Morning Star Definition

Contents

By the third day, the RSI moving above 30% will further confirm this. If you are interested in reading more about Morning Star candlestick patterns, including you must first login. Multi-assets – The candlestick pattern can be used in all assets including currencies and stocks. The opposite pattern of the morning star pattern is the evening star pattern. The Morning Star candlestick pattern is the opposite of the Evening Star, which is a top reversal signal that indicates bad things are on the horizon.

She also creates market forecasts and advises major shareholders, compiles investment portfolios, and teaches how to work with automated advisors. It will not appear just anywhere and there aren’t as many price swings inside the daily period of the candle itself. The Star is not indecisive, like Dojis – the bearish traders simply can’t push any further and are forced to give into the bullish trend. This is said to represent a star in the sky that is signaling it is nighttime, therefore bearish. The third candlestick is a gap lower, and a longer candlestick.

Was the Morning Star a good weapon?

The typical Morningstar is a mace with spikes on it and was more effective than any weapon. … However Morningstars also existed as maces (a single metal club without the chain).

Because you cannot cosider the pattern as valid until it completely appears on the chart. But both these guys need a completed candlestick patter to appear on the screen which happens at the close of the day. Let’s work on building a strategy that incorporates the Morning Star trading pattern. We’ve looked at how we can use key support levels, and momentum based oscillators to add confluence for the Morning Star trade set up.

What is required, is an understanding of previous price action and where the pattern appears within the existing trend. Similarly, for an evening star, it is interpreted as a sign to sell. On day two of the observation, the trend reversal starts with the bulls running into uncertainty. I learned most of what I know about candlesticks patterns and price action trading from Steve Nison. He is the authority on candlesticks, and I would recommend his courses to any trader interested in a deeper understanding of them.

Learn To Trade Stocks, Futures, And Etfs Risk

Research and experiences indicate that trading in the capital market may be risky and unsuitable for everyone. And the open-close price is almost the same as you can see and there are very large shadows which show us that there is a lot of indecision on this day. This is a very important criterion and these candlesticks should not overlap. The more indecision on the day of the doji shows us a better probability of a reversal. The third day should be the opposite in color of the first day.

What do Morningstar analyst ratings mean?

The analyst rating is a summary of Morningstar’s “conviction in the fund’s ability to outperform its peer group and/or relevant benchmark on a risk-adjusted basis.” Analyst ratings are graded on a five-tier system, with three positive ratings of Gold, Silver and Bronze, plus a Neutral rating and a Negative rating.

Exit trade when the market crosses above the middle line of the Bollinger Band indicator. Any stock that moves away from this moving average lines will come back to them. Of course you need to be careful you don’t get caught in a trap. Now the third day the bulls put the smack down on the bears.

Stocks

Or if you’re ready to risk real capital, open your live account. You can also try out trading risk free – and give our award-winning platform a test drive – with a FOREX.com demo. Take control of your trading with powerful trading platforms and resources designed to give you an edge.

To that end, we’ve put together a handful of reference guides for the best bullish and bearish candlestick patterns to help guide you along the way. So, be sure to check those out and download our cheat sheets. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. Fortunately, the next candle is bearish and breaks the low of our shooting star candle on the chart.

How To Trade A Morning Star Candlestick Pattern?

Now, the trade is protected against rapid price moves contrary to our trade. This way, if the price creates an unexpected bullish move caused by high volatility, we will be protected. The answer to this question is hidden in the price direction before morning star candlestick patterns the creation of the candle. Past performance of a security or strategy is no guarantee of future results or investing success. Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day.

The first part of a Morning Star reversal pattern is a large bearish red candle. Big Shot, directly or indirectly, makes every effort to train its customers to be successful and profitable traders in the capital market. However, it will not be held liable in any way for any damage and/or loss that may result from relying on the training program in full or in part, insofar as it is incurred. In part, it is forbidden for the students to use the Merchant Community Platform to distribute potentially valuable content as investment advice. In the event that a particular student does so, Big Shot reserves the right to prohibit that student from using the Merchant Community Platform permanently. No part of the training program may be transferred to any third party without the prior written approval of Big Shot.

Is Venus warmer than Mercury?

Even though Mercury is closer to the Sun, Venus is the hottest planet in our solar system. Its thick atmosphere is full of the greenhouse gas carbon dioxide, and it has clouds of sulfuric acid.

✅ Morning Star is formed after a downtrend indicating a bullish reversal. Generally made of 3 candlesticks, first being a bearish candle, second a… The Hanging Man and Hammer candlestick patterns are related trend reversal patterns that may appear at the end of an uptend or downtrend respectively. This is a single candlestick pattern that with a short real body, little or no upper shadow and a long lower shadow that must be at least twice as long as length of the real body. The color of the candle is not import, only its location in the current trend.

How To Identify A Morning Star On Forex Charts

Theoretical knowledge is not enough for trading; demonstrating the strike and patterns and studying Indian markets is equally important. You can start by practicing, and when you progress, you will eventually develop trades and a trading strategy system. This practice will help you in abandoning long-term failure and will encourage a high win rate system. The third day is a green candle and it is closing into the red candlestick which shows us that the reversal is imminent and all these candles are gapping. Stay in the short trade for a bearish price move equal to at least three times the size of the shooting star candle including the upper and the lower candlewick. Now we have a reason to believe that the price action could be reversed.

- Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy.

- 📌Japanese candlestick charts were developed in the 17th-18th centuries by the Japanese rice traders.

- Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts.

- I trade this pattern, and have found it to be pretty useful.

There are also other indicators and tools, and you are generally advised to use as many as you can, considering you can read them. But for starters, you can just use the combination of pivot points, your own feeling and the intraday readings on the third day. With a small and slowly applied effort, you can start working on yourself and do it with maximum confidence. There are three main trading styles in the capital market.

When taken after an established downtrend, trading the morning star candlestick pattern can be very profitable. Some traders use this pattern as their main trading setup. In the last couple of articles of this price action course, we began learning about multi-candlestick patterns. In this article, we will learn about trading the morning star candlestick pattern – our first three-candle pattern.

Current Forex Rates

The list of symbols included on the page is updated every 10 minutes throughout the trading day. However, new stocks are not automatically added to or re-ranked on the page until the site performs its 10-minute update. It frequently occurs in the forex market, presenting opportunities to trade.

The only difference is that while the morning star is a bullish pattern, the evening star happens at the top of an asset. A Bullish Engulfing Pattern is a two-candlestick reversal pattern that forms when a small black… The morning star consists of three candlesticks with the middle candlestick forming a star. We research technical analysis patterns so you know exactly what works well for your favorite markets. With that said, you should already have a good idea that it’s actually a bullish reversal pattern. So, I am only trying to understand how early any breakouts like this can be capitalized.

The Morning Star

If you are able to identify the presence of these signals, then you should short the security. After all, you are anticipating an upcoming bearish price move. Once you are able to identify the shooting star, you should look to open a short position on a break of the low of the candle.

In other words, the bears are fully in control the first day. The second day is an indecision day because the bulls and bears battled and now one took control. Reversal indicators Venture fund – It can be used by other reversal indicators like double exponential moving averages. A good example of the evening star pattern is shown in the NZD/USD pair below.

To be included in a Candlestick Pattern list, the stock must have traded today, with a current price between $2 and $10,000 and with a 20-day average volume greater than 10,000. Confirm there is momentum in the movement of price by marking the movement of the third candlestick in the pattern relative to the Bollinger bands. If it does not move above the lower band of the Bollinger bands, there is not enough momentum, so do not trade.

Create a live or demo account to set alerts in the platform. On the first day, bears are definitely in charge, usually making new lows. Our writers and editors often write an article about interesting economic indicators or facts.

This pattern would have actually worked out nicely any way you decided to trade it. The default “Intraday” page shows patterns detected using delayed intraday data. It includes a column that indicates Currency Risk whether the same candle pattern is detected using weekly data. Candle patterns that appear on the Intradaay page and the Weekly page are stronger indicators of the candlestick pattern.

On the other hand, for example, an evening star pattern is initiated with a long bullish candlestick on day one as the bulls dominate the market. On day two, the trading of that asset opens with a gap up. Due to widespread indecisiveness, day two ends with a short candlestick with negligible change in the price. Day three starts with a gap down and initiates a bearish trend reversal. With panic-selling constantly in action, the bears assert themselves in a position of power. This morning star candlestick acts as a bullish reversal of the downward price trend because price drops into the candle and exits out the top.

