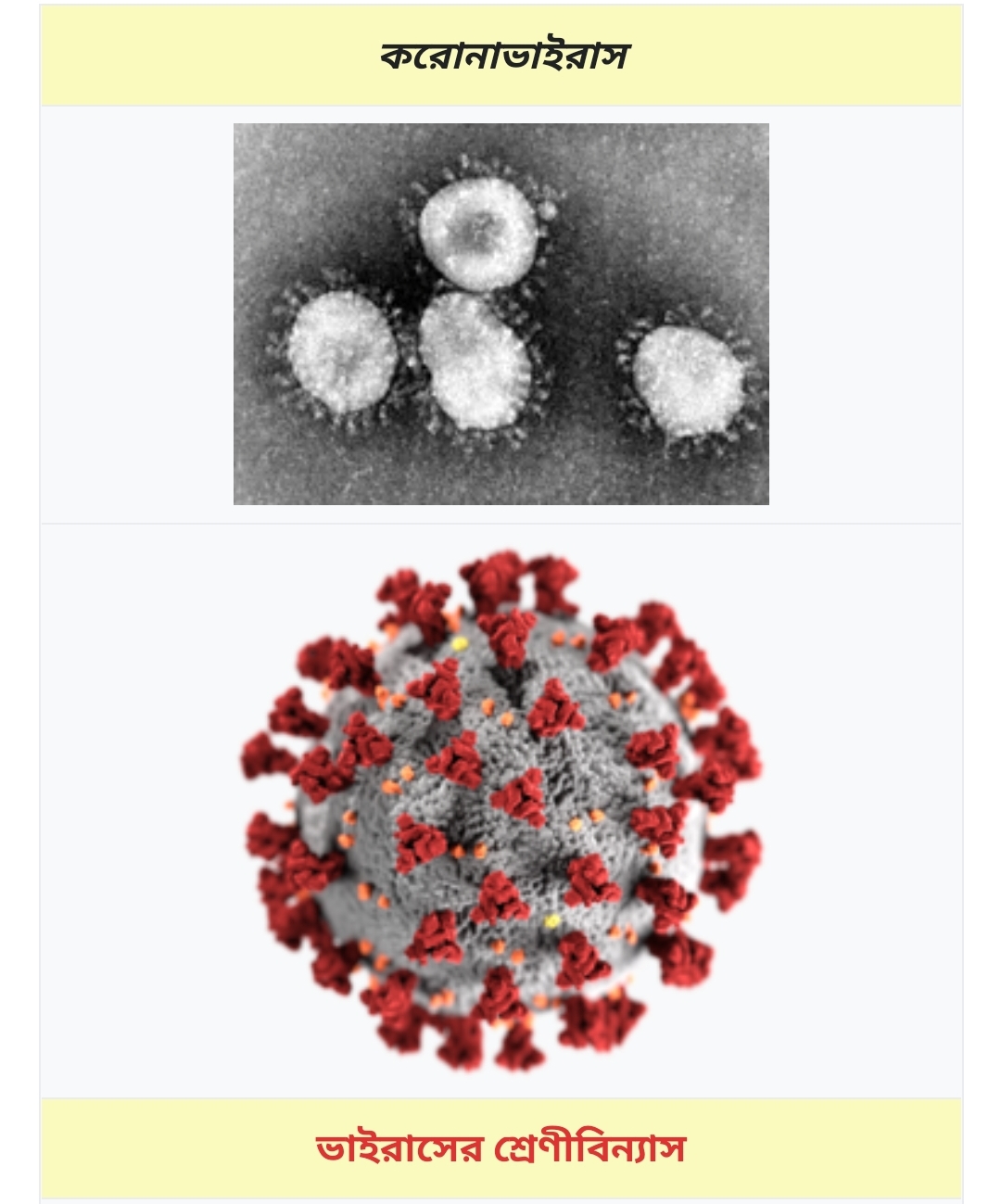

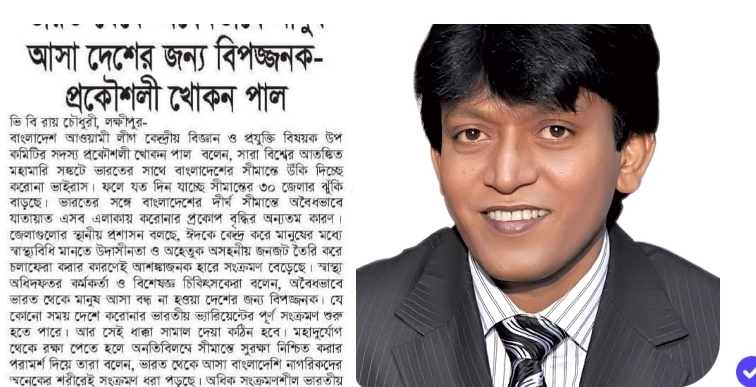

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

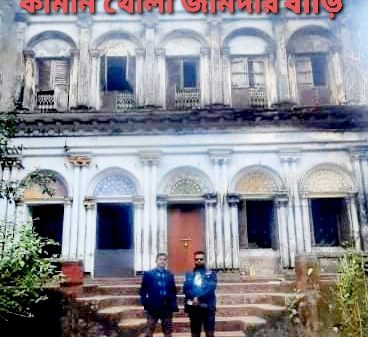

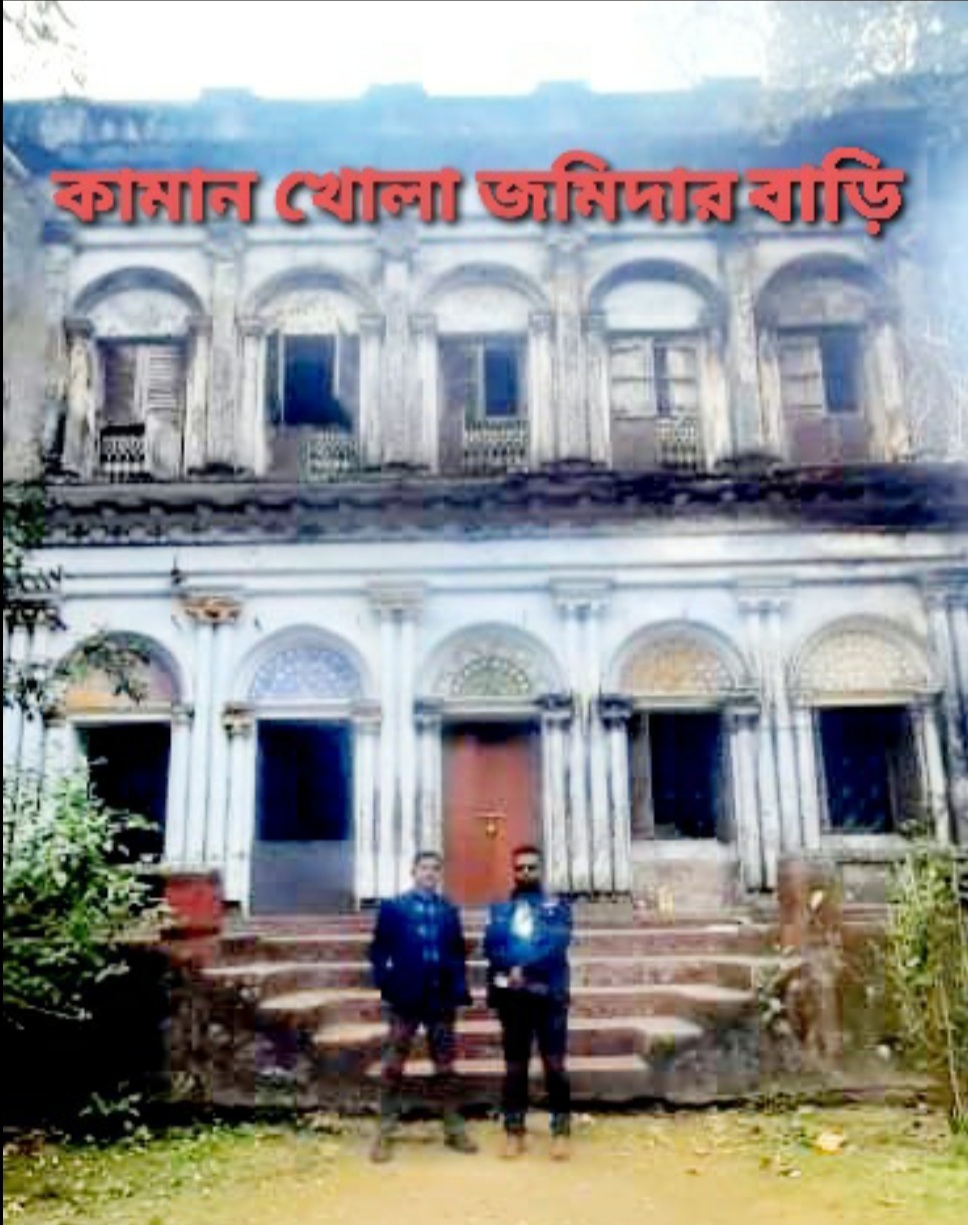