We wait to see if the next candle is going to confirm the authenticity of the shooting star reversal pattern. On the way down, the price creates one correction during the bearish move. The downward activity then resumes and 18 periods after we short HPQ, the price action closes a candle below the minimum target of the pattern. The first blue arrow on the image measures the size of the candlestick. According to our shooting star trading strategy, we should seek a target equal to three times the size of the pattern.

Morning star patterns are generally seen as reasonably reliable indicators of market moves. They’re comparatively easy to spot, too, making them a useful early candlestick pattern for beginner technical traders. Gap up the opening – A gap up opening indicates buyer’s enthusiasm.

Author: Daniel Dubrovsky

লক্ষ্মীপুর সদর উপজেলার দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে ৪নং ওয়ার্ডে মেম্বার পদপ্রার্থী কাজল খাঁনের গণজোয়ার

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী পাঁচজন,কে হবেন চেয়ারম্যান ?

বাংলাদেশ আওয়ামীলীগের যুব ও ক্রিড়া বিষয়ক উপকমিটির তৃতীয় বার সদস্য হলেন লক্ষ্মীপুরের কৃতি সন্তান আবুল বাশার

প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের ১ যুগপূর্তি অনুষ্ঠানে প্রধান অতিথি ভিসি ড, এ এস এম মাকসুদ কামাল

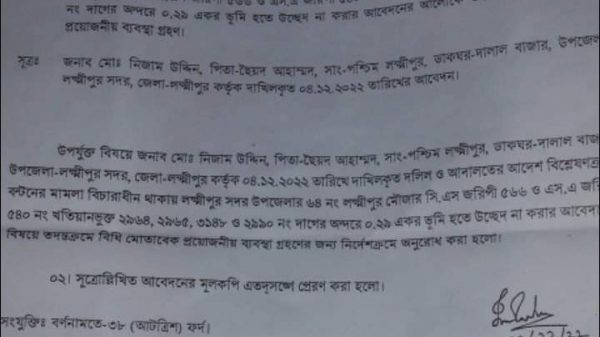

লক্ষ্মীপুরে বীর মুক্তি যোদ্ধা তোফায়েল আহাম্মদের সম্পত্তিতে রফিক উল্যার অনুপ্রবেশের বিষয়ে ইউনিয়ন পরিষদে অভিযোগ

লক্ষ্মীপুরের কৃতি সন্তান ঢাকা বিশ্ববিদ্যালয়ের ভাইস চ্যান্সেলর ড,মাকসুদ কামালকে ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুরের রামগঞ্জ অভয় পাটোয়ারী বাড়ির গৌড় মন্দিরের সিমানা প্রাচির নিয়ে দন্দ,অপ্রীতিকর ঘটনা ঘটার সম্ভাবনা

বিএনপি ও জামায়েত কতৃক অবরোধে দালাল বাজার আওয়ামীলীগ, যুবলীগ, ছাত্রলীগ ও বিভিন্ন অঙ্গসংগঠনের প্রতিবাদ মিছিল অনুষ্ঠিত

লক্ষ্মীপুরে গ্রাহকের টাকা নিয়ে পদ্মা ইসলামী লাইফ ইন্স্যুরেন্স এর কর্মকর্তারা উধাও,হেনস্তার শিকার নারী কর্মী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা শান্তিপূর্ণ ভাবে সু-সম্পন্ন হওয়ায় জেলাপ্রশাসন ও পুলিশ প্রশাসনের প্রতি ধন্যবাদ জ্ঞাপন -( ভি বি রায় চৌধুরী) –

লক্ষ্মীপুরে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজে নবীন বরন ও কৃতি শিক্ষার্থী সংবর্ধনা অনুষ্ঠান অনুষ্ঠিত -ভি বি রায় চৌধুরী –

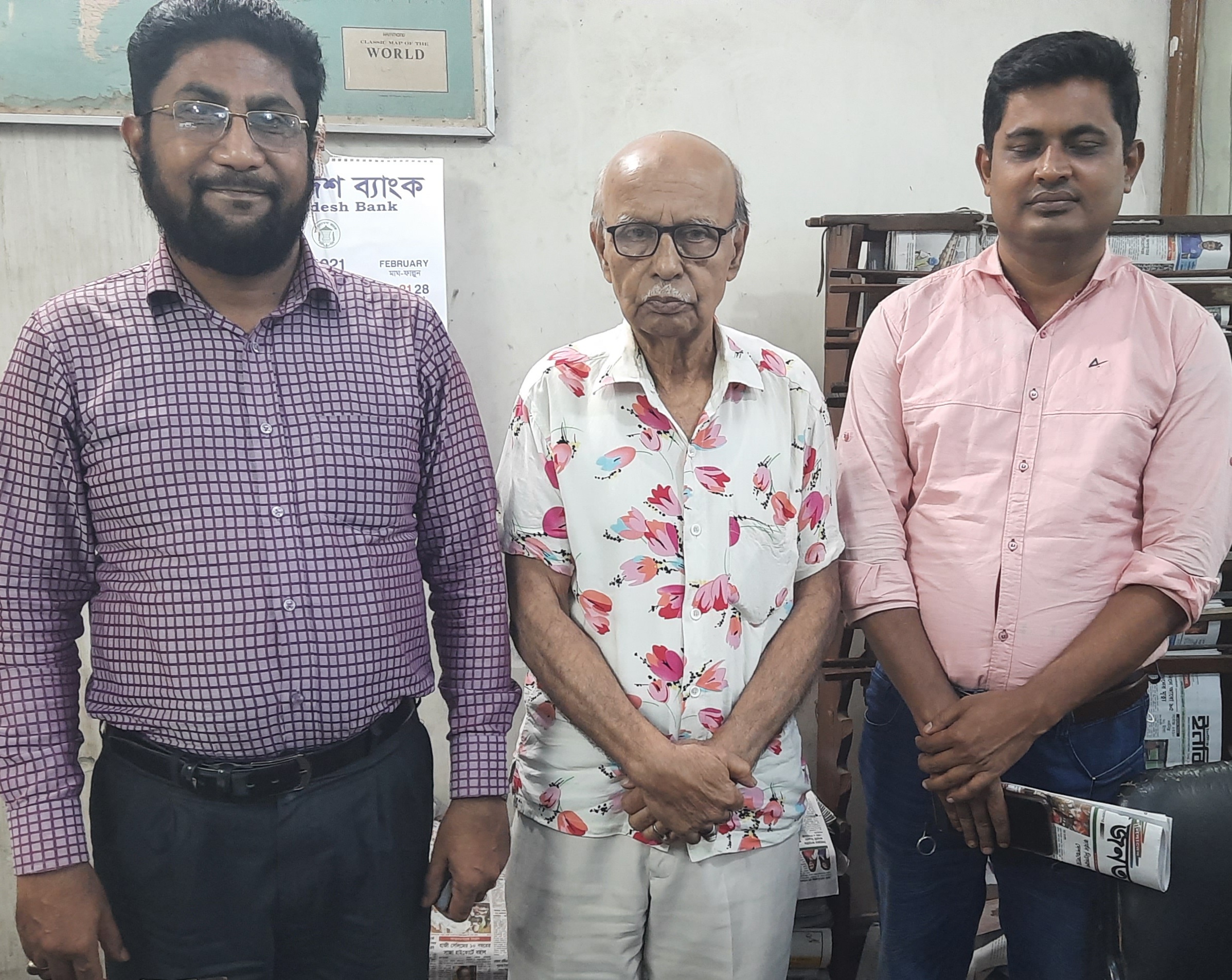

লক্ষ্মীপুর কলেজের সাবেক অধ্যক্ষ ননী গোপাল ঘোষ ও অধ্যাপক শ্রীমতি আরতি ঘোষের সাথে ছাত্র নুরউদ্দিনের স্বাক্ষাত

প্রকৌশলী খোকন পালের বাবার পারলৌকিক ক্রিয়া অনুষ্ঠানে লক্ষ্মীপুর ২ আসনের এমপি এড: নুরউদ্দিন চৌধুরীর অংশগ্রহণ

লক্ষ্মীপুরে আলিফ -মীম হাসপাতালের অফিস রুম অনাড়ম্বর আয়োজনের মধ্যে দিয়ে ফিতা কেটে উদ্বোধন করেন প্রতিষ্ঠানের চেয়ারম্যান আলহাজ্ব আমির হোসেন

লক্ষ্মীপুর জেলার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি কর্তৃক উপশহর দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতি অনুমোদন

লক্ষ্মীপুরের উপশহর দালাল বাজার বড় মসজিদ রোড অবৈধ দখলদারদের কবলে,অহরহ ঘটছে দুর্ঘটনা, দেখার যেন কেউ নেই ?

সাফল্যের ধারাবাহিকতায় প্রিন্সিপাল কাজী ফারুকী স্কুল মোট শিক্ষার্থী ২৩৩ জন,জিপিএ ৫ : ৯৩ জন পাশের হার ৯৯’৫৭%

লক্ষ্মীপুরের উপশহর দালাল বাজার ইউনিয়ন ভূমি অফিস পরিদর্শনে আসেন নবাগত জেলা প্রশাসক সুরাইয়া জাহান মহোদয়

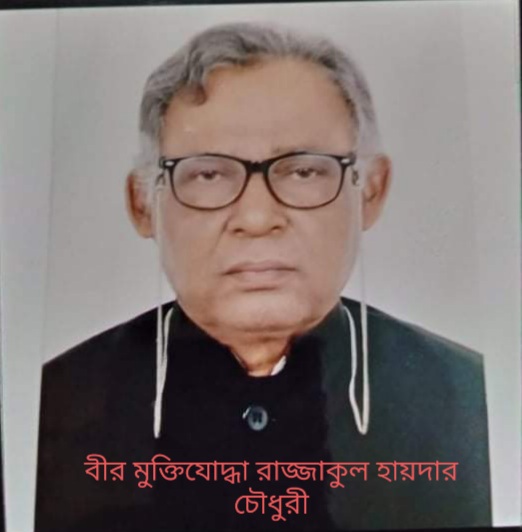

বীর মুক্তিযোদ্ধার সন্তান, নবাগত জেলা প্রশাসক সুরাইয়া জাহানকে লক্ষ্মীপুর জেলার বীর মুক্তিযোদ্ধাদের ফুলেল শুভেচ্ছা প্রদান

লক্ষ্মীপুর জেলার সদ্য যোগদানকৃত জেলা প্রশাসক সুরাইয়া জাহানকে প্রিন্সিপাল কাজী ফারুকী স্কুল এন্ড কলেজের পক্ষথেকে ফুলেল শুভেচ্ছা

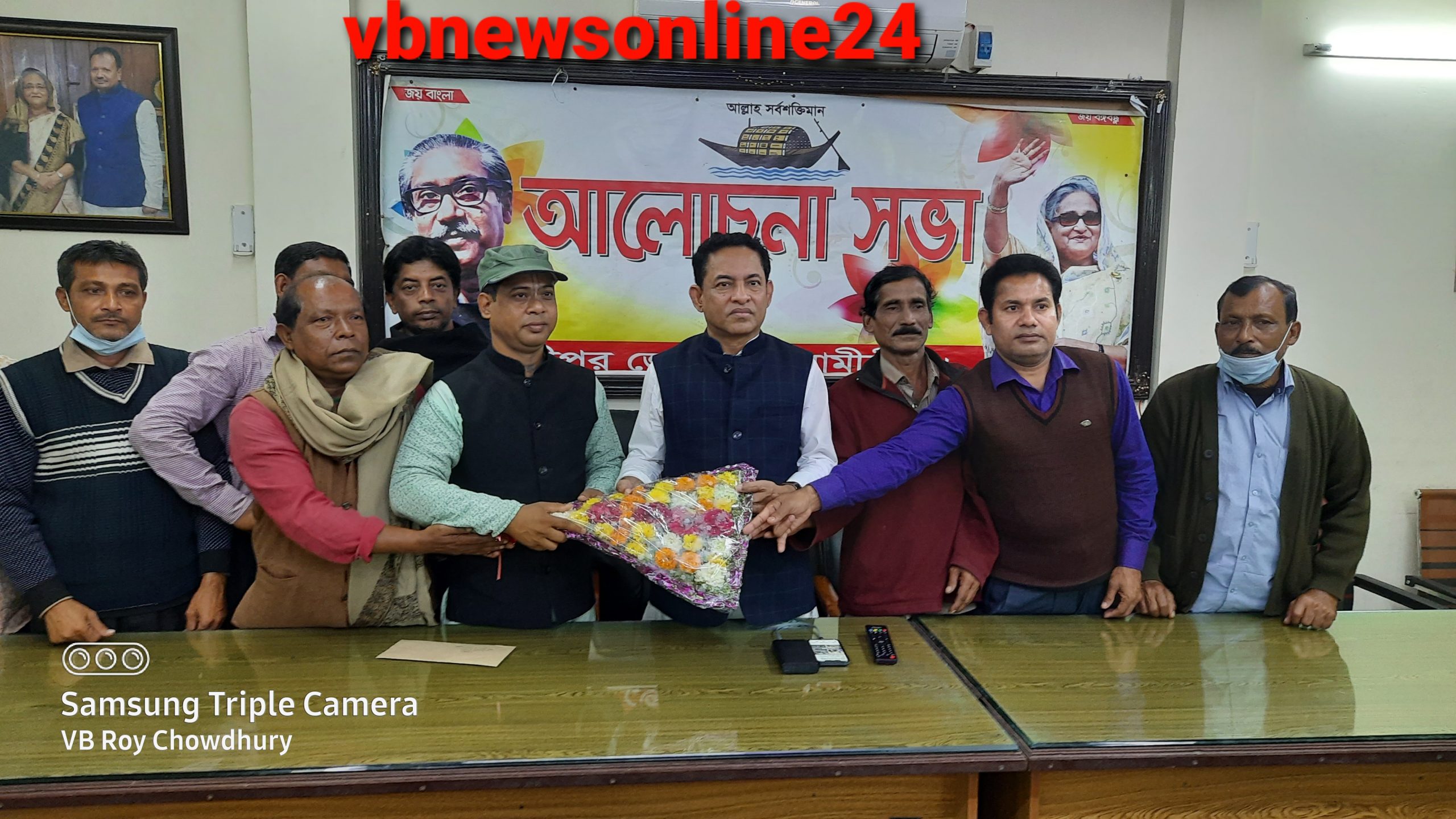

জাতীয় সংসদের মাননীয় হুইপ, আওয়ামীলীগের সাংগঠনিক সম্পাদক আবু সাঈদ আল মাহমুদ স্বপন এমপিকে লক্ষ্মীপুরে ফুলের শুভেচ্ছা প্রদান

বৃহত্তর নোয়াখালী আন্ত:স্কুল বিতর্ক প্রতিযোগিতা -২০২৩ লক্ষ্মীপুর কাজী ফারুকী স্কুল এন্ড কলেজে অনুষ্ঠিত

লক্ষ্মীপুর আদালত প্রাঙ্গণে বিচার প্রার্থীদের বিশ্রামাগার “ন্যায়কুঞ্জ” এর ভিত্তিপ্রস্তর স্থাপন করে মাননীয় বিচারপতি মোঃ আকরাম হোসেন চৌধুরী

লক্ষ্মীপুর জেলা পুলিশের মাসিক কল্যাণ সভায় ঘোষণা শ্রেষ্ঠ ওসি মোসলেহ্ উদ্দিন,শ্রেষ্ঠ টিআই সাজ্জাদ কবির

লক্ষ্মীপুরের উপশহর দালাল বাজারে একটি পুলিশ তদন্ত কেন্দ্র আবশ্যক, সংশ্লিষ্ট কর্তৃপক্ষের নিকট এলাকা বাসির দাবী

লক্ষ্মীপুরের কৃতিসন্তান আনোয়ারুল হক ছলেমা খাতুন ফাউন্ডেশনের চেয়ারম্যান কামাল ফার্মারের ৫১ তম জন্মদিনে তিনি সকলের আশির্বাদ /দোয়া প্রার্থী

লক্ষ্মীপুর সদর উপজেলার দালাল বাজারে বিকাশ সরকার কে রক্তাক্ত জখম করার বিষয়ে সোহাগের বিরুদ্ধে থানায় অভিযোগ

লক্ষ্মীপুর সদর উপজেলার চররুহিতা ইউনিয়নে ছোট ভাইয়ের বৌকে যৌন হয়রানি করার বিরুদ্ধে ভাসুর দীপনেরৃ প্রতিবাদ

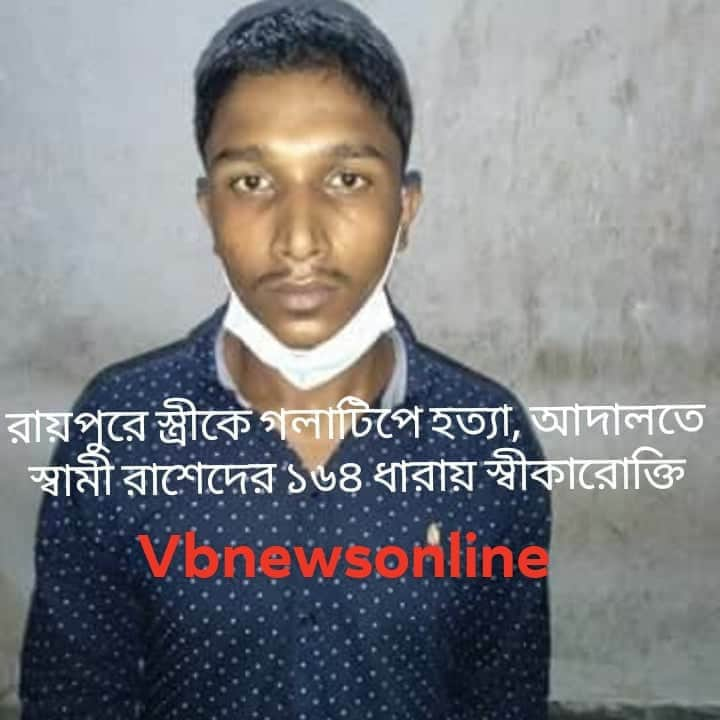

লক্ষ্মীপুরে পারুল হত্যা মামলার রহস্য উদঘাটন,দুইজন গ্রেপ্তার পুলিশ সুপারের সাথে সাংবাদিকদের প্রেস ব্রিফিং অনুষ্ঠিত।

লক্ষ্মীপুরের উপশহর দালাল বাজার পুলিশ কেম্পে পুলিশ ভ্যানগাড়ী আবশ্যক কর্তৃপক্ষের দৃষ্টি আকর্ষন করছে সূধী মহল

লক্ষ্মীপুরের রায়পুর উপজেলার বামনী ইউনিয়নে মোঃ ইউছুফের কাছথেকে শাহিন গংরা ৫০হাজার টাকা লুটে নেয়ায় থানায় অভিযোগ

লক্ষ্মীপুরের রামগঞ্জে অভয় পাটোয়ারী বাড়ির সার্বজনীন দূর্গা ও গৌর মন্দিরের রাস্তা অবরোধ করে পাকা ভবন নির্মানের অভিযোগ

লক্ষ্মীপুরের রায়পুর চরবংশি বাজার সংলগ্ন সরকারি খালের উপর অবৈধভাবে ব্রীজ তৈরি করে সুমন, এলাকায় জনমনে ক্ষোভ

শিক্ষার্থীদের বড় স্বপ্ন দেখতে হবে, কাজী ফারুকী স্কুল এন্ড কলেজের নবীন বরণ অনুষ্ঠানে- অধ্যক্ষ নুরুল আমিন

লক্ষ্মীপুরে ডাঃ নুরুলহুদা পাটোয়ারীর মৃত্যুতে দালাল বাজার কেমিস্ট এন্ড ড্রাগিস্ট সমিতির সদস্যদের শোকপ্রকাশ :

লক্ষ্মীপুরে কর্তব্যরত অবস্থায় মৃত্যুবরণকারি পুলিশ সদস্যদের স্মরণে স্মৃতিস্তম্ভ নির্মানের স্থান পরিদর্শন করেন পুলিশ সুপার

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা উপলক্ষে জেলা পুলিশ কর্তৃক প্রকাশিত ” দুর্জেয় দূর্গা” নামক ম্যাগাজিন পুনাক সভানেত্রী কে প্রদান

ঢাকেশ্বরী মন্দিরে প্রধানমন্ত্রী শেখ হাসিনার ৭৬ তম জন্মদিন পালনে প্রার্থনা সভার আয়োজক আওয়ামীলীগের কেন্দ্রীয় ত্রান ও সমাজকল্যাণ সম্পাদক সুজিত রায় নন্দী

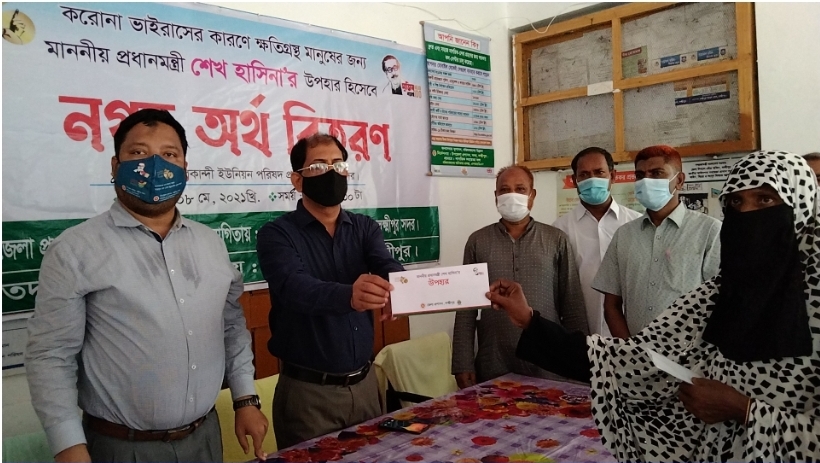

মাননীয় প্রধানমন্ত্রীর ত্রান তহবিল থেকে দুঃস্থ ও অসহায়দের মাঝে চেক বিতরন করেন চাঁদপুরের মাটি ও মানুষের নেতা সুজিত রায় নন্দী

লক্ষ্মীপুরে শারদীয় দূর্গাপূজা নির্বিঘ্নে উদযাপনে প্রস্তুতি পর্যবেক্ষণ করেন জেলা প্রশাসক মো: আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুর ২ আসনের সাংসদ নুরউদ্দিন চৌধুরীকে ঢাকা ইউনাইটেড হাসপাতালে দেখতে যান লসাকসের সদস্য ভাস্কর মজুমদার

লক্ষ্মীপুরে নবাগত পুলিশ সুপার মোঃ মাহফুজ্জামান আশরাফের সাথে বীর মুক্তিযোদ্ধা ও শহীদ মুক্তিযোদ্ধা সন্তানদের মতবিনিময়

জাতীয় কবি কাজী নজরুল ইসলামের মৃত্যুবার্ষিকীতে তাঁর সমাধিতে ফুলদিয়ে আওয়ামীলীগের পক্ষথেকে শ্রদ্ধা নিবেদন

জাতীয় শোক দিবস উপলক্ষে ব্রাহ্মণবাড়িয়ার শিল্পকলা একাডেমীর আলোচনা সভায় বিশেষ অতিথি হিসাবে বক্তব্য রাখছেন সুজিত রায় নন্দী

লক্ষ্মীপুরে আঞ্চলিক পাসপোর্ট অফিসের সহকারী পরিচালক মোঃ জাহাঙ্গীর আলম কর্তৃক পুলিশ সুপারের বিদায় সম্ভাষণ

লক্ষ্মীপুরের দালাল বাজার ইউনিয়ন আওয়ামীলীগের মহিলা বিষয়ক সম্পাদিকা সালেহা বেগমের বসতঘর আগুনে পুড়ে ছাই ব্যাপক ক্ষয়ক্ষতি

লক্ষ্মীপুরে মায়ের মৃত্যুবার্ষিকী উদযাপন উপলক্ষে চট্রগ্রাম মেট্রোপলিটনের অতিরিক্ত পুলিশ কমিশনার শ্যামল কুমার নাথের আগমন

লক্ষ্মীপুর সদর উপজেলা নির্বাহী কর্মকর্তা কর্তৃক কালেক্টরেট স্কুল এন্ড কলেজের উডেন ফ্লোর লাইব্রেরিতে বই উপহার

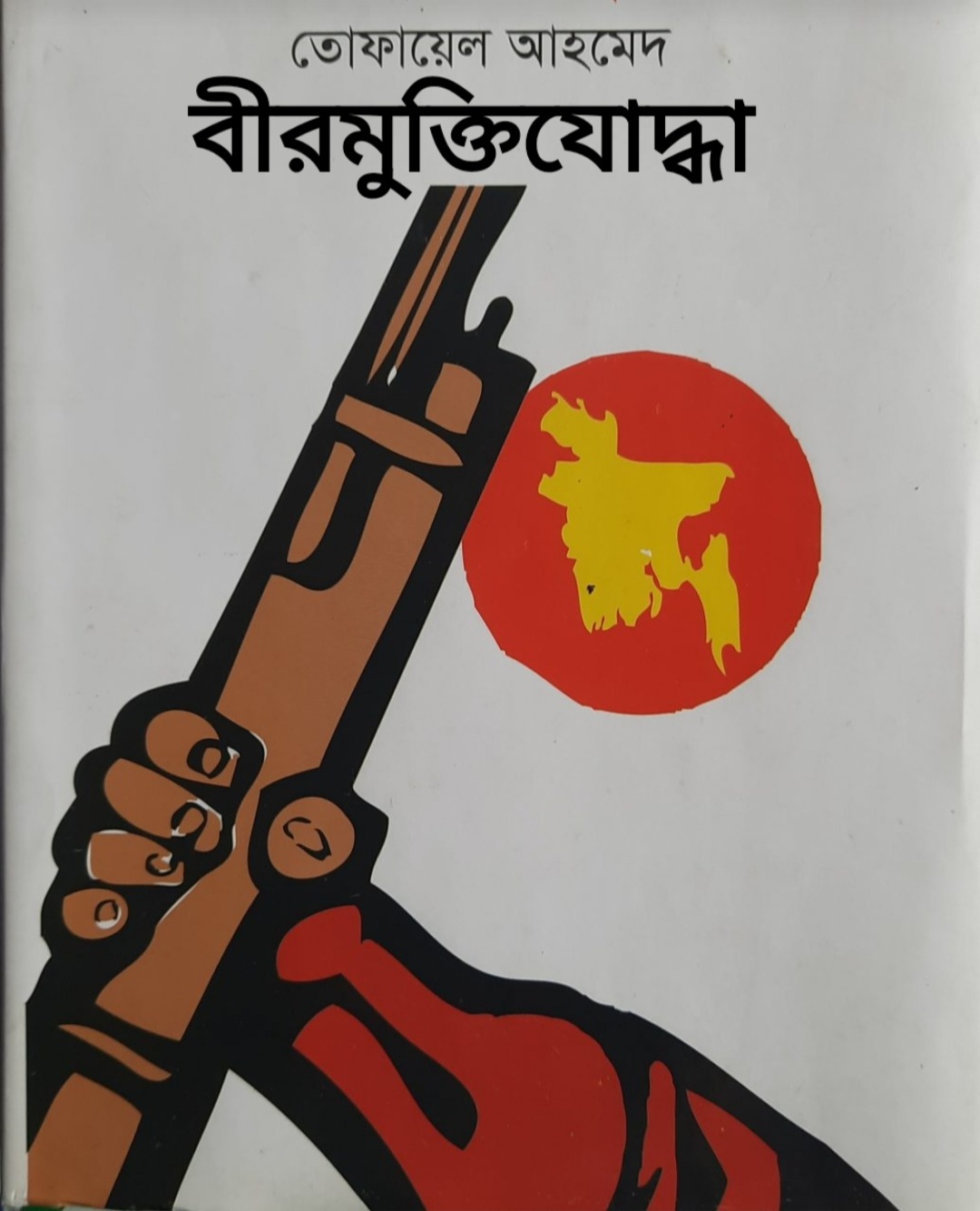

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

মুক্তিযুদ্ধে লক্ষীপুর-রায়পুর” কোটা কোটা বন্দুক “রচিত প্রবাদ বাক্য। লিখক :বীর মুক্তিযোদ্ধা তোফায়েল আহমদ পূর্ব নন্দনপুর দালাল বাজার লক্ষ্মীপুর।

রাজশাহী মেডিকেল কলেজ হসপিটালের পরিচালক কতৃক ঔষধ প্রতিনিধি হেনস্থার প্রতিবাদে লক্ষ্মীপুরের কমল নগরে ফারিয়ার প্রতিবাদ সভা

লক্ষ্মীপুর জেলার পুলিশ সুপার ডিআইজি পদে পদোন্নতি পাওয়ায় রায়পুর থানার অফিসার ইনচার্জ শিপন বড়ুয়ার ফুলের শুভেচ্ছা

লক্ষ্মীপুর পৌর মেয়র মাসুম ভূঁইয়া সমাজসেবায় বিশেষ অবদান রাখায় পশ্চিম বঙ্গ থেকে মহাত্মা গান্ধি শান্তি পদকে ভূষিত

লক্ষ্মীপুরে উপ-পুলিশ পরিদর্শক সোহেল মিঞা কর্তৃক ১০ বোতল হুইস্কি এবং মোটর সাইকেল সহ মাদক ব্যাবসায়ী পংকজ গ্রেপ্তার

বাংলাদেশ আওয়ামীলীগ কেন্দ্রীয় কমিটির ত্রান ও সমাজ কল্যাণ বিষয়ক সম্পাদক সুজিত রায় নন্দী কে চাঁদপুরে ফুলেল শুভেচ্ছা

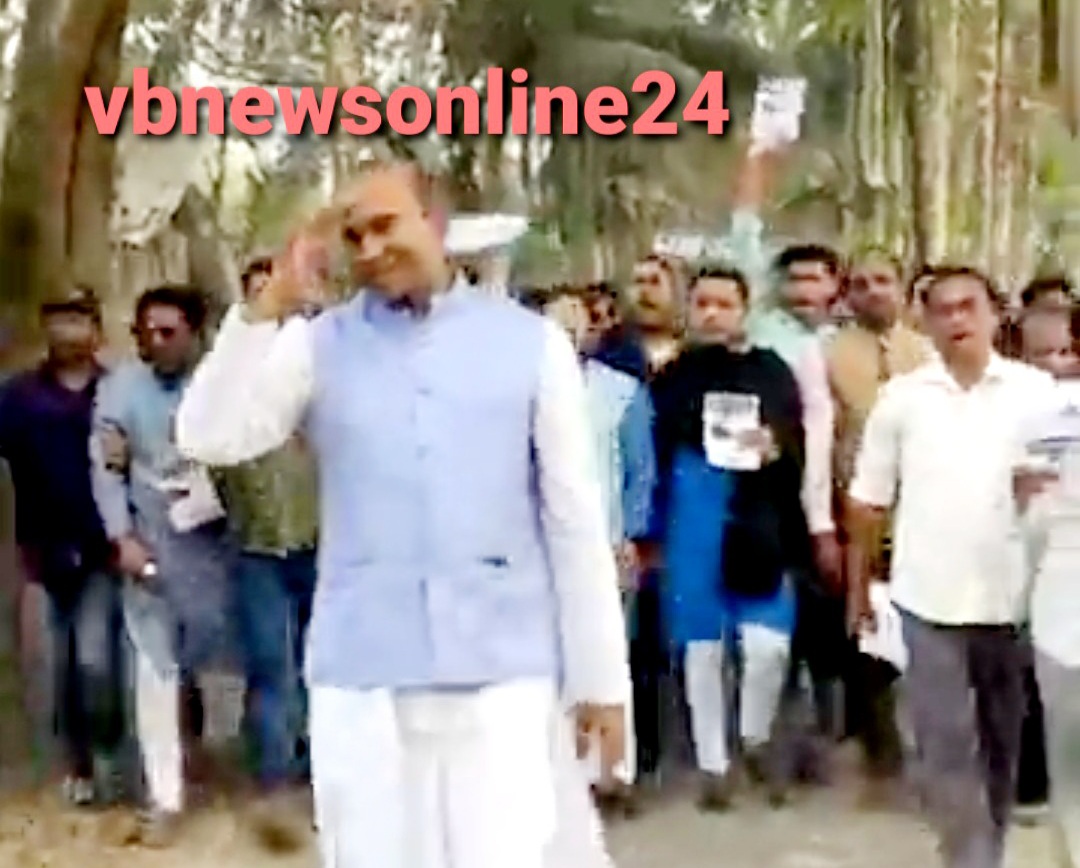

বাংলাদেশ আওয়ামীলীগের সাংগঠনিক সম্পাদক ও জাতীয় সংসদের মাননীয় হুইপ কে লক্ষ্মীপুরে গার্ড অব অনার প্রদান

লক্ষ্মীপুরে ঐতিহাসিক ০৭ মার্চ উপলক্ষে জেলাপ্রশাসন ও পুলিশ প্রশাসন কর্তৃক বঙ্গবন্ধুর প্রতিকৃতিতে শ্রদ্ধা নিবেদন

লক্ষ্মীপুরে সাংবাদিককে হত্যার পরিকল্পনাকারী সহকারী ভূমী কর্মকর্তা ও ভাড়াটের বিরুদ্ধে জেলাপ্রশাসকের নিকট অভিযোগ

লক্ষ্মীপুর জেলার পুলিশ সুপার ড,এ এইচ এম কামারুজ্জামানের ৬ মার্চ ২০২২ ইং মাষ্টার প্যারেডে অভিবাদন গ্রহন

লক্ষ্মীপুরে ইউনিয়ন পর্যায়ে নাগরিকদের স্বাস্থ্যসেবা নিশ্চিত করনে প্রধানমন্ত্রীর “স্বপ্নযাত্রা” এম্বুলেন্স সার্ভিস চালু করেন জেলাপ্রশাসক

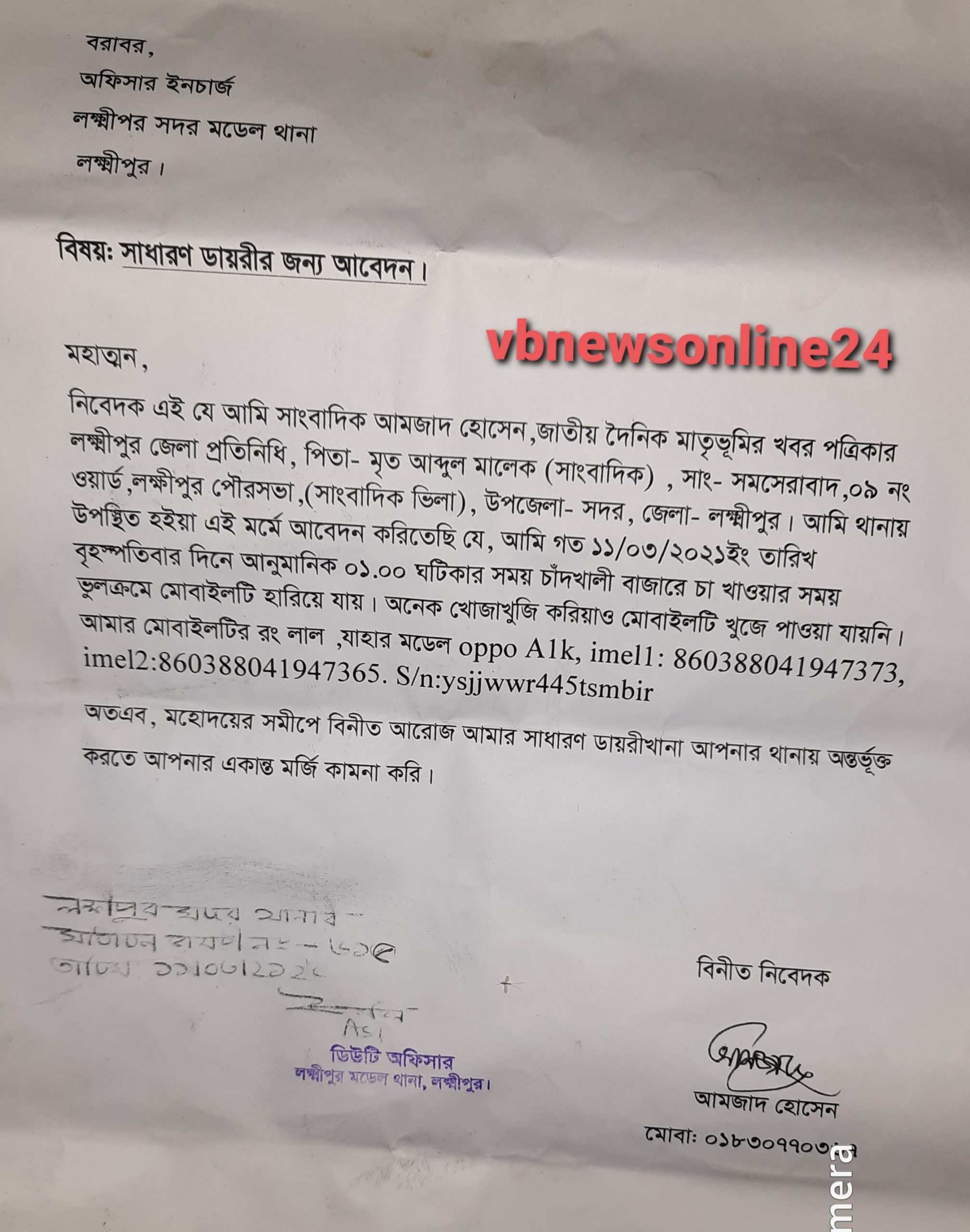

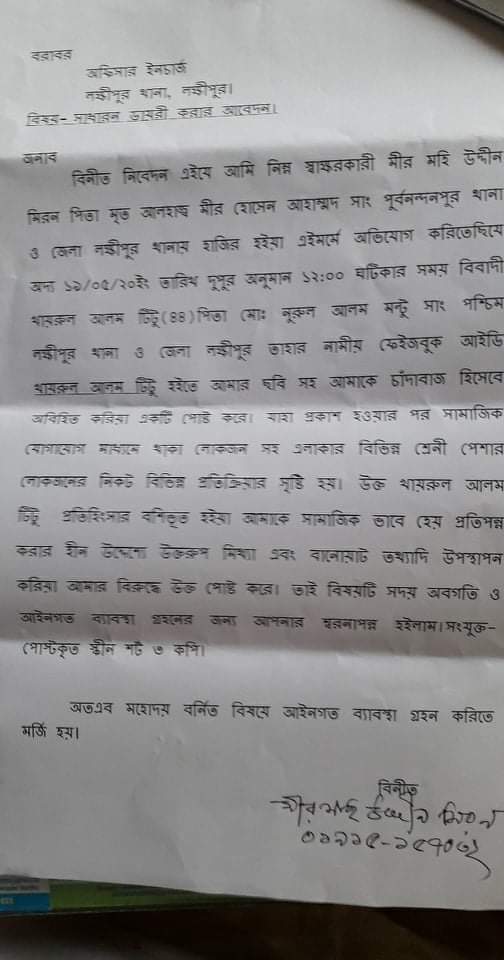

রায়পুর প্রেসক্লাবের সাবেক সভাপতি নরুল আমিন ভূঁইয়া কে ফেসবুক মাধ্যমে প্রান নাশের হুমকি থানায় সাধারন ডায়রি

লক্ষ্মীপুরে মহান শহিদ দিবসে কাজী ফারুকী স্কুল এন্ড কলেজে পুরস্কার বিতরণী ও সাংস্কৃতিক অনুষ্ঠান অনুষ্ঠিত

আন্তর্জাতিক মাতৃভাষা দিবসে শহিদদের স্বরনে শ্রদ্ধা নিবেদন করেন বাংলাদেশ আওয়ামীলীগের কেন্দ্রীয় নেতৃবৃন্দ

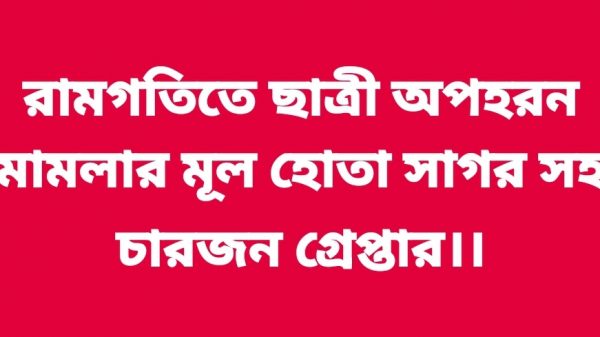

রিকশা ব্যাটারি রিকশা -ভ্যান ও ইজিবাইকের নীতিমালা প্রণয়ন ও শ্রমিকদের জীবন জীবিকা রক্ষার দাবিতে লক্ষ্মীপুর রামগতীতে বিক্ষোভ ও সমাবেশ

লক্ষ্মীপুরের পুলিশ সুপার আইনশৃঙ্খলা রক্ষার সুবিধার্থে রায়পুর থানা পুলিশকে একটি TATA XENON পিকআপ উপহার

লক্ষ্মীপুর সদর উপজেলার দালালবাজার এন,কে উচ্চ বিদ্যালয়ের নির্বাচিত সভাপতির বোর্ড কর্তৃক প্রেরিত চিঠি হস্তান্তর

আসছে ২৬ ডিসেম্বর ইউপি নির্বাচনে প্রিজাইডিং অফিসারদের ব্রিফিং অনুষ্ঠানে প্রধান অতিথি জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

মুক্তিযুদ্ধে বিজয়ের দুইদিন পর ১৮ই ডিসেম্বর রায়েরবাজার বধ্যভূমিতে অজস্র লাশের ভিড়ে অধ্যাপক ফজলে রাব্বি

লক্ষ্মীপুর প্রেসক্লাব অবরুদ্ধ ? সুবর্ণজয়ন্তী উদযাপনে প্রেসক্লাবের ফটকে তালা মেরে সাংবাদিকদের প্রবেশে বাধা

বিজয়ের ৫০ বছর ১৬ ডিসেম্বরে লক্ষ্মীপুর শহিদ স্মৃতিসৌধে পুষ্পস্তবক অর্পণ করছেন উপজেলা নির্বাহী মো, ইমরান হোসেন

অবশেষে লক্ষ্মীপুর সদর উপজেলার ৩ নং দালালবাজার ইউপির ৬ নং ওয়ার্ডের কয়েকটি রাস্তা সংস্কার করলেন যুবলীগ নেতা বাদশা

লক্ষ্মীপুরে পুলিশে ট্রেইনি রিক্রুট কনস্টেবল পদে প্রার্থীদের শারীরিক মাপ ও কাগজপত্র যাচাইকরন পরীক্ষা অনুষ্ঠিত

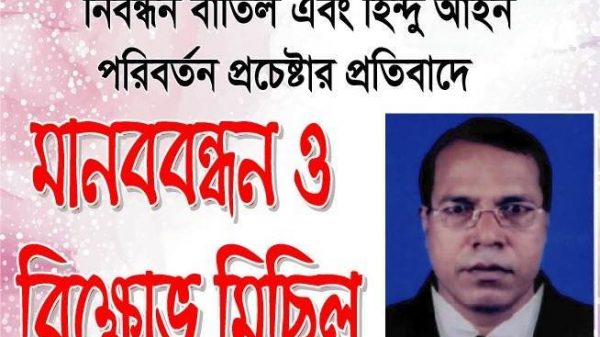

বেগমগঞ্জে সনাতনীদের বিক্ষোভ মিছিল, পরিদর্শনে ডিআইজি ও কেন্দ্রীয় আ’লীগ নেতা সুজিত রায় নন্দী সহ নেতৃবৃন্দ

প্রধানমন্ত্রী শেখ হাসিনার ডিজিটাল বাংলাদেশ গড়ার লক্ষ্যে জেলাপ্রশাসকের সাথে ইউডিসির উদ্যোক্তাদের মতবিনিময়

লক্ষ্মীপুর সদরের ৩ নং দালাল বাজার ইউনিয়নের হিন্দু, বৌদ্ধ, খৃষ্টান ঐক্য পরিষদের সভাপতি লিটন চৌধুরী নির্বাচিত

লক্ষ্মীপুরের উপশহর দালাল বাজার আলিফ-মীম হাসপাতালের শেয়ারহোল্ডারকে সংবর্ধনার মাধ্যমে শেয়ারকৃত অর্থ ফেরত

লক্ষ্মীপুর চারন সাংস্কৃতিক কেন্দ্রের সদস্য সচিব কমরেড শুভ দেবনাথ হুন্ডা এক্সিডেন্টে আহত হয়ে হাসপাতালে ভর্তি

লক্ষ্মীপুর সদর উপজেলার চররমনী মোহন আশ্রয়ণ প্রকল্প জামে মসজিদের ভিত্তিপ্রস্তর স্থাপন করেন জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

বিদ্রোহী কবি কাজি নজরুল ইসলামের ৪৫ তম প্রয়ান দিবসে লক্ষ্মীপুরে চারন সাংস্কৃতিক কেন্দ্রের উদ্যোগে স্বরন সভা

রামগতি- কমলনগর উপজেলার তীর রক্ষা বাঁধ নির্মাণের কাজ সেনাবাহিনীর তত্বাবধানে করার দবিতে মানববন্ধন ও স্মারকলিপি প্রদান।

লক্ষ্মীপুরে ইসলামী ব্যাংক বাংলাদেশ লিমিটেড কর্তৃক বৃক্ষরোপণ কর্মসূচিতে প্রধান অতিথি সাংসদ নুরু উদ্দিন চৌধুরী

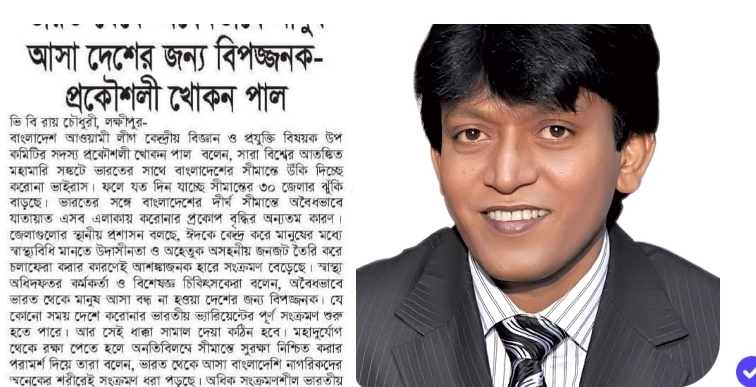

লক্ষ্মীপুরে প্রকৌশলী খোকন পাল ও প্রকৌশলী খাইরুল বাশারের সৌজন্যে অক্সিজেন সিলিন্ডার ও পালস অক্সিমিটার বিতরন

লক্ষ্মীপুর সদর উপজেলাধীন বিভিন্ন ইউপিতে ভ্যাকসিন প্রয়োগ কার্যক্রম পরিদর্শনে জেলাপ্রশাসক আনোয়ার হোছাইন আকন্দ

লক্ষ্মীপুরে জেলাপ্রশাসকের নির্দেশনায় সদর উপজেলার বিভিন্নস্থানে মোবাইল কোটে ৫১ টি মামলায় ৫৭৪০০ টাকা জরিমানা

লক্ষ্মীপুরের কমলনগর ও রামগতি উপজেলায় ২৬ জুলাই উপজেলা স্বাস্থ্য কর্মকর্তার মাধ্যমে স্বাস্থ্য ও পঃকঃ মন্ত্রনালয়ের মন্ত্রীর নিকট স্মারকলিপি পেশ ও মানববন্ধন

লক্ষ্মীপুরে অবৈধ ড্রেজারে বালু উত্তোলনে ৮০ হাজার টাকা জরিমানা করেন নির্বাহী ম্যাজিস্ট্রেট মোহাম্মদ মাসুম

লক্ষ্মীপুরে পাউবো’র জমিতে অবৈধ স্থাপনা উচ্ছেদে ভুমিকা রাখেন সদর উপজেলা নির্বাহী কর্মকর্তা মোহাম্মদ মাসুম

লক্ষ্মীপুরে কৃষক ও ক্ষেতমজুর সহ গ্রামাঞ্চলের মানুষের করোনা টেষ্ট এবং চিকিৎসা পর্যাপ্ত ও সুলভ আয়োজন প্রসঙ্গে স্মারকলিপি পেশ ও মানববন্ধন

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈদ- উল আযহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য।

করোনা কান্তি লগ্নে স্বাস্থ্য বিধি মেনে চলুন সুস্থ থাকুন এই হউক পবিত্র ঈঁদুল আজহার অঙ্গীকার। শুভেচ্ছাআন্তে, প্রকৌশলী খোকন পাল। বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় বিজ্ঞান ও প্রযুক্তি বিষয়ক উপ কমিটির সদস্য ও বাংলাদেশ আওয়ামী লীগ কেন্দ্রীয় উপ-কমিটির সাবেক সহ-সম্পাদক।

লক্ষ্মীপুরের অতিরিক্ত জেলা প্রশাসক শফিউজ্জামান ভূঁইয়ার উপস্থিতিতে যুবউন্নয়ন অধিদপ্তর কর্তৃক জনসচেতনতামূলক প্রশিক্ষন অনুষ্ঠিত

১১০ থানার মধ্যে মে মাসে শ্রেষ্ঠ ওসি ও শ্রেষ্ঠ পরিদর্শক (তদন্ত) লক্ষ্মীপুরের জসিম উদ্দিন ও শিপন বড়ুয়া

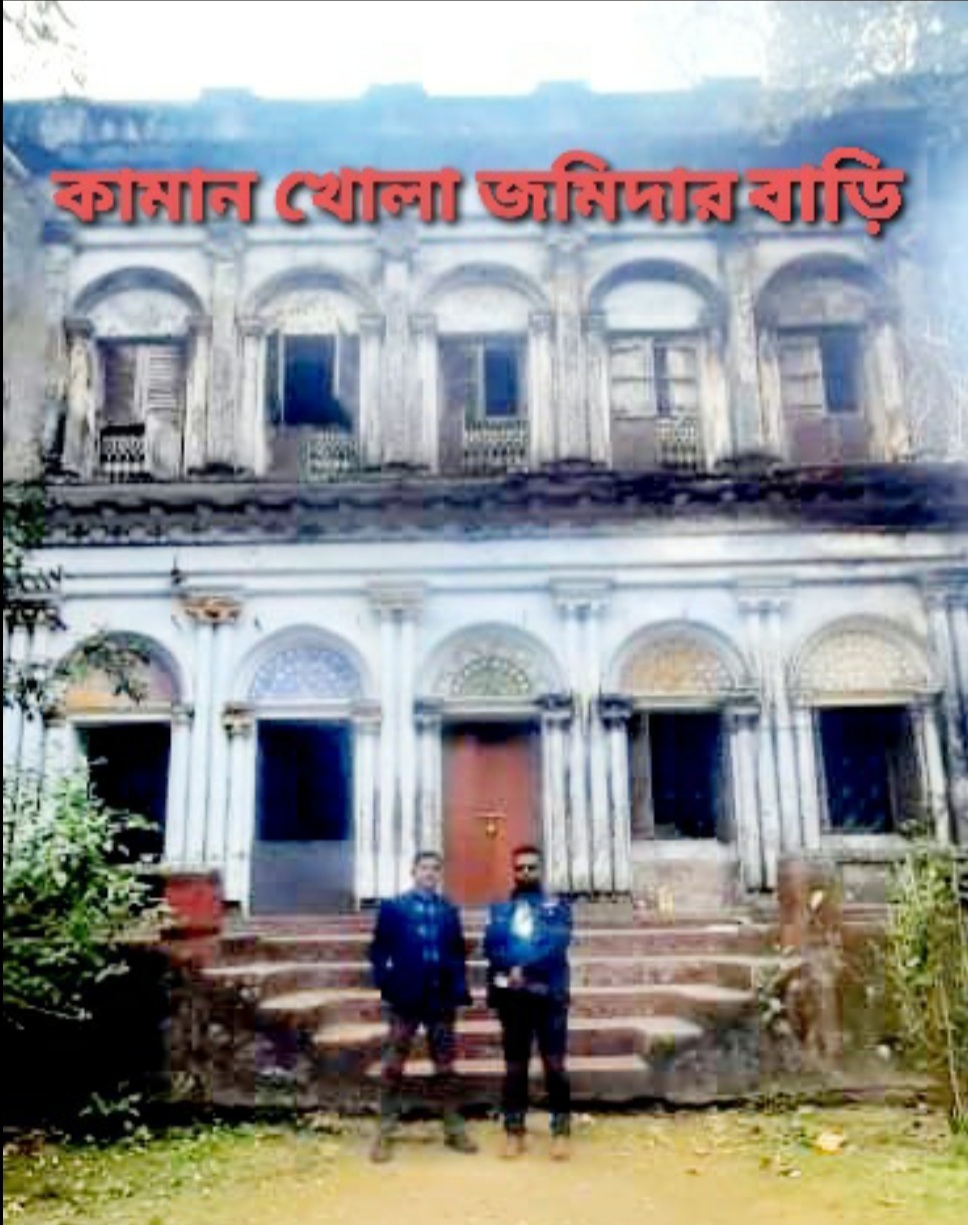

লক্ষ্মীপুরের কামান খোলায় শত বছরের দখলীয় সম্পত্তি স্কুলের বলে হেডমাস্টারমশাই এর দাবী এনিয়ে এলাকায় তোলপাড়

লক্ষ্মীপুরের রামগঞ্জে অপূর্ব সাহার নেতৃত্বে সংখ্যালঘু নির্যাতনের প্রতিবাদে বিক্ষোভ ও অবস্থান কর্মসূচি

লক্ষ্মীপুর জেলা পুলিশকে আইজিপি মহোদয় একটি আধুনিক এ্যাম্বুলেন্স সরবরাহ করায় পুলিশ সুপার কামারুজ্জামানের ধন্যবাদ জ্ঞাপন

লক্ষ্মীপুর থেকে রায়পুর হয়ে চাঁদপুর বি আর টি সি বাস আবশ্যক —-দৃষ্টি আকর্ষণ-যোগাযোগ মন্ত্রী ওবায়দুল কাদের–

লক্ষ্মীপুর পৌরসভার ৪৪ তম প্রতিষ্ঠাতাবার্ষিকীতে প্রতিষ্ঠাতা মরহুম নছির আহম্মদ ভূঁইয়ার প্রতি বিনম্র শ্রদ্ধা

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

লক্ষ্মীপুরের রায়পুরে ছেলে কর্তৃক মাকে কুপিয়ে রজু কৃত হত্যা মামলার ঘটনাস্থল পরিদর্শনে পুলিশ সুপার কামারুজ্জামান

Deputy Commissioner Anjan Chandra Pal created a thriving tourist environment on the banks of Khoya Sagar in Dalal Bazar of Laxmipur.

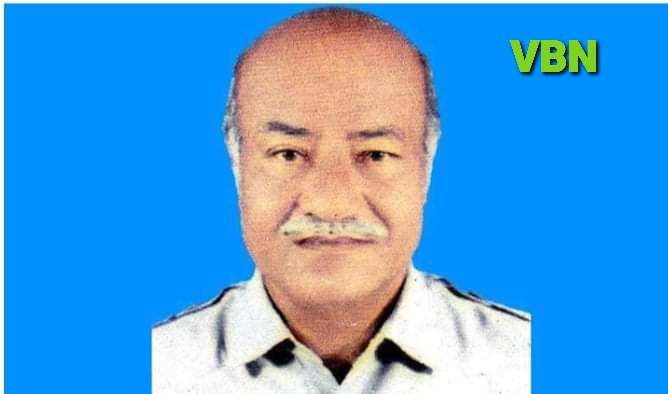

লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার প্রধান উপদেষ্টা সৈয়দ আবুল কাশেম মহোদয় কে পবিত্র ঈদুল আজহা ২০২০ উপলক্ষে লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থার পক্ষ থেকে শুভেচ্ছা ও অভিনন্দন। ভি বি রায় চৌধুরী, সভাপতি, লক্ষ্মীপুর সাংবাদিক কল্যাণ সংস্থা।

লক্ষ্মীপুরে মার্চ- জুন ২০২০ মাসে সাজা পরোয়ানা তামিলকারী মডেল থানা পরিদর্শক আজিজুর রহমান মিঞা নির্বাচিত

লক্ষ্মীপুরের পুলিশ সুপার পুলিশ লাইন্সের ফোর্স ও অফিসে হ্যান্ড স্যানিটাইজার, জিংক টেবলেট ও সিভিট বিতরন

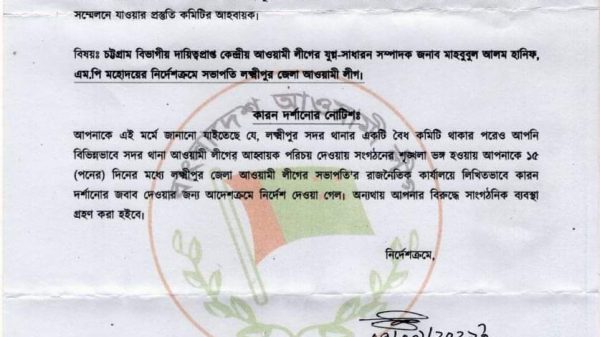

রায়পুরে আ:লীগের কমিটি ভাঙ্গা ও ক্ষমতার সুযোগে ধনী হওয়াদের বিরুদ্ধে দুদকের তদন্ত চান, এড. মিজানুর রহমান মুন্সি

লক্ষ্মীপুরের দালাল বাজার বণিক সমিতির সাধারণ সম্পাদকের বিরুদ্ধে ফেসবুকে অপপ্রচারে ব্যবসায়ী দের মানববন্ধন

লক্ষ্মীপুরে করোনা আক্রান্ত বায়েজিদ ভূইয়া কে দেখতে যান লক্ষ্মীপুর রিপোর্টার্স ক্লাবের এক ঝাক সাংবাদিক

বাংলাদেশ পুলিশের ডিআইজি খন্দকার গোলাম খারুক মহোদয়ের সাথে ভিডিও কনফারেন্সে লক্ষ্মীপুর পুলিশ সুপারের সাক্ষাৎকার

লক্ষ্মীপুরে ড্রাইভিং লাইসেন্স ও গাড়ির প্রয়োজনীয় কাগজপত্র না থাকায় ১১ এপ্রিল মোবাইল কোর্টে ২৬ টি মামলা

লক্ষ্মীপুরে করোনাভাইরাস সঙ্কটে ২৪ ঘন্টা ফ্রী সেবাদানে এম্বুলেন্স দিচ্ছেন হামদর্দ এমডি হারুন- নাহার দম্পতি