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

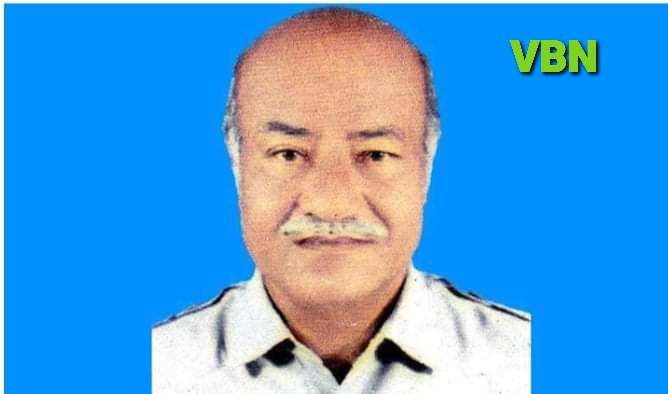

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

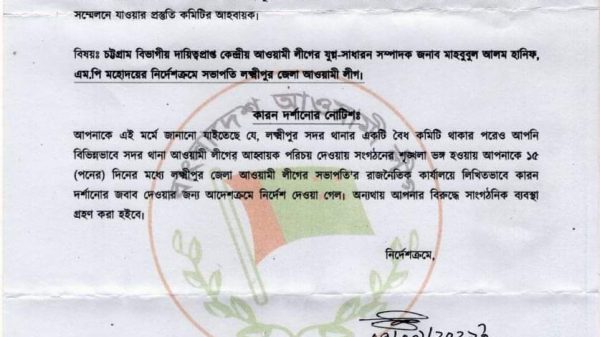

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি